Question: Problem 1. Consider a spread that is created by the following three activities: buy one quarter of a call option with strike price of 10

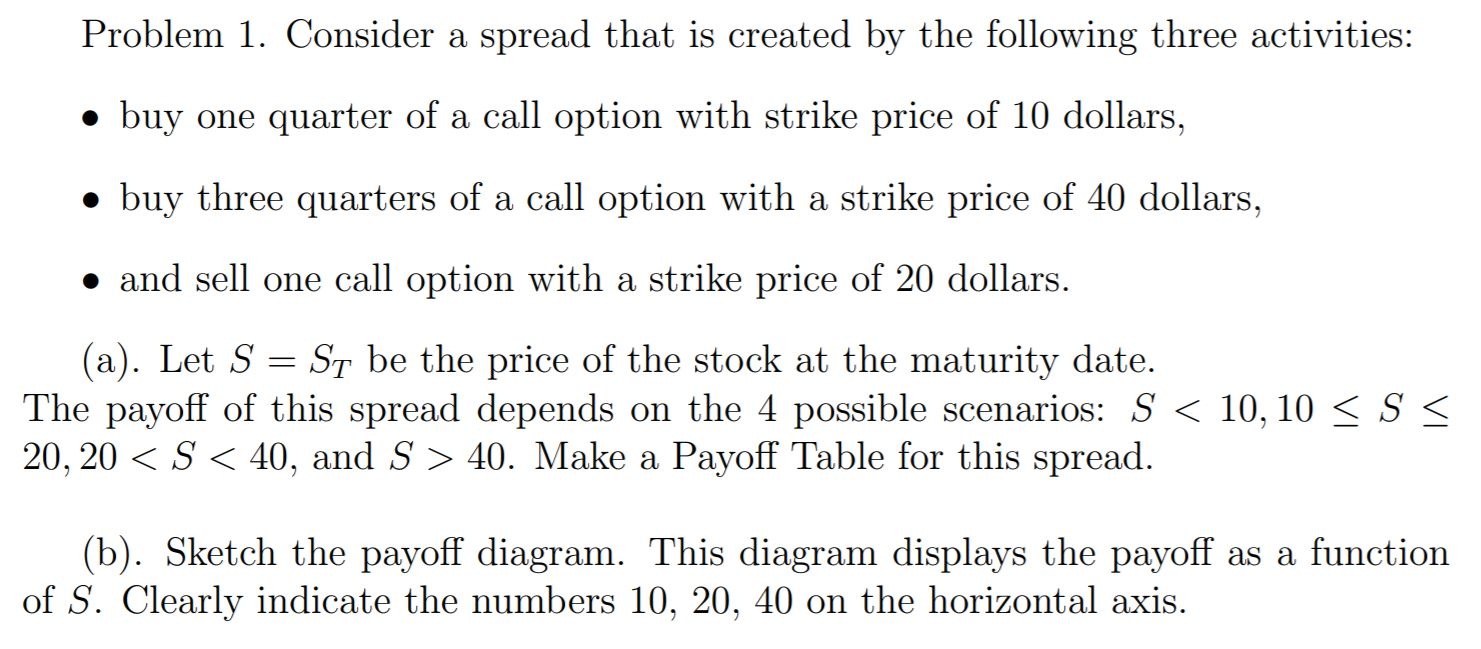

Problem 1. Consider a spread that is created by the following three activities: buy one quarter of a call option with strike price of 10 dollars, buy three quarters of a call option with a strike price of 40 dollars, and sell one call option with a strike price of 20 dollars. (a). Let S = ST be the price of the stock at the maturity date. The payoff of this spread depends on the 4 possible scenarios: S 40. Make a Payoff Table for this spread. (b). Sketch the payoff diagram. This diagram displays the payoff as a function of S. Clearly indicate the numbers 10, 20, 40 on the horizontal axis. Problem 1. Consider a spread that is created by the following three activities: buy one quarter of a call option with strike price of 10 dollars, buy three quarters of a call option with a strike price of 40 dollars, and sell one call option with a strike price of 20 dollars. (a). Let S = ST be the price of the stock at the maturity date. The payoff of this spread depends on the 4 possible scenarios: S 40. Make a Payoff Table for this spread. (b). Sketch the payoff diagram. This diagram displays the payoff as a function of S. Clearly indicate the numbers 10, 20, 40 on the horizontal axis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts