Question: Problem 1 - Decision Making - 9 marks - 18 minutes Part 1: John's Fancy Chocolate Shop has two product lines; milk chocolate bars

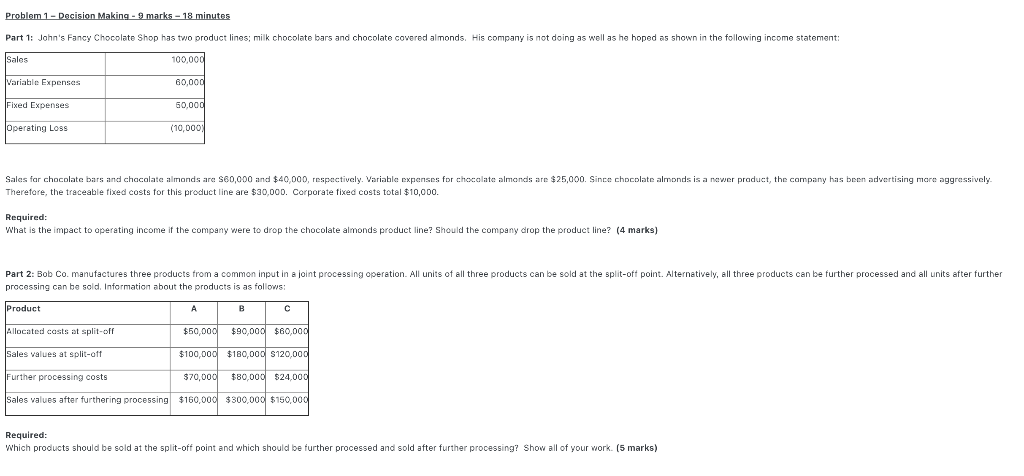

Problem 1 - Decision Making - 9 marks - 18 minutes Part 1: John's Fancy Chocolate Shop has two product lines; milk chocolate bars and chocolate covered almonds. His company is not doing as well as he hoped as shown in the following income statement: Sales Variable Expenses Fixed Expenses Operating Loss 100,000 60,000 50,000 (10,000) Sales for chocolate bars and chocolate almonds are $60,000 and $40,000, respectively. Variable expenses for chocolate almonds are $25,000. Since chocolate almonds is a newer product, the company has been advertising more aggressively. Therefore, the traceable fixed costs for this product line are $30,000. Corporate fixed costs total $10,000. Required: What is the impact to operating income if the company were to drop the chocolate almonds product line? Should the company drop the product line? (4 marks) Part 2: Bob Co. manufactures three products from a common input in a joint processing operation. All units of all three products can be sold at the split-off point. Alternatively, all three products can be further processed and all units after further processing can be sold. Information about the products is as follows: Product B Allocated costs at split-off $50,000 $90,000 $60,000 Sales values at split-off $100,000 $180,000 $120,000 Further processing costs Sales values after furthering processing $160,000 $300,000 $150,000 $70,000 $80,000 $24,000 Required: Which products should be sold at the split-off point and which should be further processed and sold after further processing? Show all of your work. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Part 1 Impact of Dropping Chocolate Almonds To determine the impact of dropping the chocolate almonds product line on operating income we need to cons... View full answer

Get step-by-step solutions from verified subject matter experts