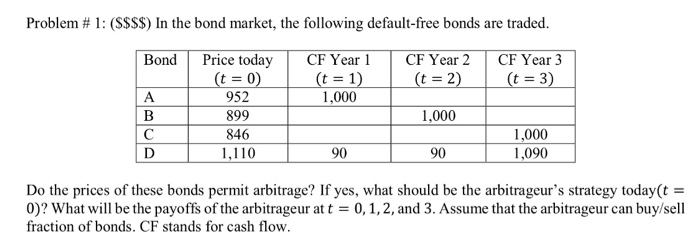

Question: Problem # 1 : ($$$$) In the bond market, the following default-free bonds are traded. BondPrice todayCF Year CF Year 2CF Year 3 952 899

Problem # 1 : ($$$$) In the bond market, the following default-free bonds are traded. BondPrice todayCF Year CF Year 2CF Year 3 952 899 846 1,110 1,000 1,000 1,000 1,090 90 90 Do the prices of these bonds permit arbitrage? If yes, what should be the arbitrageur's strategy today(t - 0)? What will be the payoffs of the arbitrageur att 0,1,2, and 3. Assume that the arbitrageur can buy/sell fraction of bonds. CF stands for cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts