Question: Problem 1 Eastern Canada Pipeline issues 5-year bonds with a face value of $25,000,000 on December 31, 2018. The contract interest rate on the bonds

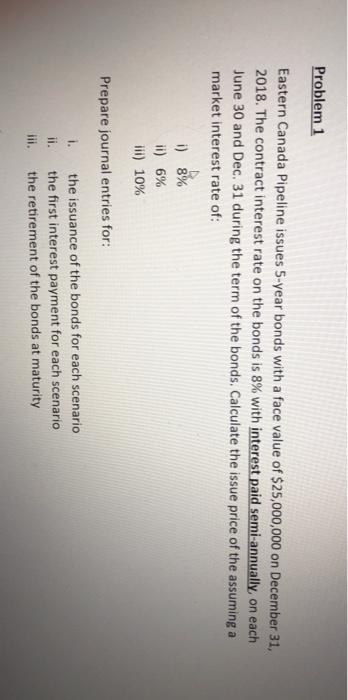

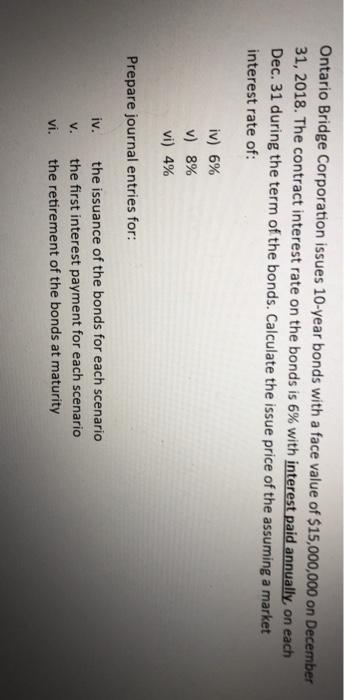

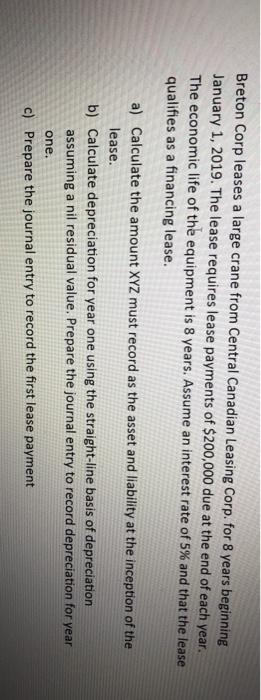

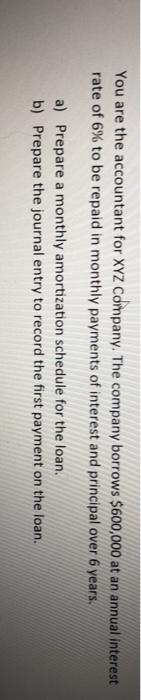

Problem 1 Eastern Canada Pipeline issues 5-year bonds with a face value of $25,000,000 on December 31, 2018. The contract interest rate on the bonds is 8% with interest paid semi-annually, on each June 30 and Dec. 31 during the term of the bonds. Calculate the issue price of the assuming a market interest rate of: i) 8% ii) 6% iii) 10% Prepare journal entries for: i. ii. the issuance of the bonds for each scenario the first interest payment for each scenario the retirement of the bonds at maturity Ontario Bridge Corporation issues 10-year bonds with a face value of $15,000,000 on December 31, 2018. The contract interest rate on the bonds is 6% with interest paid annually, on each Dec. 31 during the term of the bonds. Calculate the issue price of the assuming a market interest rate of: iv) 6% v) 8% vi) 4% Prepare journal entries for: iv. V. the issuance of the bonds for each scenario the first interest payment for each scenario the retirement of the bonds at maturity vi. Breton Corp leases a large crane from Central Canadian Leasing Corp. for 8 years beginning January 1, 2019. The lease requires lease payments of $200,000 due at the end of each year. The economic life of the equipment is 8 years. Assume an interest rate of 5% and that the lease qualifies as a financing lease. a) Calculate the amount XYZ must record as the asset and liability at the inception of the lease. b) Calculate depreciation for year one using the straight-line basis of depreciation assuming a nil residual value. Prepare the journal entry to record depreciation for year one. c) Prepare the journal entry to record the first lease payment You are the accountant for XYZ Company. The company borrows $600,000 at an annual interest rate of 6% to be repaid in monthly payments of interest and principal over 6 years. a) Prepare a monthly amortization schedule for the loan. b) Prepare the journal entry to record the first payment on the loan. Problem 1 Eastern Canada Pipeline issues 5-year bonds with a face value of $25,000,000 on December 31, 2018. The contract interest rate on the bonds is 8% with interest paid semi-annually, on each June 30 and Dec. 31 during the term of the bonds. Calculate the issue price of the assuming a market interest rate of: i) 8% ii) 6% iii) 10% Prepare journal entries for: i. ii. the issuance of the bonds for each scenario the first interest payment for each scenario the retirement of the bonds at maturity Ontario Bridge Corporation issues 10-year bonds with a face value of $15,000,000 on December 31, 2018. The contract interest rate on the bonds is 6% with interest paid annually, on each Dec. 31 during the term of the bonds. Calculate the issue price of the assuming a market interest rate of: iv) 6% v) 8% vi) 4% Prepare journal entries for: iv. V. the issuance of the bonds for each scenario the first interest payment for each scenario the retirement of the bonds at maturity vi. Breton Corp leases a large crane from Central Canadian Leasing Corp. for 8 years beginning January 1, 2019. The lease requires lease payments of $200,000 due at the end of each year. The economic life of the equipment is 8 years. Assume an interest rate of 5% and that the lease qualifies as a financing lease. a) Calculate the amount XYZ must record as the asset and liability at the inception of the lease. b) Calculate depreciation for year one using the straight-line basis of depreciation assuming a nil residual value. Prepare the journal entry to record depreciation for year one. c) Prepare the journal entry to record the first lease payment You are the accountant for XYZ Company. The company borrows $600,000 at an annual interest rate of 6% to be repaid in monthly payments of interest and principal over 6 years. a) Prepare a monthly amortization schedule for the loan. b) Prepare the journal entry to record the first payment on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts