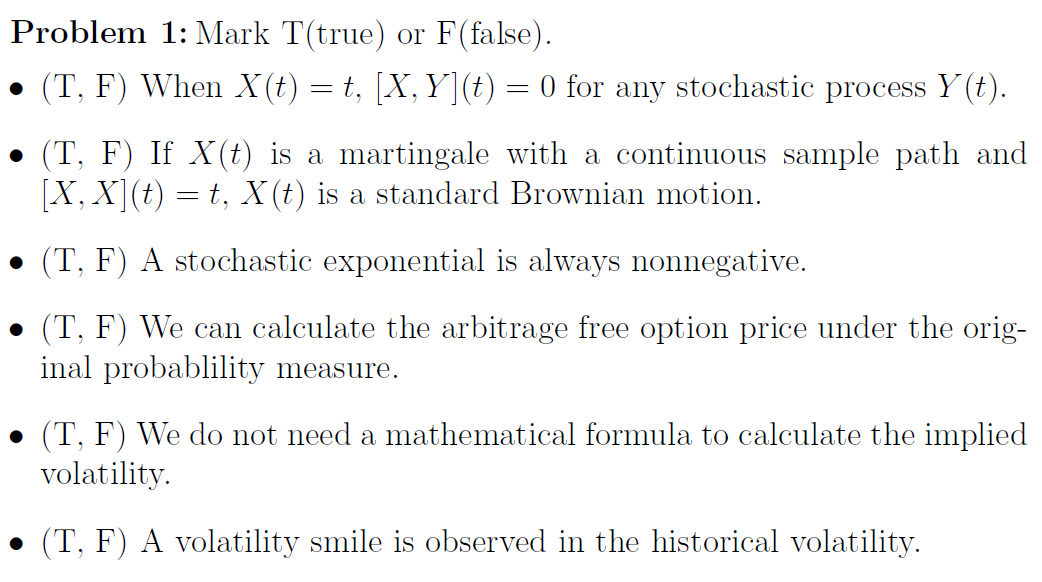

Question: Problem 1: Mark T (true) or F (false). - (T,F) When X(t)=t,[X,Y](t)=0 for any stochastic process Y(t). - (T,F) If X(t) is a martingale with

Problem 1: Mark T (true) or F (false). - (T,F) When X(t)=t,[X,Y](t)=0 for any stochastic process Y(t). - (T,F) If X(t) is a martingale with a continuous sample path and [X,X](t)=t,X(t) is a standard Brownian motion. - (T,F) A stochastic exponential is always nonnegative. - (T,F) We can calculate the arbitrage free option price under the original probablility measure. - (T,F) We do not need a mathematical formula to calculate the implied volatility. - (T,F) A volatility smile is observed in the historical volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts