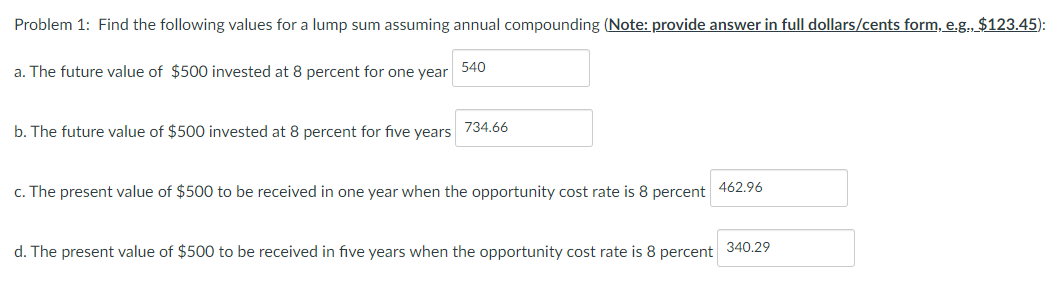

Question: Problem 1: Find the following values for a lump sum assuming annual compounding (Note: provide answer in full dollars/cents form, e.g.,_ $123.45 ): a. The

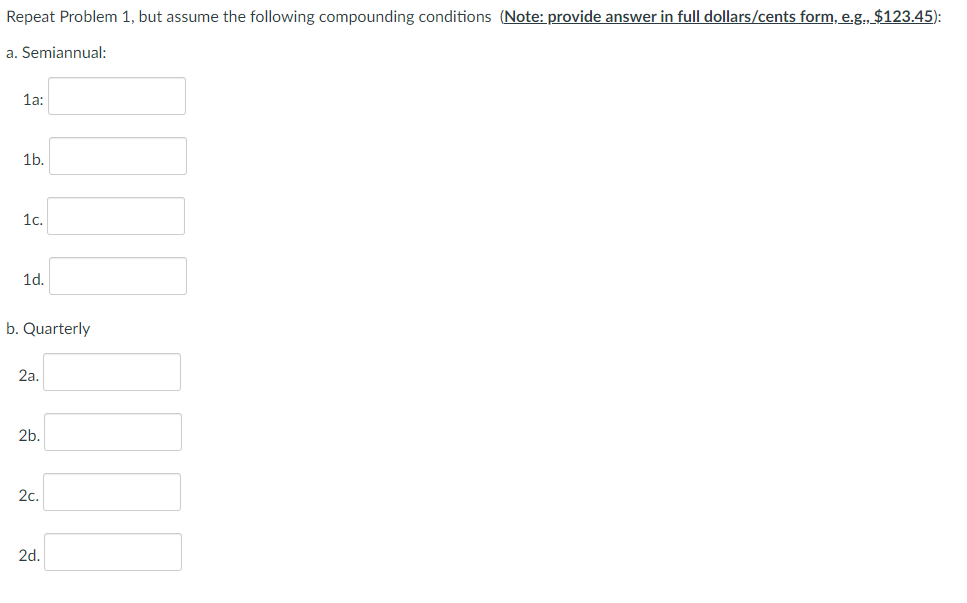

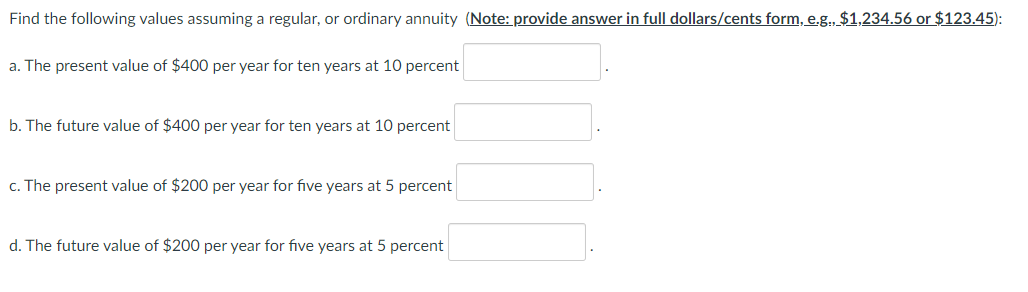

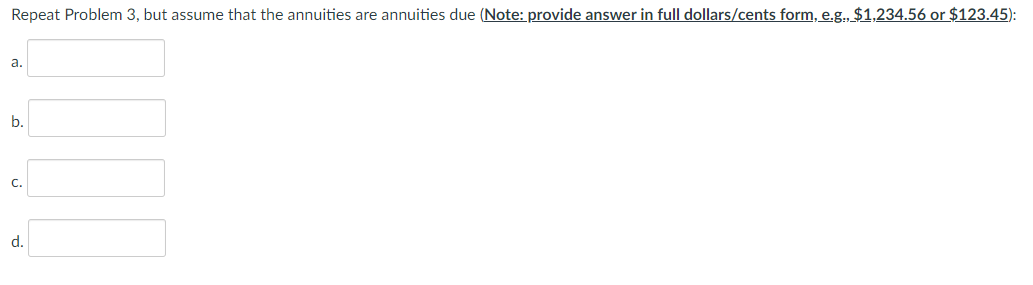

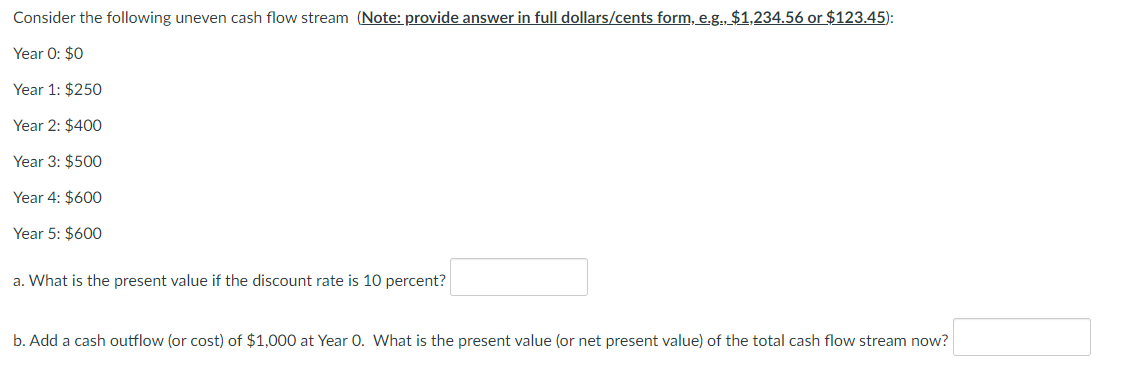

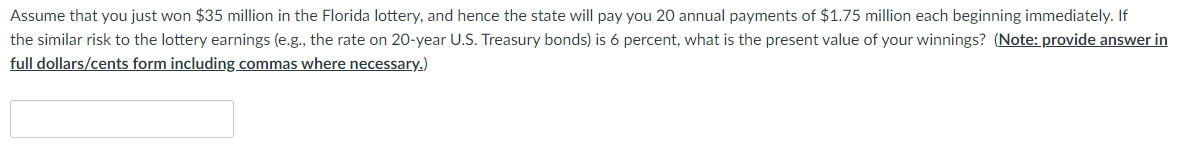

Problem 1: Find the following values for a lump sum assuming annual compounding (Note: provide answer in full dollars/cents form, e.g.,_ $123.45 ): a. The future value of $500 invested at 8 percent for one year b. The future value of $500 invested at 8 percent for five years c. The present value of $500 to be received in one year when the opportunity cost rate is 8 percent d. The present value of $500 to be received in five years when the opportunity cost rate is 8 percent Repeat Problem 1, but assume the following compounding conditions (Note: provide answer in full dollars/cents form, e.g:, $123.45 ): a. Semiannual: 1a: 1b. 1c. 1d. b. Quarterly 2a. 2b. 2c. 2d. Find the following values assuming a regular, or ordinary annuity (Note: provide answer in full dollars/cents form, e.g:., $1,234.56 or $123.45 ): a. The present value of $400 per year for ten years at 10 percent b. The future value of $400 per year for ten years at 10 percent c. The present value of $200 per year for five years at 5 percent d. The future value of $200 per year for five years at 5 percent Repeat Problem 3 , but assume that the annuities are annuities due (Note: provide answer in full dollars/cents form, e.g:, $1,134.56 or $123.45 ): a. b. c. d. Consider the following uneven cash flow stream (Note: provide answer in full dollars/cents form, e.g:, $1,234.56 or $123.45 ): Year 0: $0 Year 1: $250 Year 2: $400 Year 3: $500 Year 4: $600 Year 5: $600 a. What is the present value if the discount rate is 10 percent? b. Add a cash outflow (or cost) of $1,000 at Year 0 . What is the present value (or net present value) of the total cash flow stream now? Assume that you just won $35 million in the Florida lottery, and hence the state will pay you 20 annual payments of $1.75 million each beginning immediately. If the similar risk to the lottery earnings (e.g., the rate on 20-year U.S. Treasury bonds) is 6 percent, what is the present value of your winnings? (Note: provide answer in full dollars/cents form including commas where necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts