Question: Problem 1 NBL bank classifies loans as good, risky, or uncollectable, depending on the history of their repayment. Based on past data a one-month

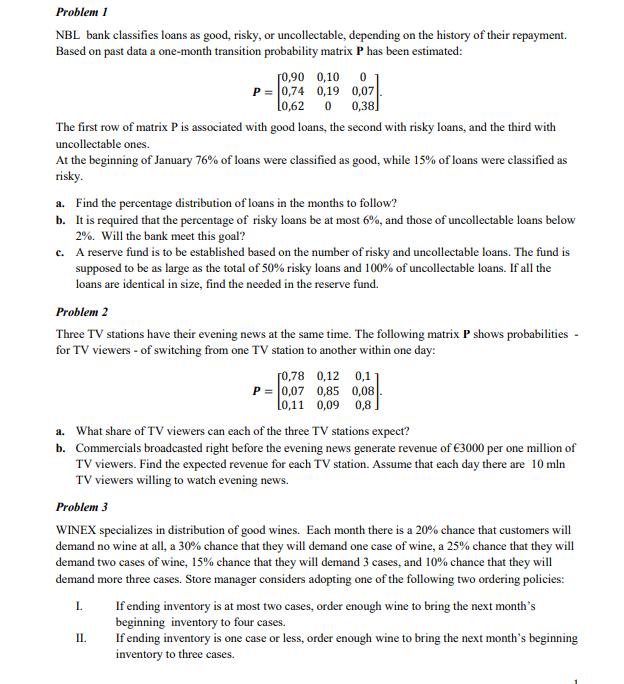

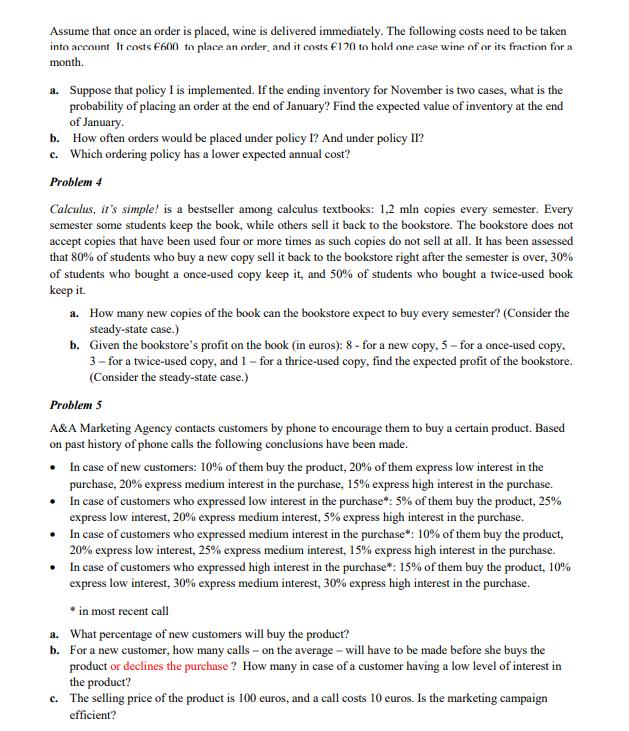

Problem 1 NBL bank classifies loans as good, risky, or uncollectable, depending on the history of their repayment. Based on past data a one-month transition probability matrix P has been estimated: [0,90 0,10 0 P= 0,74 0,19 0,07 10,62 0 0,38] The first row of matrix P is associated with good loans, the second with risky loans, and the third with uncollectable ones. At the beginning of January 76% of loans were classified as good, while 15% of loans were classified as risky. a. Find the percentage distribution of loans in the months to follow? b. It is required that the percentage of risky loans be at most 6%, and those of uncollectable loans below 2%. Will the bank meet this goal? c. A reserve fund is to be established based on the number of risky and uncollectable loans. The fund is supposed to be as large as the total of 50% risky loans and 100% of uncollectable loans. If all the loans are identical in size, find the needed in the reserve fund. Problem 2 Three TV stations have their evening news at the same time. The following matrix P shows probabilities - for TV viewers - of switching from one TV station to another within one day: [0,78 0,12 0,1 P = 0,07 0,85 0,08 0,11 0,09 0,8 ] a. What share of TV viewers can each of the three TV stations expect? b. Commercials broadcasted right before the evening news generate revenue of 3000 per one million of TV viewers. Find the expected revenue for each TV station. Assume that each day there are 10 mln TV viewers willing to watch evening news. II. Problem 3 WINEX specializes in distribution of good wines. Each month there is a 20% chance that customers will demand no wine at all, a 30% chance that they will demand one case of wine, a 25% chance that they will demand two cases of wine, 15% chance that they will demand 3 cases, and 10% chance that they will demand more three cases. Store manager considers adopting one of the following two ordering policies: L If ending inventory is at most two cases, order enough wine to bring the next month's beginning inventory to four cases. If ending inventory is one case or less, order enough wine to bring the next month's beginning inventory to three cases. Assume that once an order is placed, wine is delivered immediately. The following costs need to be taken into account It costs 600 to place an order, and it costs 120 to hold one case wine of or its fraction for a month.. a. Suppose that policy I is implemented. If the ending inventory for November is two cases, what is the probability of placing an order at the end of January? Find the expected value of inventory at the end of January. b. How often orders would be placed under policy I? And under policy II? c. Which ordering policy has a lower expected annual cost? Problem 4 Calculus, it's simple! is a bestseller among calculus textbooks: 1,2 mln copies every semester. Every semester some students keep the book, while others sell it back to the bookstore. The bookstore does not accept copies that have been used four or more times as such copies do not sell at all. It has been assessed that 80% of students who buy a new copy sell it back to the bookstore right after the semester is over, 30% of students who bought a once-used copy keep it, and 50% of students who bought a twice-used book keep it. a. How many new copies of the book can the bookstore expect to buy every semester? (Consider the steady-state case.) b. Given the bookstore's profit on the book (in euros): 8 - for a new copy, 5-for a once-used copy, 3- for a twice-used copy, and 1 - for a thrice-used copy, find the expected profit of the bookstore. (Consider the steady-state case.) Problem 5 A&A Marketing Agency contacts customers by phone to encourage them to buy a certain product. Based on past history of phone calls the following conclusions have been made. In case of new customers: 10% of them buy the product, 20% of them express low interest in the purchase, 20% express medium interest in the purchase, 15% express high interest in the purchase. In case of customers who expressed low interest in the purchase*: 5% of them buy the product, 25% express low interest, 20% express medium interest, 5% express high interest in the purchase. In case of customers who expressed medium interest in the purchase*: 10% of them buy the product, 20% express low interest, 25% express medium interest, 15% express high interest in the purchase. In case of customers who expressed high interest in the purchase*: 15% of them buy the product, 10% express low interest, 30% express medium interest, 30% express high interest in the purchase. * in most recent call a. What percentage of new customers will buy the product? b. For a new customer, how many calls on the average - will have to be made before she buys the product or declines the purchase? How many in case of a customer having a low level of interest in the product? c. The selling price of the product is 100 euros, and a call costs 10 euros. Is the marketing campaign efficient?

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Answer 1 a The percentage distribution of loans in the months to follow can be found using the transition probability matrix The expected number of good loans in February is calculated by multiplying ... View full answer

Get step-by-step solutions from verified subject matter experts