Question: Problem 1 Eastern Edison Company leased equipment from Low-Tech Leasing on January 3, 2019. Low-Tech purchased the equipment on January 1, 2019 at a cost

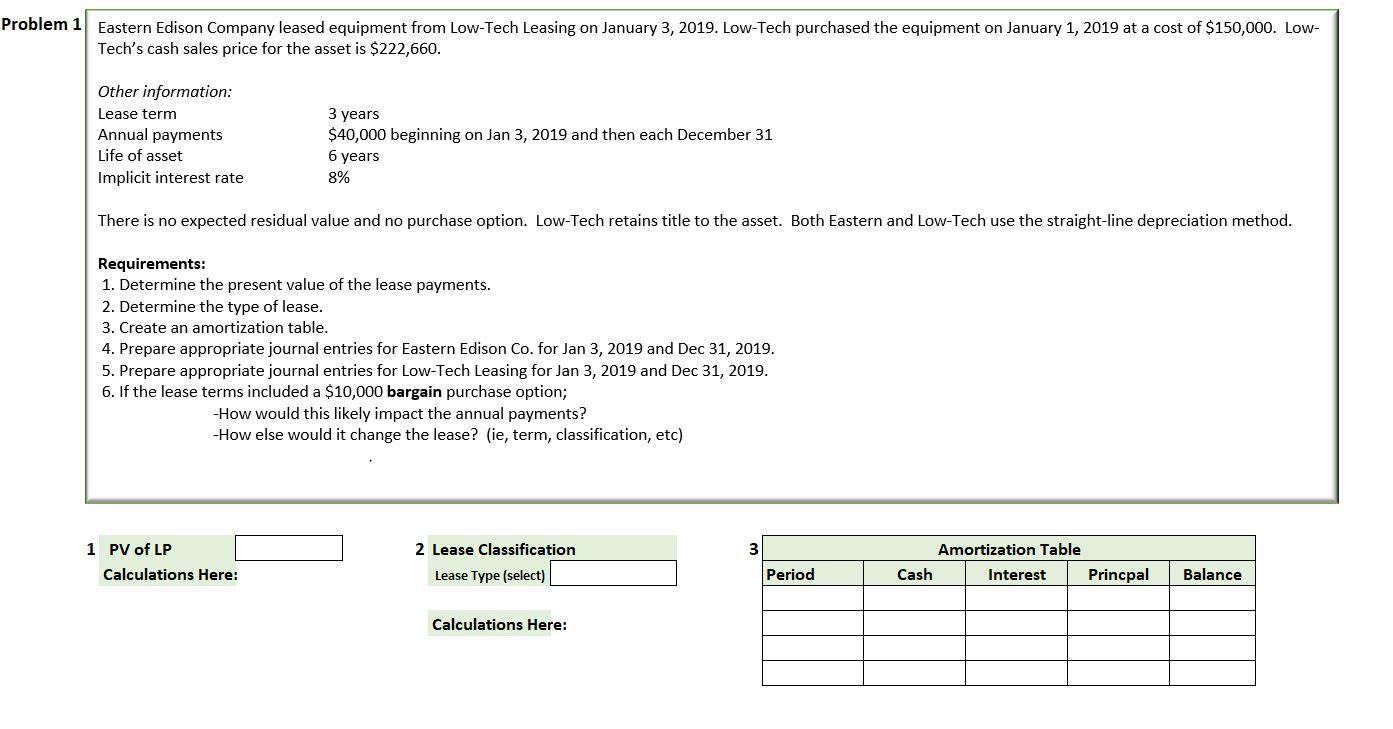

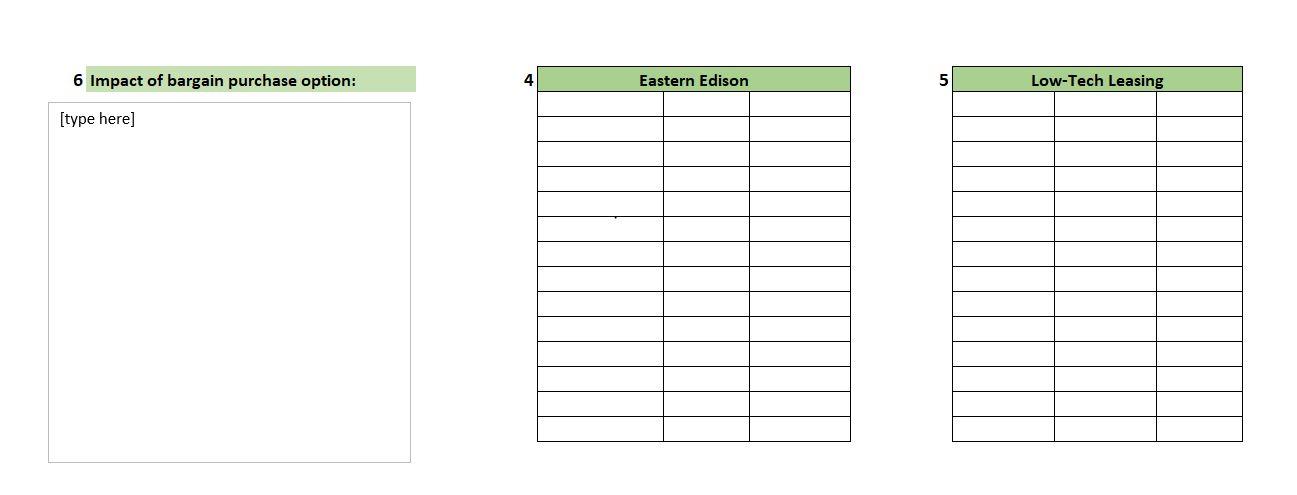

Problem 1 Eastern Edison Company leased equipment from Low-Tech Leasing on January 3, 2019. Low-Tech purchased the equipment on January 1, 2019 at a cost of $150,000. Low- Tech's cash sales price for the asset is $222,660. Other information: Lease term Annual payments Life of asset Implicit interest rate 3 years $40,000 beginning on Jan 3, 2019 and then each December 31 6 years 8% There is no expected residual value and no purchase option. Low-Tech retains title to the asset. Both Eastern and Low-Tech use the straight-line depreciation method. Requirements: 1. Determine the present value of the lease payments. 2. Determine the type of lease. 3. Create an amortization table. 4. Prepare appropriate journal entries for Eastern Edison Co. for Jan 3, 2019 and Dec 31, 2019. 5. Prepare appropriate journal entries for Low-Tech Leasing for Jan 3, 2019 and Dec 31, 2019. 6. If the lease terms included a $10,000 bargain purchase option; -How would this likely impact the annual payments? -How else would it change the lease? (ie, term, classification, etc) 3 1 PV of LP Calculations Here: 2 Lease Classification Lease Type (select) Amortization Table Cash Interest Period Princpal Balance Calculations Here: 6 Impact of bargain purchase option: 4 Eastern Edison 5 Low-Tech Leasing [type here)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts