Question: Problem #1 Here is some information about Company P's Dec. 31, Year 0 balance sheet. Total stockholders' equity: $12,000,000 Common stock + APIC: $6,400,000 Retained

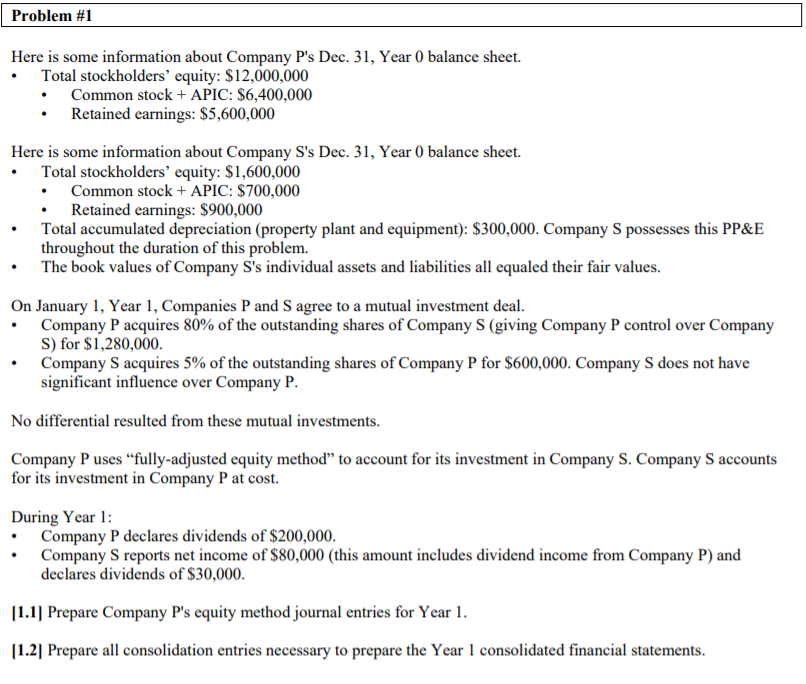

Problem #1 Here is some information about Company P's Dec. 31, Year 0 balance sheet. Total stockholders' equity: $12,000,000 Common stock + APIC: $6,400,000 Retained earnings: $5,600,000 Here is some information about Company S's Dec. 31, Year 0 balance sheet. Total stockholders' equity: $1,600,000 Common stock + APIC: $700,000 Retained earnings: $900,000 Total accumulated depreciation (property plant and equipment): $300,000. Company S possesses this PP&E throughout the duration of this problem. The book values of Company S's individual assets and liabilities all equaled their fair values. On January 1, Year 1, Companies P and S agree to a mutual investment deal. Company Pacquires 80% of the outstanding shares of Company S (giving Company P control over Company S) for $1,280,000 Company S acquires 5% of the outstanding shares of Company P for $600,000. Company S does not have significant influence over Company P. No differential resulted from these mutual investments. Company P uses fully-adjusted equity method to account for its investment in Company S. Company S accounts for its investment in Company P at cost. During Year 1: Company P declares dividends of $200,000. Company S reports net income of $80,000 (this amount includes dividend income from Company P) and declares dividends of $30,000. [1.1] Prepare Company P's equity method journal entries for Year 1. [1.2Prepare all consolidation entries necessary to prepare the Year 1 consolidated financial statements. Problem #1 Here is some information about Company P's Dec. 31, Year 0 balance sheet. Total stockholders' equity: $12,000,000 Common stock + APIC: $6,400,000 Retained earnings: $5,600,000 Here is some information about Company S's Dec. 31, Year 0 balance sheet. Total stockholders' equity: $1,600,000 Common stock + APIC: $700,000 Retained earnings: $900,000 Total accumulated depreciation (property plant and equipment): $300,000. Company S possesses this PP&E throughout the duration of this problem. The book values of Company S's individual assets and liabilities all equaled their fair values. On January 1, Year 1, Companies P and S agree to a mutual investment deal. Company Pacquires 80% of the outstanding shares of Company S (giving Company P control over Company S) for $1,280,000 Company S acquires 5% of the outstanding shares of Company P for $600,000. Company S does not have significant influence over Company P. No differential resulted from these mutual investments. Company P uses fully-adjusted equity method to account for its investment in Company S. Company S accounts for its investment in Company P at cost. During Year 1: Company P declares dividends of $200,000. Company S reports net income of $80,000 (this amount includes dividend income from Company P) and declares dividends of $30,000. [1.1] Prepare Company P's equity method journal entries for Year 1. [1.2Prepare all consolidation entries necessary to prepare the Year 1 consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts