Question: Problem #1 Lump-Sum Liquidation with Gain on Realization After several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After

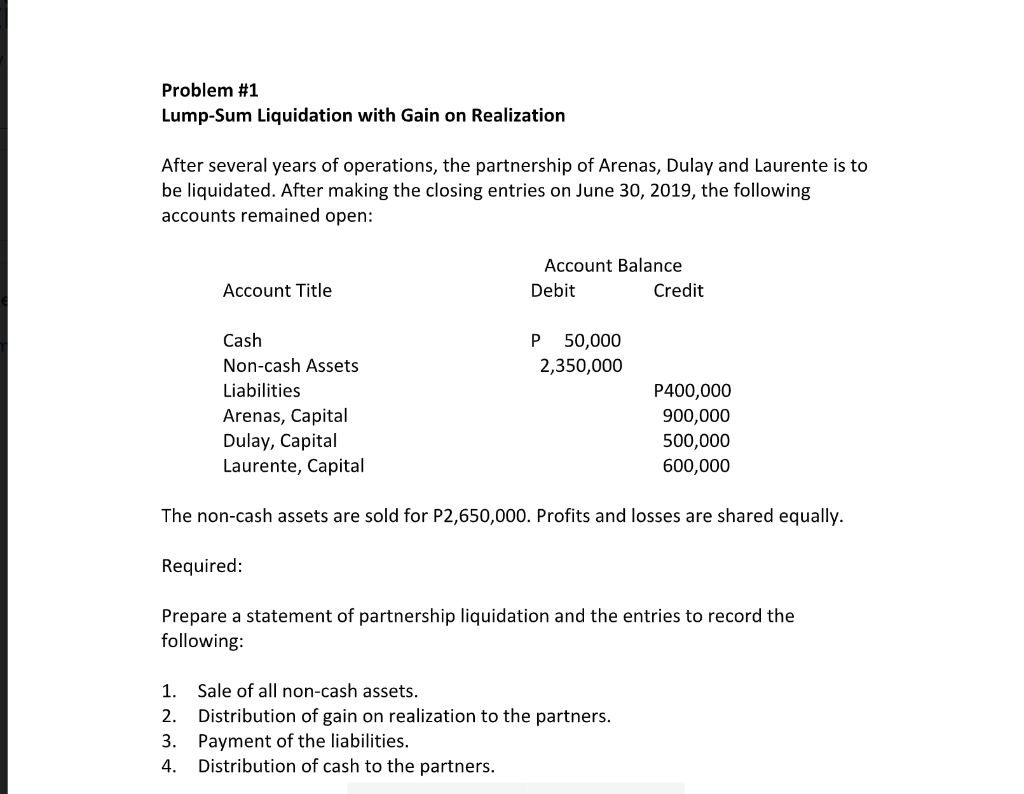

Problem #1 Lump-Sum Liquidation with Gain on Realization After several years of operations, the partnership of Arenas, Dulay and Laurente is to be liquidated. After making the closing entries on June 30, 2019, the following accounts remained open: Account Balance Debit Credit Account Title P 50,000 2,350,000 Cash Non-cash Assets Liabilities Arenas, Capital Dulay, Capital Laurente, Capital P400,000 900,000 500,000 600,000 The non-cash assets are sold for P2,650,000. Profits and losses are shared equally. Required: Prepare a statement of partnership liquidation and the entries to record the following: 1. Sale of all non-cash assets. 2. Distribution of gain on realization to the partners. 3. Payment of the liabilities. 4. Distribution of cash to the partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts