Question: Problem 1: Consider a capital budgeting example with five projects from which to select. The firm needs to decide how to allocate its available capital

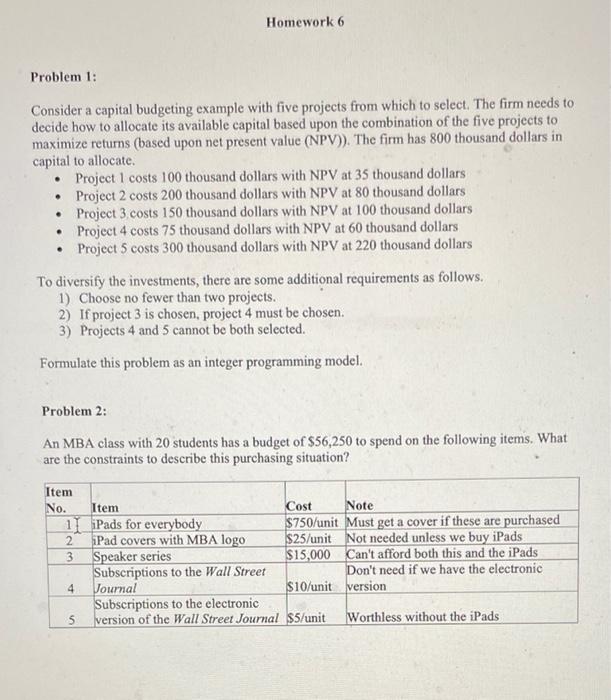

Problem 1: Consider a capital budgeting example with five projects from which to select. The firm needs to decide how to allocate its available capital based upon the combination of the five projects to maximize returns (based upon net present value (NPV)). The firm has 800 thousand dollars in capital to allocate. - Project 1 costs 100 thousand dollars with NPV at 35 thousand dollars - Project 2 costs 200 thousand dollars with NPV at 80 thousand dollars - Project 3 costs 150 thousand dollars with NPV at 100 thousand dollars - Project 4 costs 75 thousand dollars with NPV at 60 thousand dollars - Project 5 costs 300 thousand dollars with NPV at 220 thousand dollars To diversify the investments, there are some additional requirements as follows. 1) Choose no fewer than two projects. 2) If project 3 is chosen, project 4 must be chosen. 3) Projects 4 and 5 cannot be both selected. Formulate this problem as an integer programming model. Problem 2: An MBA class with 20 students has a budget of $56,250 to spend on the following items. What are the constraints to describe this purchasing situation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts