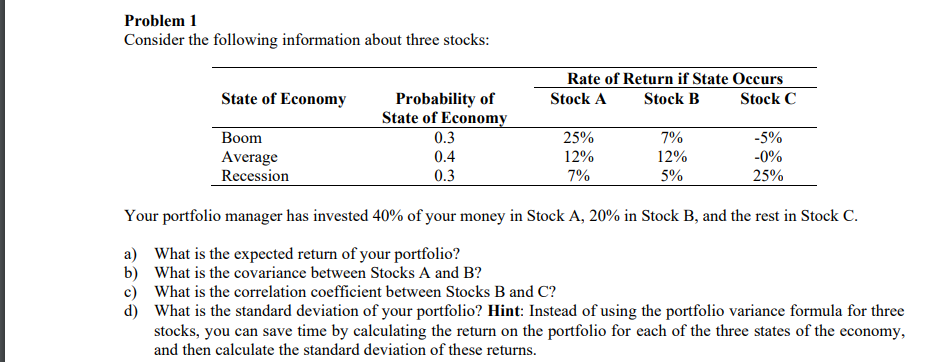

Question: Problem 1 Consider the following information about three stocks: State of Economy Rate of Return if State Occurs Stock A Stock B Stock C Probability

Problem 1 Consider the following information about three stocks: State of Economy Rate of Return if State Occurs Stock A Stock B Stock C Probability of State of Economy 0.3 0.4 Boom Average Recession 25% 12% 7% 7% 12% 5% -5% -0% 25% 0.3 Your portfolio manager has invested 40% of your money in Stock A, 20% in Stock B, and the rest in Stock C. a) What is the expected return of your portfolio? b) What is the covariance between Stocks A and B? c) What is the correlation coefficient between Stocks B and C? d) What is the standard deviation of your portfolio? Hint: Instead of using the portfolio variance formula for three stocks, you can save time by calculating the return on the portfolio for each of the three states of the economy, and then calculate the standard deviation of these returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts