Question: Problem 1: Consider a financial model where one can borrow and lend money at year i and up to year i + 1 at the

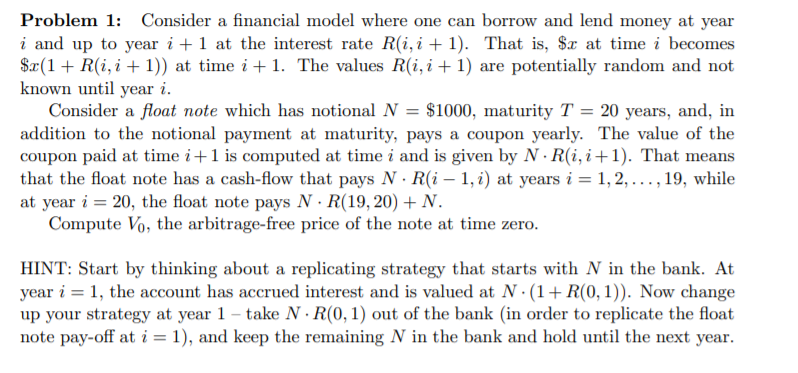

Problem 1: Consider a financial model where one can borrow and lend money at year i and up to year i + 1 at the interest rate R(i, i+ 1). That is, $x at time i becomes $ar(1R(i, i1)) at time i + 1. The values R(i, i+ 1) are potentially random and not known until year i. Consider a float note which has notional N = $1000, maturity T = 20 years, and, in addition to the notional payment at maturity, pays a coupon yearly. The value of the coupon paid at time i+1 is computed at time i and is given by N R(i, i+1). That means that the float note has a cash-flow that pays N R(i - 1, i) at years i = 1,2,... , 19, while at year i 20, the float note pays N R(19,20)+ N. Compute Vo, the arbitrage-free price of the note at time zero HINT: Start by thinking about a replicating strategy that starts with N in the bank. At year i 1, the account has accrued interest and is valued at N (1R(0,1)). Now change up your strategy at year 1 - take N R(0, 1) out of the bank (in order to replicate the float note pay-off at i = 1), and keep the remaining N in the bank and hold until the next year Problem 1: Consider a financial model where one can borrow and lend money at year i and up to year i + 1 at the interest rate R(i, i+ 1). That is, $x at time i becomes $ar(1R(i, i1)) at time i + 1. The values R(i, i+ 1) are potentially random and not known until year i. Consider a float note which has notional N = $1000, maturity T = 20 years, and, in addition to the notional payment at maturity, pays a coupon yearly. The value of the coupon paid at time i+1 is computed at time i and is given by N R(i, i+1). That means that the float note has a cash-flow that pays N R(i - 1, i) at years i = 1,2,... , 19, while at year i 20, the float note pays N R(19,20)+ N. Compute Vo, the arbitrage-free price of the note at time zero HINT: Start by thinking about a replicating strategy that starts with N in the bank. At year i 1, the account has accrued interest and is valued at N (1R(0,1)). Now change up your strategy at year 1 - take N R(0, 1) out of the bank (in order to replicate the float note pay-off at i = 1), and keep the remaining N in the bank and hold until the next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts