Question: PROBLEM 1: Johnston Industries finances its projects with 30% debt, 10% preferred stock and 60% common stock. The company can issue bonds at a YTM

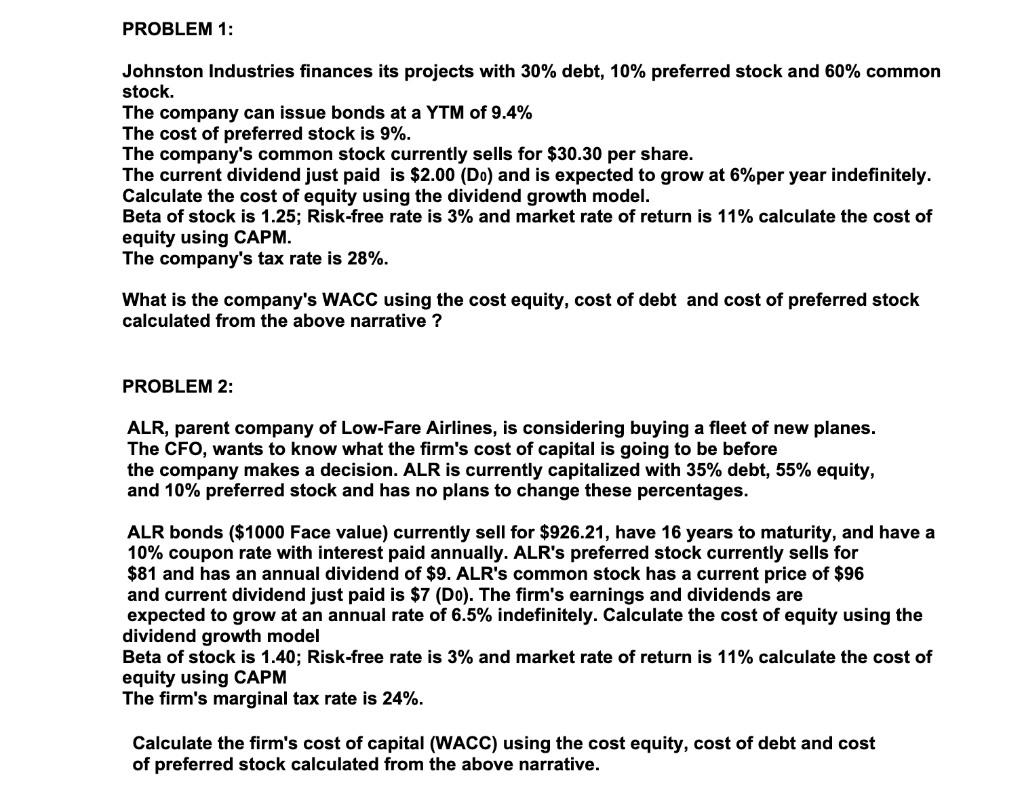

PROBLEM 1: Johnston Industries finances its projects with 30% debt, 10% preferred stock and 60% common stock. The company can issue bonds at a YTM of 9.4% The cost of preferred stock is 9%. The company's common stock currently sells for $30.30 per share. The current dividend just paid is $2.00 (Do) and is expected to grow at 6%per year indefinitely. Calculate the cost of equity using the dividend growth model. Beta of stock is 1.25; Risk-free rate is 3% and market rate of return is 11% calculate the cost of equity using CAPM. The company's tax rate is 28%. What is the company's WACC using the cost equity, cost of debt and cost of preferred stock calculated from the above narrative ? PROBLEM 2: ALR, parent company of Low-Fare Airlines, is considering buying a fleet of new planes. The CFO, wants to know what the firm's cost of capital is going to be before the company makes a decision. ALR is currently capitalized with 35% debt, 55% equity, and 10% preferred stock and has no plans to change these percentages. ALR bonds ($1000 Face value) currently sell for $926.21, have 16 years to maturity, and have a 10% coupon rate with interest paid annually. ALR's preferred stock currently sells for $81 and has an annual dividend of $9. ALR's common stock has a current price of $96 and current dividend just paid is $7 (Do). The firm's earnings and dividends are expected to grow at an annual rate of 6.5% indefinitely. Calculate the cost of equity using the dividend growth model Beta of stock is 1.40; Risk-free rate is 3% and market rate of return is 11% calculate the cost of equity using CAPM The firm's marginal tax rate is 24%. Calculate the firm's cost of capital (WACC) using the cost equity, cost of debt and cost of preferred stock calculated from the above narrative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts