Question: Problem 1 Consider two countries. Toluca Lake (TL) and Shepherd's Glen (SG), in short run equilibrium with price stickiness and capital mobility. The velocity of

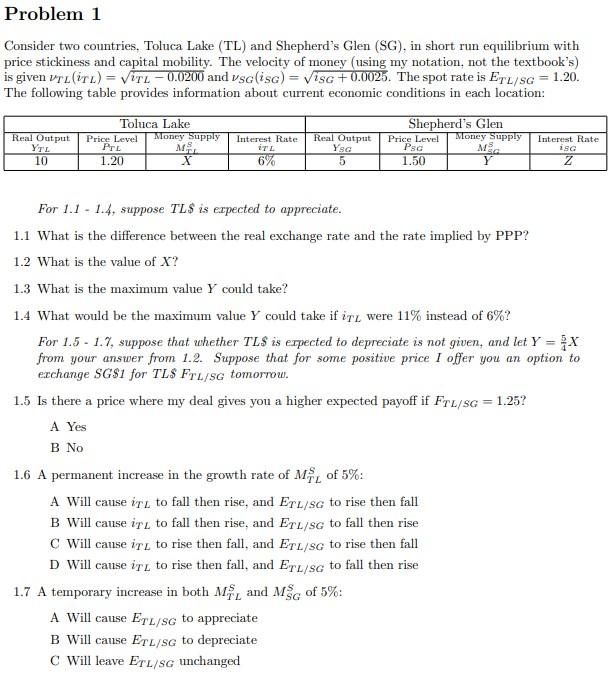

Problem 1 Consider two countries. Toluca Lake (TL) and Shepherd's Glen (SG), in short run equilibrium with price stickiness and capital mobility. The velocity of money (using my notation, not the textbook's) is given vrilir.) = V TL -0.0200 and vsGlis) = Visc +0.0025. The spot rate is Erl/sG = 1.20. The following table provides information about current economic conditions in each location: Real Output YT! 10 Toluca Lake Price Level Money Supply MAL 1.20 X Interest Rate TL PEL Shepherd's Glen Price Level Money Supply Psc 1.50 Y Real Output YSG 5 MC Interest Rate is Z 6% For 1.1 - 1.4. suppose TLS is expected to appreciate. 1.1 What is the difference between the real exchange rate and the rate implied by PPP? 1.2 What is the value of X? 1.3 What is the maximum value Y could take? 1.4 What would be the maximum value Y could take if it were 11% instead of 6%? For 1.5 - 1.7, suppose that whether TLS is expected to depreciate is not given, and let y = x from your answer from 1.2. Suppose that for some positive price I offer you an option to erchange SG$1 for TLS FTL/SG tomorrow. 1.5 Is there a price where my deal gives you a higher expected payoff if FTL/SG = 1.25? A Yes B No 1.6 A permanent increase in the growth rate of Mf, of 5%: A Will cause it, to fall then rise, and Erlisg to rise then fall B Will cause ir, to fall then rise, and Erl/sy to fall then rise C Will cause it to rise then fall, and ETL/SG to rise then fall D Will cause it to rise then fall, and Erl/sg to fall then rise 1.7 A temporary increase in both M, and Mc of 5%: A Will cause ErL/SG to appreciate B Will cause Erl/sy to depreciate C Will leave Erl/sy unchanged Problem 1 Consider two countries. Toluca Lake (TL) and Shepherd's Glen (SG), in short run equilibrium with price stickiness and capital mobility. The velocity of money (using my notation, not the textbook's) is given vrilir.) = V TL -0.0200 and vsGlis) = Visc +0.0025. The spot rate is Erl/sG = 1.20. The following table provides information about current economic conditions in each location: Real Output YT! 10 Toluca Lake Price Level Money Supply MAL 1.20 X Interest Rate TL PEL Shepherd's Glen Price Level Money Supply Psc 1.50 Y Real Output YSG 5 MC Interest Rate is Z 6% For 1.1 - 1.4. suppose TLS is expected to appreciate. 1.1 What is the difference between the real exchange rate and the rate implied by PPP? 1.2 What is the value of X? 1.3 What is the maximum value Y could take? 1.4 What would be the maximum value Y could take if it were 11% instead of 6%? For 1.5 - 1.7, suppose that whether TLS is expected to depreciate is not given, and let y = x from your answer from 1.2. Suppose that for some positive price I offer you an option to erchange SG$1 for TLS FTL/SG tomorrow. 1.5 Is there a price where my deal gives you a higher expected payoff if FTL/SG = 1.25? A Yes B No 1.6 A permanent increase in the growth rate of Mf, of 5%: A Will cause it, to fall then rise, and Erlisg to rise then fall B Will cause ir, to fall then rise, and Erl/sy to fall then rise C Will cause it to rise then fall, and ETL/SG to rise then fall D Will cause it to rise then fall, and Erl/sg to fall then rise 1.7 A temporary increase in both M, and Mc of 5%: A Will cause ErL/SG to appreciate B Will cause Erl/sy to depreciate C Will leave Erl/sy unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts