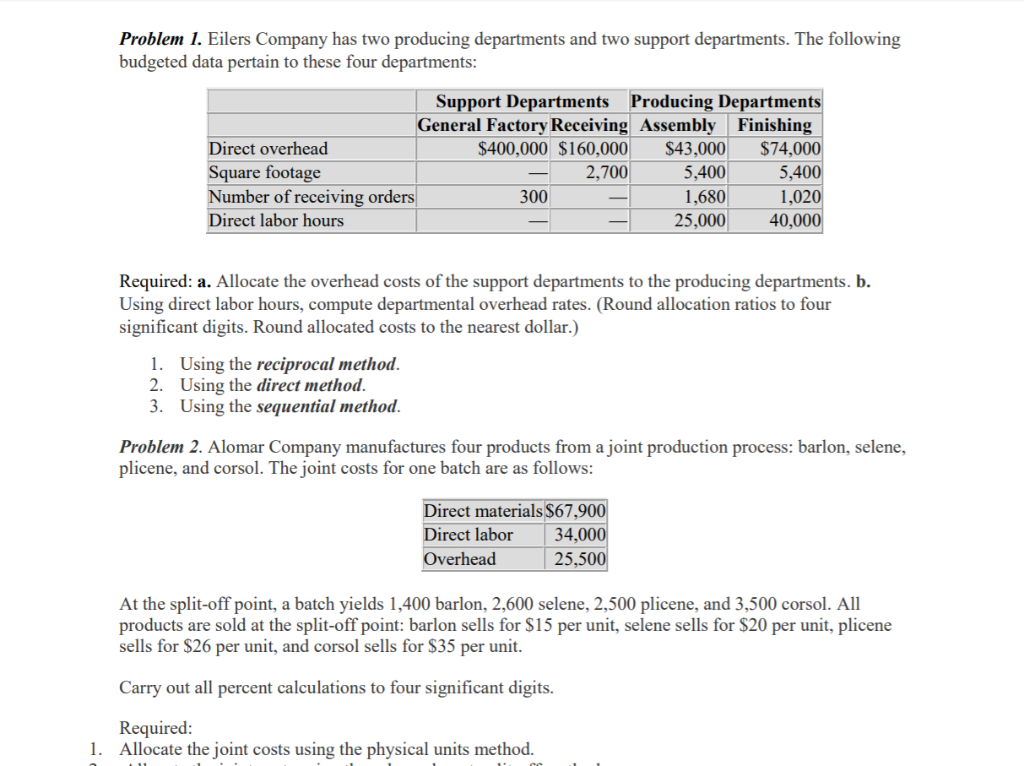

Question: Problem 1. Eilers Company has two producing departments and two support departments. The following budgeted data pertain to these four departments Support Departments General Factory

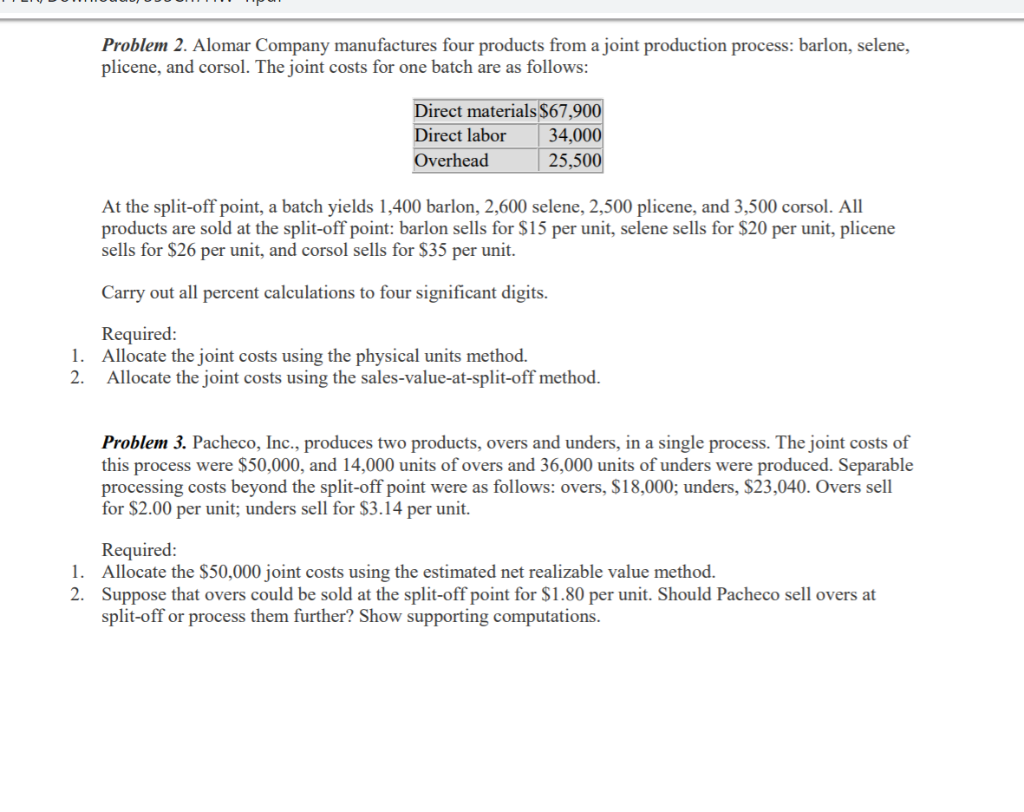

Problem 1. Eilers Company has two producing departments and two support departments. The following budgeted data pertain to these four departments Support Departments General Factory Receiving Assembly Producing Departments Finishing Direct overhead $400,000 $160,000$43,000 $74, quare footage Number of receiving orders Direct labor hours 5,400 ,680 2,700 5,40 1,020 300 25,000 40, Required: a. Allocate the overhead costs of the support departments to the producing departments. b. Using direct labor hours, compute departmental overhead rates. (Round allocation ratios to four significant digits. Round allocated costs to the nearest dollar.) 1. Using the reciprocal method 2. Using the direct method 3. Using the sequential method Problem 2. Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows Direct materials S67, Direct labor 34, Overhead 25,5 At the split-off point, a batch yields 1,400 barlon, 2,600 selene, 2,500 plicene, and 3,500 corsol. All products are sold at the split-off point: barlon sells for $15 per unit, selene sells for $20 per unit, plicene sells for $26 per unit, and corsol sells for $35 per unit. Carry out all percent calculations to four significant digits. Required Allocate the joint costs using the physical units method. 1. Problem 2. Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows Direct materials $67,9 Direct labor 34,000 Overhead 25,500 At the split-off point, a batch yields 1,400 barlon, 2,600 selene, 2,500 plicene, and 3,500 corsol. All products are sold at the split-off point: barlon sells for $15 per unit, selene sells for $20 per unit, plicene Carry out all percent calculations to four significant digits Required 1. Allocate the joint costs using the physical units method 2. Allocate the joint costs using the sales-value-at-split-off method Problem 3. Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were $50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, S18,000; unders, $23,040. Overs sell for $2.00 per unit, unders sell for $3.14 per unit. Required Allocate the $50,000 joint costs using the estimated net realizable value method. Suppose that overs could be sold at the split-off point for $1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations. 1. 2. Problem 1. Eilers Company has two producing departments and two support departments. The following budgeted data pertain to these four departments Support Departments General Factory Receiving Assembly Producing Departments Finishing Direct overhead $400,000 $160,000$43,000 $74, quare footage Number of receiving orders Direct labor hours 5,400 ,680 2,700 5,40 1,020 300 25,000 40, Required: a. Allocate the overhead costs of the support departments to the producing departments. b. Using direct labor hours, compute departmental overhead rates. (Round allocation ratios to four significant digits. Round allocated costs to the nearest dollar.) 1. Using the reciprocal method 2. Using the direct method 3. Using the sequential method Problem 2. Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows Direct materials S67, Direct labor 34, Overhead 25,5 At the split-off point, a batch yields 1,400 barlon, 2,600 selene, 2,500 plicene, and 3,500 corsol. All products are sold at the split-off point: barlon sells for $15 per unit, selene sells for $20 per unit, plicene sells for $26 per unit, and corsol sells for $35 per unit. Carry out all percent calculations to four significant digits. Required Allocate the joint costs using the physical units method. 1. Problem 2. Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows Direct materials $67,9 Direct labor 34,000 Overhead 25,500 At the split-off point, a batch yields 1,400 barlon, 2,600 selene, 2,500 plicene, and 3,500 corsol. All products are sold at the split-off point: barlon sells for $15 per unit, selene sells for $20 per unit, plicene Carry out all percent calculations to four significant digits Required 1. Allocate the joint costs using the physical units method 2. Allocate the joint costs using the sales-value-at-split-off method Problem 3. Pacheco, Inc., produces two products, overs and unders, in a single process. The joint costs of this process were $50,000, and 14,000 units of overs and 36,000 units of unders were produced. Separable processing costs beyond the split-off point were as follows: overs, S18,000; unders, $23,040. Overs sell for $2.00 per unit, unders sell for $3.14 per unit. Required Allocate the $50,000 joint costs using the estimated net realizable value method. Suppose that overs could be sold at the split-off point for $1.80 per unit. Should Pacheco sell overs at split-off or process them further? Show supporting computations. 1. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts