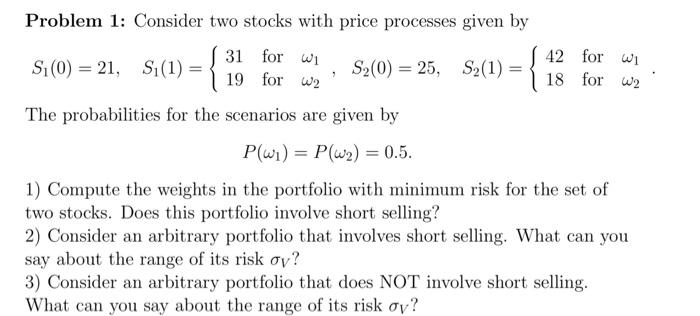

Question: Problem 1: Consider two stocks with price processes given by S1(0)=21,S1(1)={3119forfor12,S2(0)=25,S2(1)={4218forfor12. The probabilities for the scenarios are given by P(1)=P(2)=0.5. 1) Compute the weights in

Problem 1: Consider two stocks with price processes given by S1(0)=21,S1(1)={3119forfor12,S2(0)=25,S2(1)={4218forfor12. The probabilities for the scenarios are given by P(1)=P(2)=0.5. 1) Compute the weights in the portfolio with minimum risk for the set of two stocks. Does this portfolio involve short selling? 2) Consider an arbitrary portfolio that involves short selling. What can you say about the range of its risk V ? 3) Consider an arbitrary portfolio that does NOT involve short selling. What can you say about the range of its risk V ? Problem 1: Consider two stocks with price processes given by S1(0)=21,S1(1)={3119forfor12,S2(0)=25,S2(1)={4218forfor12. The probabilities for the scenarios are given by P(1)=P(2)=0.5. 1) Compute the weights in the portfolio with minimum risk for the set of two stocks. Does this portfolio involve short selling? 2) Consider an arbitrary portfolio that involves short selling. What can you say about the range of its risk V ? 3) Consider an arbitrary portfolio that does NOT involve short selling. What can you say about the range of its risk V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts