Question: PROBLEM 1. EQUITY VALUATION & CAPITAL STRUCTURE (25 POINTS) Red Torch generated earnings per share of $15 last year. Firm paid out all earnings as

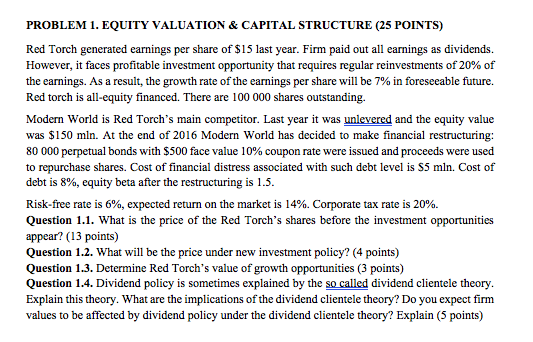

PROBLEM 1. EQUITY VALUATION & CAPITAL STRUCTURE (25 POINTS) Red Torch generated earnings per share of $15 last year. Firm paid out all earnings as dividends. However, it faces profitable investment opportunity that requires regular reinvestments of 20% of the earnings. As a result, the growth rate of the earnings per share will be 7% in foreseeable future. Red torch is all-equity financed. There are 100 000 shares outstanding. Modern World is Red Torch's main competitor. Last year it was unlevered and the equity value was $150 mln. At the end of 2016 Modern World has decided to make financial restructuring: 80 000 perpetual bonds with $500 face value l 0% coupon rate were issued and proceeds were used to repurchase shares. Cost of financial distress associated with such debt level is S5 mln. Cost of debt is 8%, equity beta after the restructuring is 1.5 Risk-free rate is 6%, expected return on the market is 14%. Corporate tax rate is 20%. Question 1.1. What is the price of the Red Torch's shares before the investment opportunities Question 1.2. What will be the price under new investment policy? (4 points) Question 1.3. Determine Red Torch's value of growth opportunities (3 points) Question 1.4. Dividend policy is sometimes explained by the so called dividend clientele theory Explain this theory. What are the implications of the dividend clientele theory? Do you expect firm values to be affected by dividend policy under the dividend clientele theory? Explain (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts