Question: PROBLEM 1 In January 1, 2016, Argo issued a 10-year, $700M bond paying 5.55% annually in two equal coupons each June and December. It is

PROBLEM 1

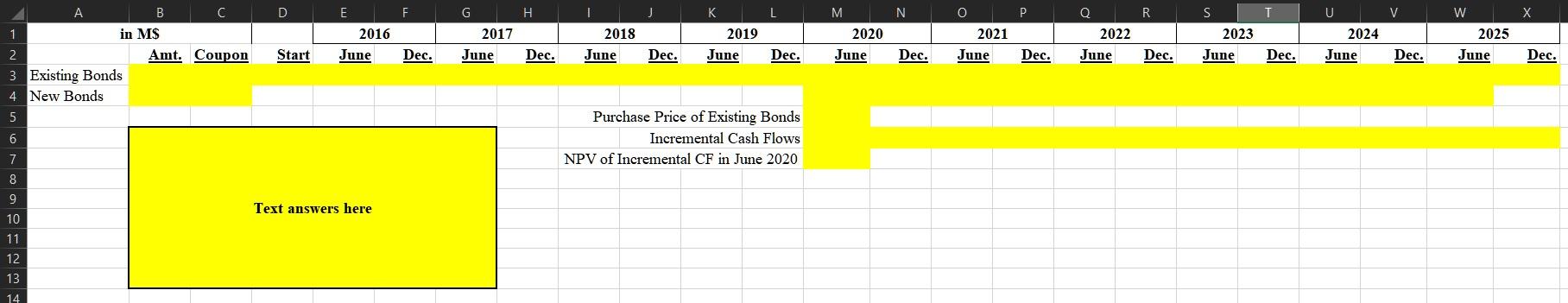

In January 1, 2016, Argo issued a 10-year, $700M bond paying 5.55% annually in two equal coupons each June and December. It is now June 2020 and Argo just paid the June coupon on its existing bond. Rates have come down, so it is thinking of buying back the bond and issuing a 5-year, $300M bond. This bond matures in June 2025 and will pay 3.45% per year in equal coupons each June and December.

a. What is the price that Argo must pay the current bond holders to buy back the bond? (Hint - the present value of the coupon payments and the final face value)

b. What are the cash flows associated with the new bond?

c. What are the cash flow differentials to Argo? In other words, what are the net cash flows in or out for Argo each June and December when comparing both bonds?

d. What is the present value of these cash flow differentials?

PLEASE SHOW FORMULAS IN EXCEL AND USE THE PROVIDED TEMPLATE.

D E F I J K N O R S V W X 2016 G 2017 June 2018 2021 A B 1 in M$ 2 Amt. Coupon 3 Existing Bonds 4 New Bonds M 2020 June 2023 Q 2022 June 2019 June 2025 U 2024 June Start June Dec. Dec. June Dec. Dec. Dec. June Dec. Dec. June Dec. Dec. June Dec. 5 6 Purchase Price of Existing Bonds Incremental Cash Flows NPV of Incremental CF in June 2020 7 8 9 Text answers here 10 11 12 13 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts