Question: Problem 1 Eastern Edison Company leased equipment from Low-Tech Leasing on January 3, 2019. Low-Tech purchased the equipment on January 1, 2019 at a

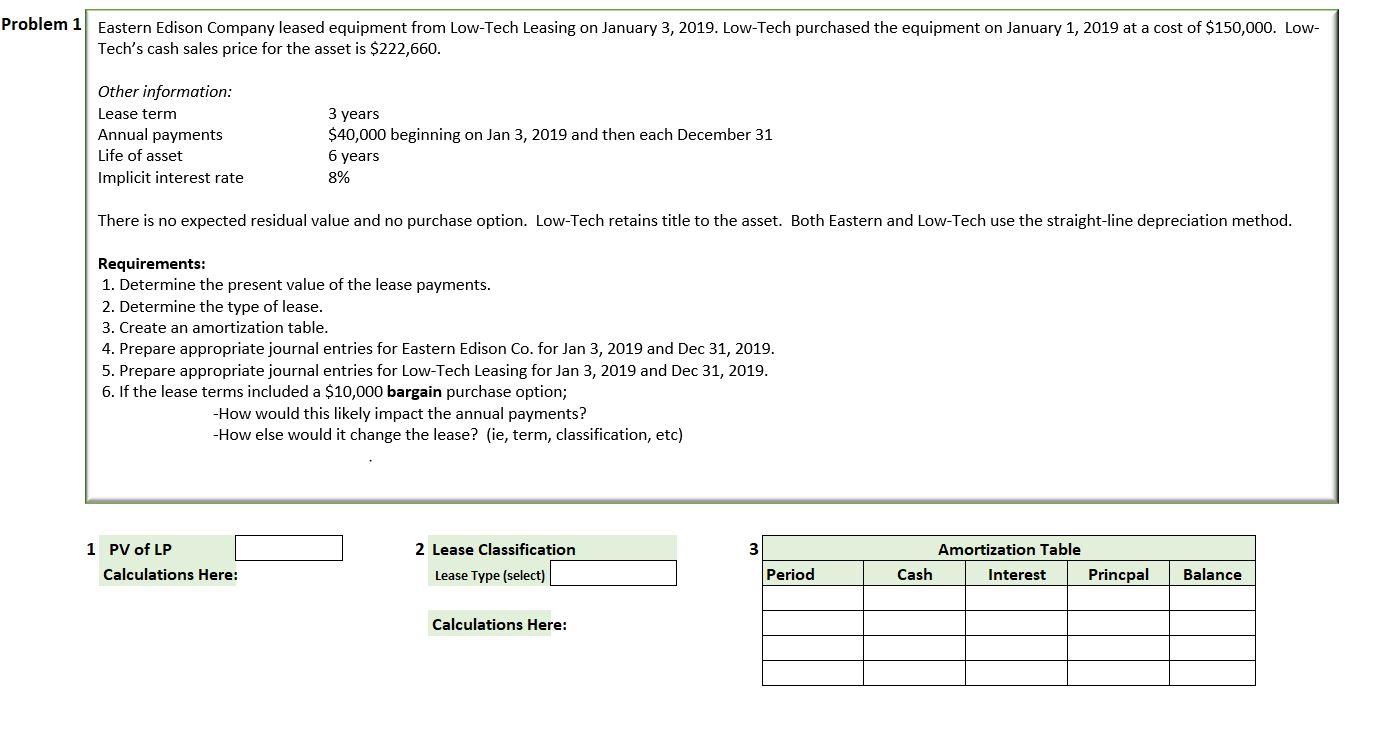

Problem 1 Eastern Edison Company leased equipment from Low-Tech Leasing on January 3, 2019. Low-Tech purchased the equipment on January 1, 2019 at a cost of $150,000. Low- Tech's cash sales price for the asset is $222,660. Other information: 3 years $40,000 beginning on Jan 3, 2019 and then each December 31 6 years Lease term Annual payments Life of asset Implicit interest rate 8% There is no expected residual value and no purchase option. Low-Tech retains title to the asset. Both Eastern and Low-Tech use the straight-line depreciation method. Requirements: 1. Determine the present value of the lease payments. 2. Determine the type of lease. 3. Create an amortization table. 4. Prepare appropriate journal entries for Eastern Edison Co. for Jan 3, 2019 and Dec 31, 2019. 5. Prepare appropriate journal entries for Low-Tech Leasing for Jan 3, 2019 and Dec 31, 2019. 6. If the lease terms included a $10,000 bargain purchase option; -How would this likely impact the annual payments? -How else would it change the lease? (ie, term, classification, etc) 1 PV of LP 2 Lease Classification 3 Amortization Table Calculations Here: Lease Type (select) Period Cash Interest Princpal Balance Calculations Here: 6 Impact of bargain purchase option: 4 Eastern Edison Low-Tech Leasing [type here]

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Answer 1 Year PV factor 8 Remarks 0 100000 1 092593 1 108 2 085734 092593 108 Total 278326 Annual pa... View full answer

Get step-by-step solutions from verified subject matter experts