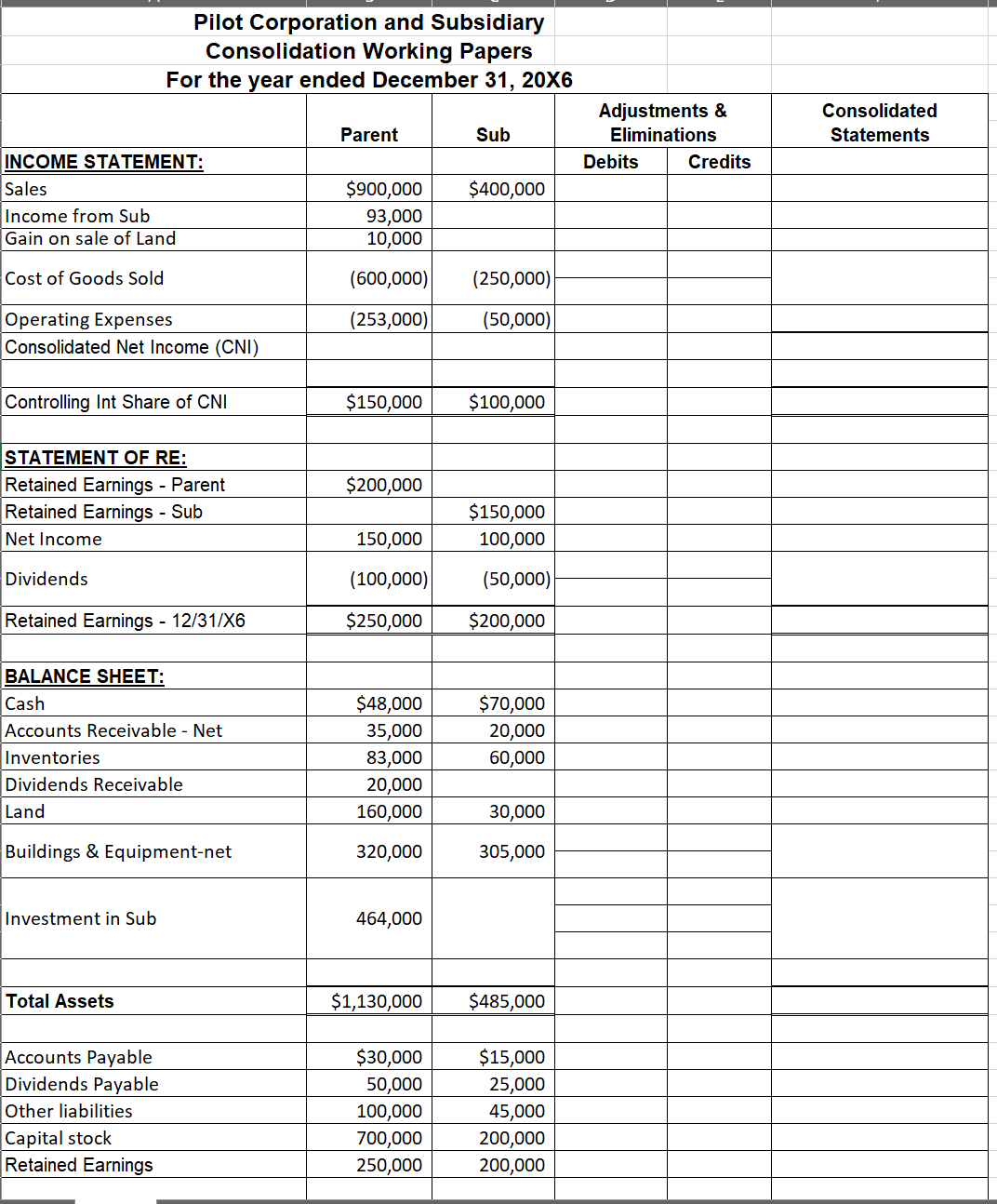

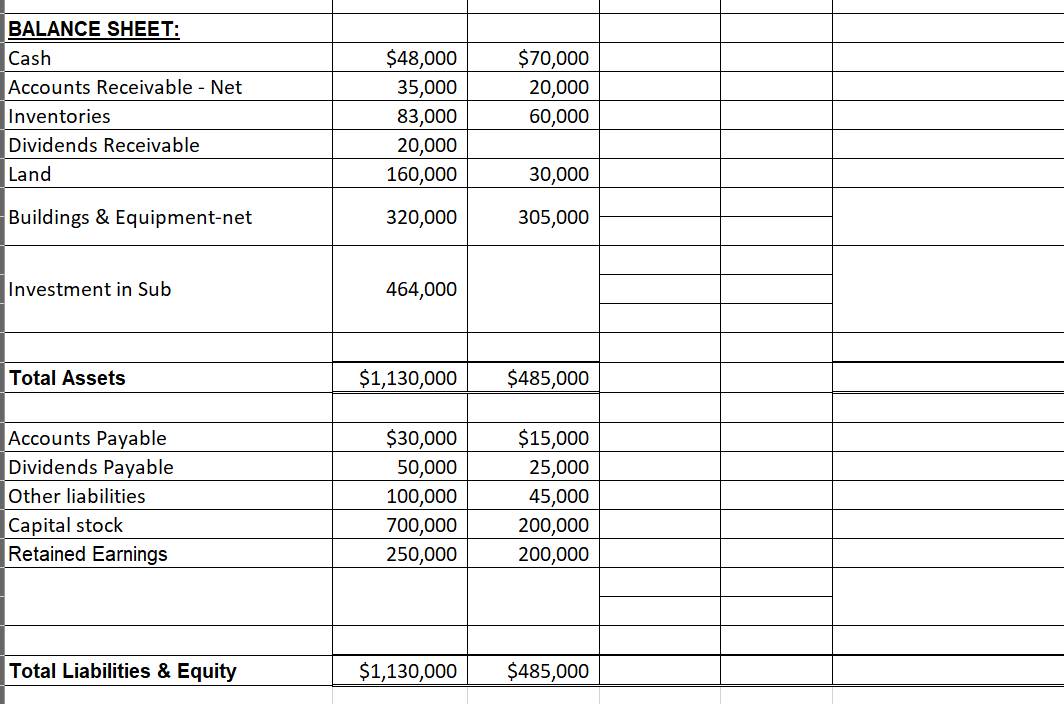

Question: Problem 1 - Consolidation Workpapers Refer to this data to answer questions 21-23. Parent Corporation acquired an 80% interest in Sub Corporation for $380,000 on

Problem 1 - Consolidation Workpapers

Refer to this data to answer questions 21-23.

Parent Corporation acquired an 80% interest in Sub Corporation for $380,000 on January 1, 20X4 when Sub's stockholders' equity consisted of $200,000 capital stock and $75,000 retained earnings. The excess cost over book value acquired was allocated to inventory that was overvalued by $50,000 and sold in 20X4, to equipment that was undervalued by $100,000 and to goodwill. The undervalued equipment had an 8-year remaining useful life.

- Parent regularly sells inventory to Sub at 125% of cost. Intercompany sales were $200,000 in 20X5 and $100,000 in 20X6. Sub's inventory included $35,000 of this merchandise at 12/31/20X5 and $20,000 of this merchandise at 12/31/20X6.

- On October 1, 20X4 Sub sold Parent a building for $110,000. Sub had originally paid $150,000 for the building and had accumulated depreciation as of the date of sale of $90,000. Parent is depreciating the building at a rate of $22,000 per 12-month period.

- During 20X4 Sub sold land for which it had paid $50,000 to Parent for $65,000. Parent resold the land to outsiders during 20X6 for $75,000.

Complete the consolidation working papers. Click Here to Download the excel file, complete the file, save it to your computer, and upload the saved file in the drop box below.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts