Question: Problem 1 . Imagine you are a rational ( utility maximizing ) investor and assume you are in the case of one risky and one

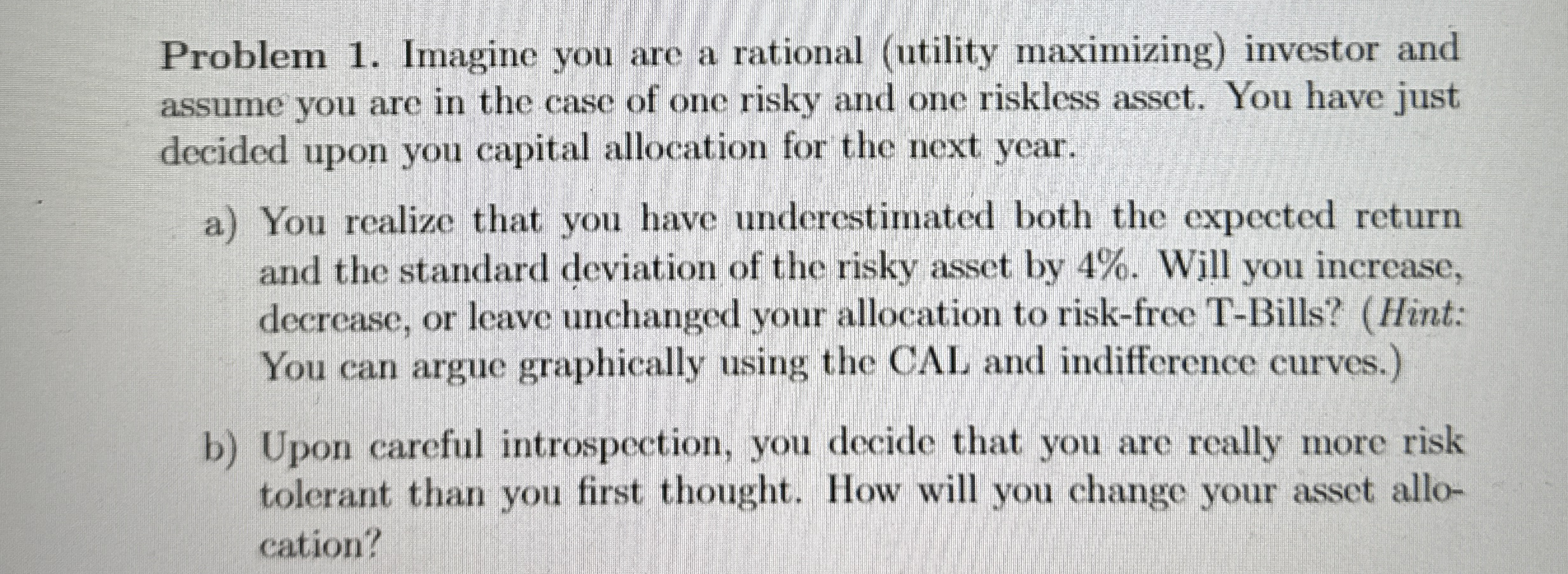

Problem Imagine you are a rational utility maximizing investor and assume you are in the case of one risky and one riskless asset. You have just decided upon you capital allocation for the next year.

a You realize that you have underestimated both the expected return and the standard deviation of the risky asset by Will you increase, decrease, or leave unchanged your allocation to riskfree TBills? Hint: You can argue graphically using the CAL and indifference curves.

b Upon careful introspection, you decide that you are really more risk tolerant than you first thought. How will you change your asset allocation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock