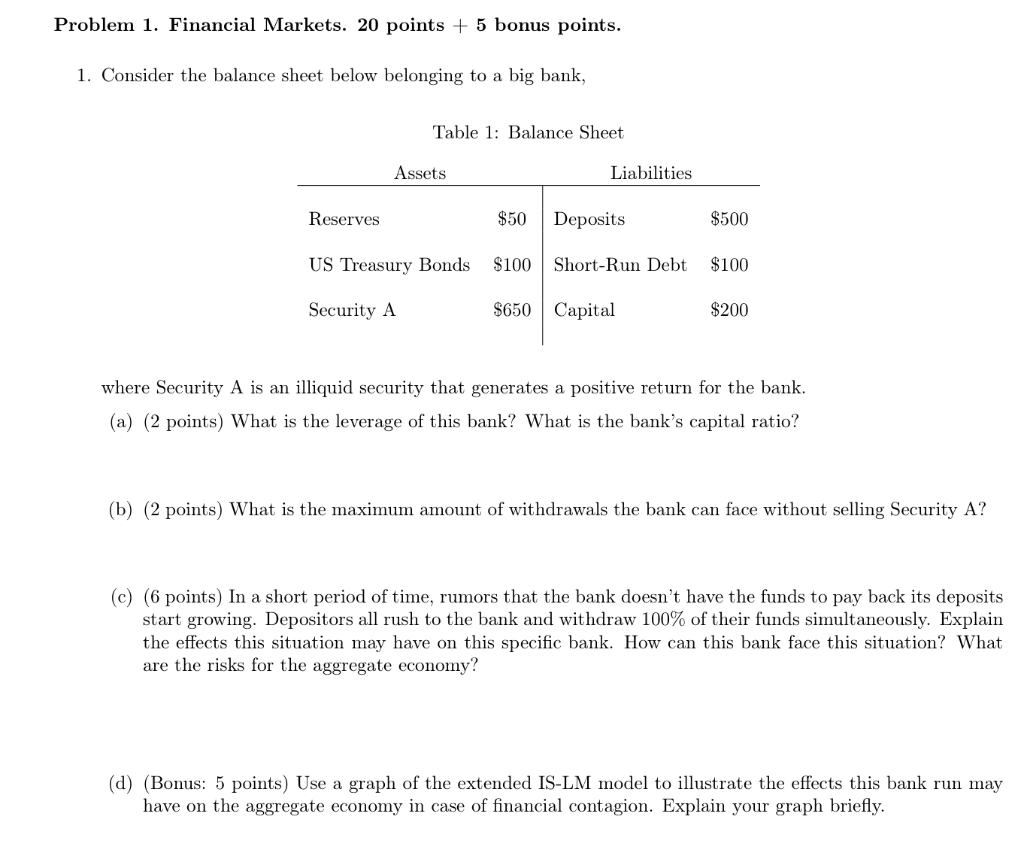

Question: Problem 1. Financial Markets. 20 points + 5 bonus points. 1. Consider the balance sheet below belonging to a big bank, Table 1: Balance Sheet

Problem 1. Financial Markets. 20 points + 5 bonus points. 1. Consider the balance sheet below belonging to a big bank, Table 1: Balance Sheet Assets Liabilities Reserves $50 Deposits $500 US Treasury Bonds $100 Short-Run Debt $100 Security A $650 Capital $200 where Security A is an illiquid security that generates a positive return for the bank. (a) (2 points) What is the leverage of this bank? What is the bank's capital ratio? (b) (2 points) What is the maximum amount of withdrawals the bank can face without selling Security A? a (c) (6 points) In a short period of time, rumors that the bank doesn't have the funds to pay back its deposits start growing. Depositors all rush to the bank and withdraw 100% of their funds simultaneously. Explain the effects this situation may have on this specific bank. How can this bank face this situation? What are the risks for the aggregate economy? (d) (Bonus: 5 points) Use a graph of the extended IS-LM model to illustrate the effects this bank run may have on the aggregate economy in case of financial contagion. Explain your graph briefly. Problem 1. Financial Markets. 20 points + 5 bonus points. 1. Consider the balance sheet below belonging to a big bank, Table 1: Balance Sheet Assets Liabilities Reserves $50 Deposits $500 US Treasury Bonds $100 Short-Run Debt $100 Security A $650 Capital $200 where Security A is an illiquid security that generates a positive return for the bank. (a) (2 points) What is the leverage of this bank? What is the bank's capital ratio? (b) (2 points) What is the maximum amount of withdrawals the bank can face without selling Security A? a (c) (6 points) In a short period of time, rumors that the bank doesn't have the funds to pay back its deposits start growing. Depositors all rush to the bank and withdraw 100% of their funds simultaneously. Explain the effects this situation may have on this specific bank. How can this bank face this situation? What are the risks for the aggregate economy? (d) (Bonus: 5 points) Use a graph of the extended IS-LM model to illustrate the effects this bank run may have on the aggregate economy in case of financial contagion. Explain your graph briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts