Question: Problem 1 - Knapsack Problem (10 points): A hedge-fund manager is considering 5 independent investment opportunities for a client. There is a fixed amount of

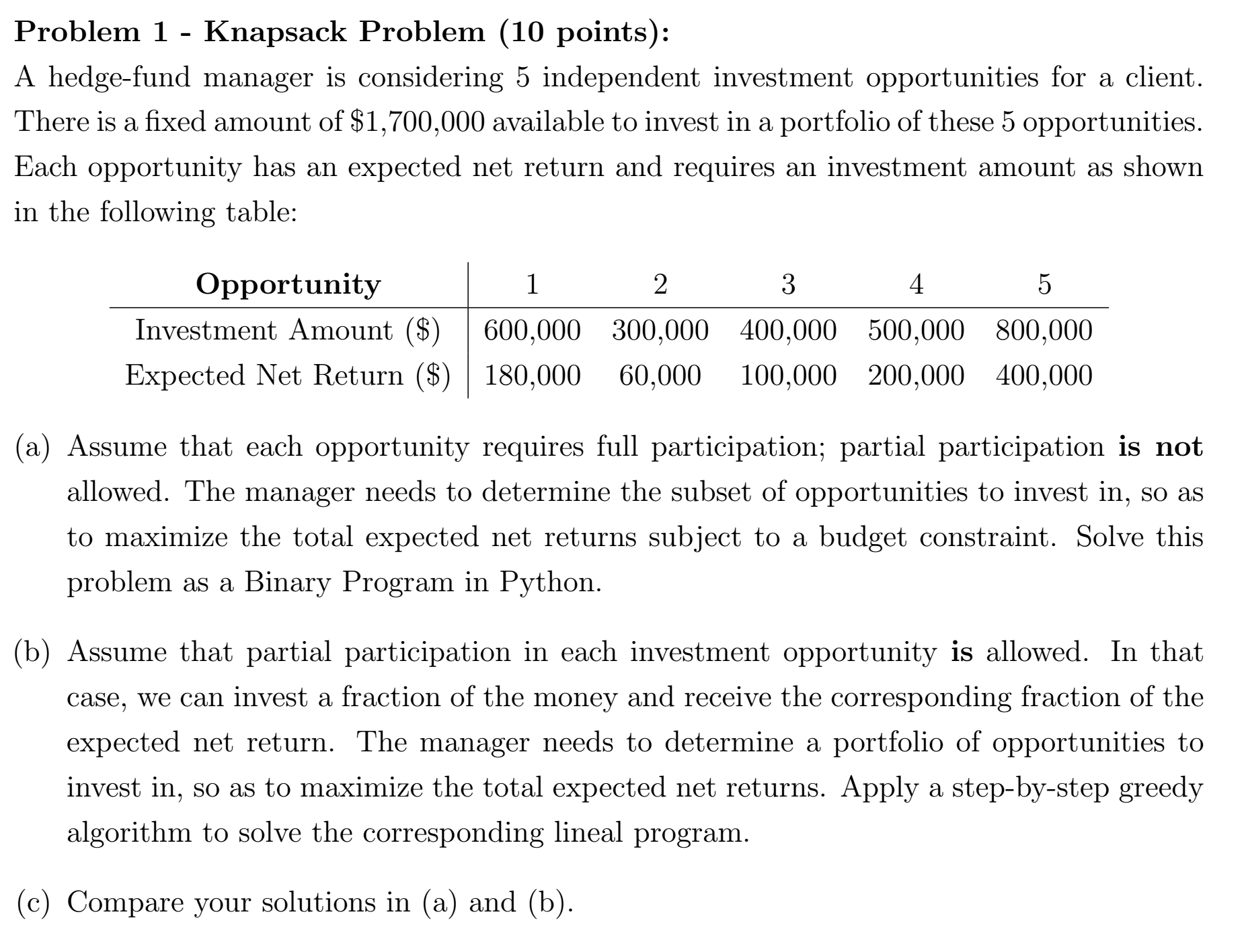

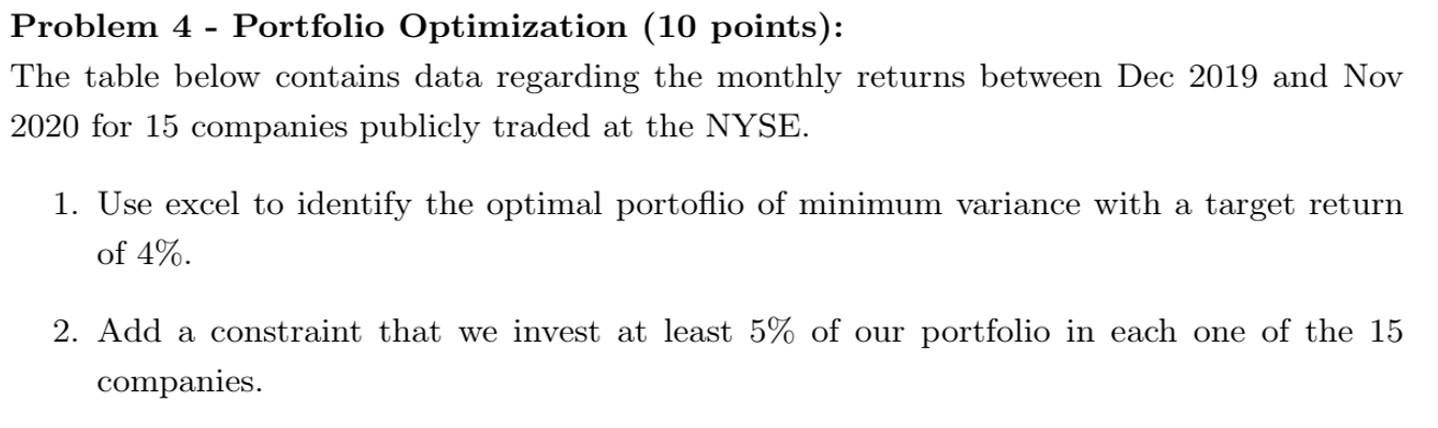

Problem 1 - Knapsack Problem (10 points): A hedge-fund manager is considering 5 independent investment opportunities for a client. There is a fixed amount of $1,700,000 available to invest in a portfolio of these 5 opportunities. Each opportunity has an expected net return and requires an investment amount as shown in the following table: (a) Assume that each opportunity requires full participation; partial participation is not allowed. The manager needs to determine the subset of opportunities to invest in, so as to maximize the total expected net returns subject to a budget constraint. Solve this problem as a Binary Program in Python. (b) Assume that partial participation in each investment opportunity is allowed. In that case, we can invest a fraction of the money and receive the corresponding fraction of the expected net return. The manager needs to determine a portfolio of opportunities to invest in, so as to maximize the total expected net returns. Apply a step-by-step greedy algorithm to solve the corresponding lineal program. (c) Compare your solutions in (a) and (b). Problem 4 - Portfolio Optimization ( 10 points): The table below contains data regarding the monthly returns between Dec 2019 and Nov 2020 for 15 companies publicly traded at the NYSE. 1. Use excel to identify the optimal portoflio of minimum variance with a target return of 4%. 2. Add a constraint that we invest at least 5% of our portfolio in each one of the 15 companies. Problem 1 - Knapsack Problem (10 points): A hedge-fund manager is considering 5 independent investment opportunities for a client. There is a fixed amount of $1,700,000 available to invest in a portfolio of these 5 opportunities. Each opportunity has an expected net return and requires an investment amount as shown in the following table: (a) Assume that each opportunity requires full participation; partial participation is not allowed. The manager needs to determine the subset of opportunities to invest in, so as to maximize the total expected net returns subject to a budget constraint. Solve this problem as a Binary Program in Python. (b) Assume that partial participation in each investment opportunity is allowed. In that case, we can invest a fraction of the money and receive the corresponding fraction of the expected net return. The manager needs to determine a portfolio of opportunities to invest in, so as to maximize the total expected net returns. Apply a step-by-step greedy algorithm to solve the corresponding lineal program. (c) Compare your solutions in (a) and (b). Problem 4 - Portfolio Optimization ( 10 points): The table below contains data regarding the monthly returns between Dec 2019 and Nov 2020 for 15 companies publicly traded at the NYSE. 1. Use excel to identify the optimal portoflio of minimum variance with a target return of 4%. 2. Add a constraint that we invest at least 5% of our portfolio in each one of the 15 companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts