Question: Problem 1: Intel stock is trading at $100 per share. The risk-free interest rate (annualized, continuously compounded) is 4.00%. The market assumes that Intel will

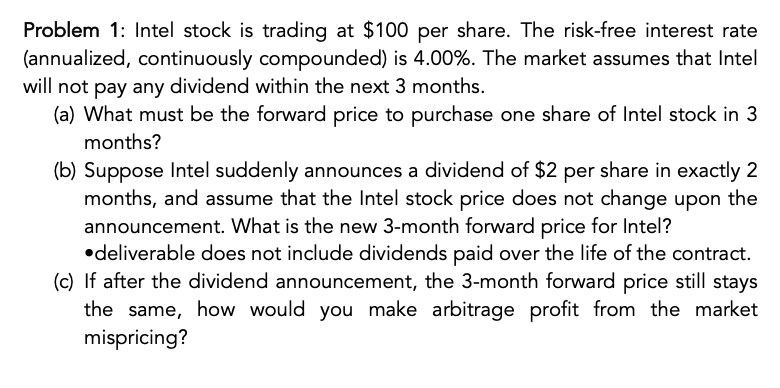

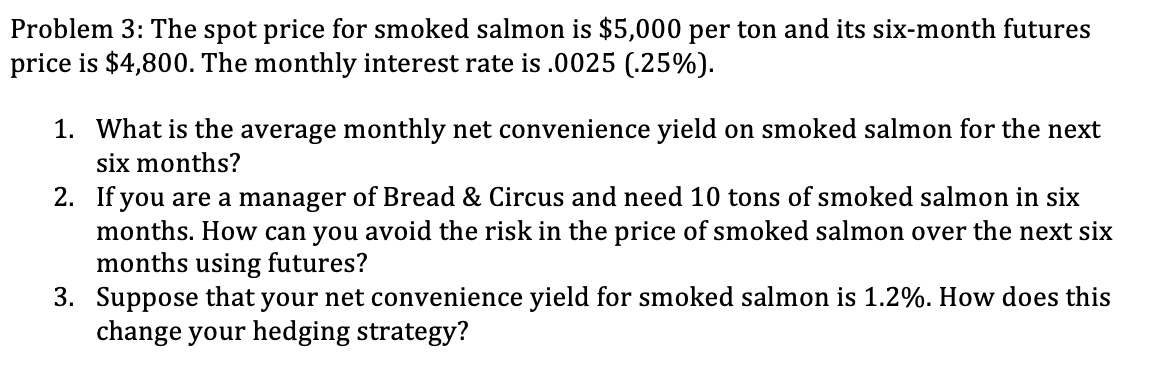

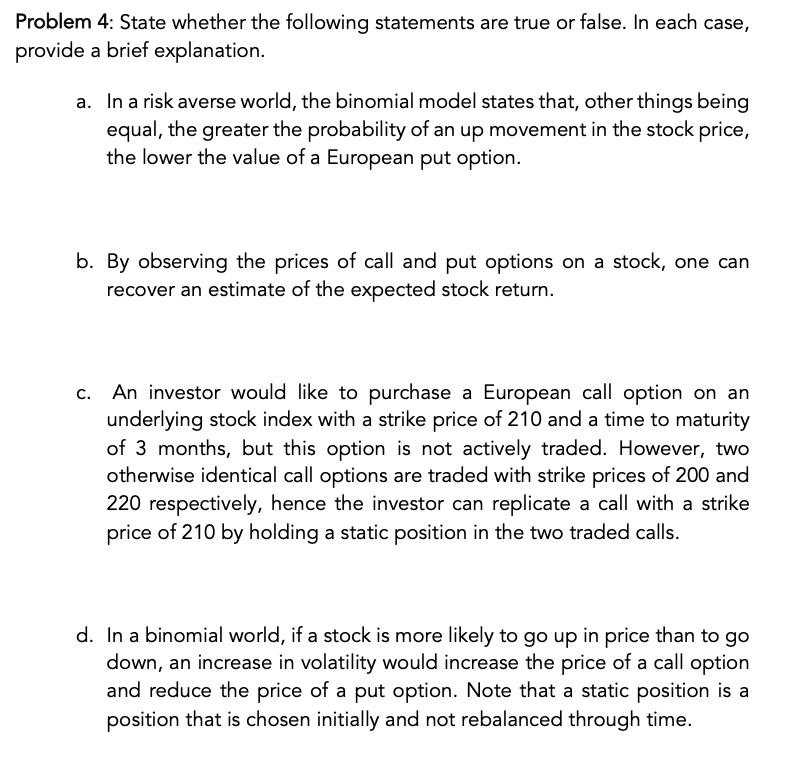

Problem 1: Intel stock is trading at $100 per share. The risk-free interest rate (annualized, continuously compounded) is 4.00%. The market assumes that Intel will not pay any dividend within the next 3 months. (a) What must be the forward price to purchase one share of Intel stock in 3 months? (b) Suppose Intel suddenly announces a dividend of $2 per share in exactly 2 months, and assume that the Intel stock price does not change upon the announcement. What is the new 3-month forward price for Intel? deliverable does not include dividends paid over the life of the contract. (c) If after the dividend announcement, the 3-month forward price still stays the same, how would you make arbitrage profit from the market mispricing? Problem 3: The spot price for smoked salmon is $5,000 per ton and its six-month futures price is $4,800. The monthly interest rate is .0025 (.25%). 1. What is the average monthly net convenience yield on smoked salmon for the next six months? 2. If you are a manager of Bread & Circus and need 10 tons of smoked salmon in six months. How can you avoid the risk in the price of smoked salmon over the next six months using futures? 3. Suppose that your net convenience yield for smoked salmon is 1.2%. How does this change your hedging strategy? Problem 4: State whether the following statements are true or false. In each case, provide a brief explanation. a. In a risk averse world, the binomial model states that, other things being equal, the greater the probability of an up movement in the stock price, the lower the value of a European put option. b. By observing the prices of call and put options on a stock, one can recover an estimate of the expected stock return. C. An investor would like to purchase a European call option on an underlying stock index with a strike price of 210 and a time to maturity of 3 months, but this option is not actively traded. However, two otherwise identical call options are traded with strike prices of 200 and 220 respectively, hence the investor can replicate a call with a strike price of 210 by holding a static position in the two traded calls. d. In a binomial world, if a stock is more likely to go up in price than to go down, an increase in volatility would increase the price of a call option and reduce the price of a put option. Note that a static position is a position that is chosen initially and not rebalanced through time. Problem 1: Intel stock is trading at $100 per share. The risk-free interest rate (annualized, continuously compounded) is 4.00%. The market assumes that Intel will not pay any dividend within the next 3 months. (a) What must be the forward price to purchase one share of Intel stock in 3 months? (b) Suppose Intel suddenly announces a dividend of $2 per share in exactly 2 months, and assume that the Intel stock price does not change upon the announcement. What is the new 3-month forward price for Intel? deliverable does not include dividends paid over the life of the contract. (c) If after the dividend announcement, the 3-month forward price still stays the same, how would you make arbitrage profit from the market mispricing? Problem 3: The spot price for smoked salmon is $5,000 per ton and its six-month futures price is $4,800. The monthly interest rate is .0025 (.25%). 1. What is the average monthly net convenience yield on smoked salmon for the next six months? 2. If you are a manager of Bread & Circus and need 10 tons of smoked salmon in six months. How can you avoid the risk in the price of smoked salmon over the next six months using futures? 3. Suppose that your net convenience yield for smoked salmon is 1.2%. How does this change your hedging strategy? Problem 4: State whether the following statements are true or false. In each case, provide a brief explanation. a. In a risk averse world, the binomial model states that, other things being equal, the greater the probability of an up movement in the stock price, the lower the value of a European put option. b. By observing the prices of call and put options on a stock, one can recover an estimate of the expected stock return. C. An investor would like to purchase a European call option on an underlying stock index with a strike price of 210 and a time to maturity of 3 months, but this option is not actively traded. However, two otherwise identical call options are traded with strike prices of 200 and 220 respectively, hence the investor can replicate a call with a strike price of 210 by holding a static position in the two traded calls. d. In a binomial world, if a stock is more likely to go up in price than to go down, an increase in volatility would increase the price of a call option and reduce the price of a put option. Note that a static position is a position that is chosen initially and not rebalanced through time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts