Question: Problem 1: Interest Rate and Purchasing Power Parities (12 points total, 3 points each) Suppose that the following conditions all hold: uncovered and covered interest

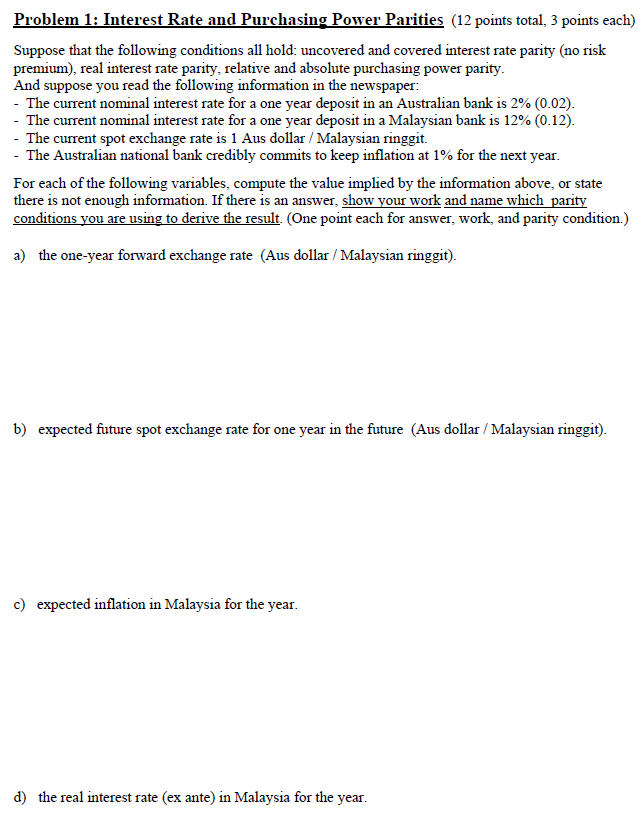

Problem 1: Interest Rate and Purchasing Power Parities (12 points total, 3 points each) Suppose that the following conditions all hold: uncovered and covered interest rate parity (no risk premium), real interest rate parity, relative and absolute purchasing power parity. And suppose you read the following information in the newspaper: - The current nominal interest rate for a one year deposit in an Australian bank is 2%(0.02). - The current nominal interest rate for a one year deposit in a Malaysian bank is 12%(0.12). - The current spot exchange rate is 1 Aus dollar / Malaysian ringgit. - The Australian national bank credibly commits to keep inflation at 1% for the next year. For each of the following variables, compute the value implied by the information above, or state there is not enough information. If there is an answer, show your work and name which parity conditions you are using to derive the result. (One point each for answer, work, and parity condition.) a) the one-year forward exchange rate (Aus dollar / Malaysian ringgit). b) expected future spot exchange rate for one year in the future (Aus dollar / Malaysian ringgit). c) expected inflation in Malaysia for the year. d) the real interest rate (ex ante) in Malaysia for the year. Problem 1: Interest Rate and Purchasing Power Parities (12 points total, 3 points each) Suppose that the following conditions all hold: uncovered and covered interest rate parity (no risk premium), real interest rate parity, relative and absolute purchasing power parity. And suppose you read the following information in the newspaper: - The current nominal interest rate for a one year deposit in an Australian bank is 2%(0.02). - The current nominal interest rate for a one year deposit in a Malaysian bank is 12%(0.12). - The current spot exchange rate is 1 Aus dollar / Malaysian ringgit. - The Australian national bank credibly commits to keep inflation at 1% for the next year. For each of the following variables, compute the value implied by the information above, or state there is not enough information. If there is an answer, show your work and name which parity conditions you are using to derive the result. (One point each for answer, work, and parity condition.) a) the one-year forward exchange rate (Aus dollar / Malaysian ringgit). b) expected future spot exchange rate for one year in the future (Aus dollar / Malaysian ringgit). c) expected inflation in Malaysia for the year. d) the real interest rate (ex ante) in Malaysia for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts