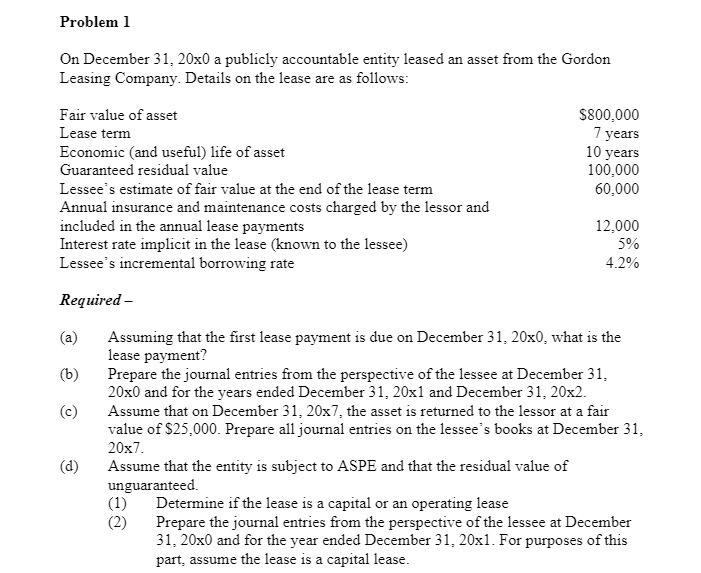

Question: Problem 1 On December 31, 20x0 a publicly accountable entity leased an asset from the Gordon Leasing Company. Details on the lease are as follows:

Problem 1 On December 31, 20x0 a publicly accountable entity leased an asset from the Gordon Leasing Company. Details on the lease are as follows: Fair value of asset $800,000 Lease term 7 years Economic (and useful) life of asset 10 years Guaranteed residual value 100,000 Lessee's estimate of fair value at the end of the lease term 60.000 Annual insurance and maintenance costs charged by the lessor and included in the annual lease payments 12,000 Interest rate implicit in the lease (known to the lessee) 5% Lessee's incremental borrowing rate 4.2% Required - (a) Assuming that the first lease payment is due on December 31, 20x0, what is the lease payment? (b ) Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the years ended December 31, 20x1 and December 31, 20x2. (c) Assume that on December 31, 20x7, the asset is returned to the lessor at a fair value of $25,000. Prepare all journal entries on the lessee's books at December 31, 20x7. (d) Assume that the entity is subject to ASPE and that the residual value of unguaranteed. (1) Determine if the lease is a capital or an operating lease (2) Prepare the journal entries from the perspective of the lessee at December 31, 20x0 and for the year ended December 31, 20x1. For purposes of this part, assume the lease is a capital lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts