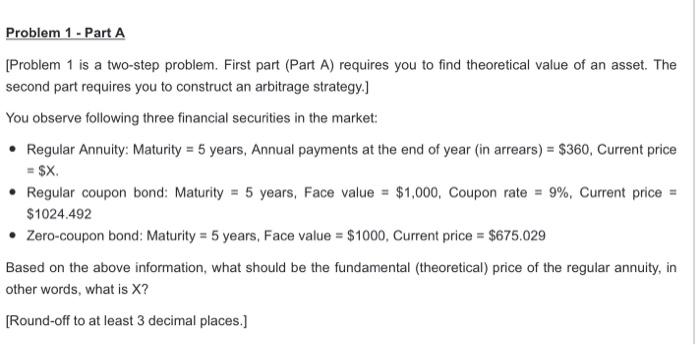

Question: [Problem 1 is a two-step problem. First part (Part A) requires you to find theoretical value of an asset. The second part requires you to

[Problem 1 is a two-step problem. First part (Part A) requires you to find theoretical value of an asset. The second part requires you to construct an arbitrage strategy.] You observe following three financial securities in the market: - Regular Annuity: Maturity = 5 years, Annual payments at the end of year (in arrears) = $360, Current price =$X. - Regular coupon bond: Maturity =5 years, Face value =$1,000, Coupon rate =9%, Current price = $1024.492 - Zero-coupon bond: Maturity = 5 years, Face value =$1000, Current price =$675.029 Based on the above information, what should be the fundamental (theoretical) price of the regular annuity, in other words, what is X? [Round-off to at least 3 decimal places.] [Problem 1 is a two-step problem. First part (Part A) requires you to find theoretical value of an asset. The second part requires you to construct an arbitrage strategy.] You observe following three financial securities in the market: - Regular Annuity: Maturity = 5 years, Annual payments at the end of year (in arrears) = $360, Current price =$X. - Regular coupon bond: Maturity =5 years, Face value =$1,000, Coupon rate =9%, Current price = $1024.492 - Zero-coupon bond: Maturity = 5 years, Face value =$1000, Current price =$675.029 Based on the above information, what should be the fundamental (theoretical) price of the regular annuity, in other words, what is X? [Round-off to at least 3 decimal places.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts