Question: Problem 1 On February 2 0 , 2 0 2 3 , I bought a 1 9 6 7 Mustang for $ 1 1 ,

Problem

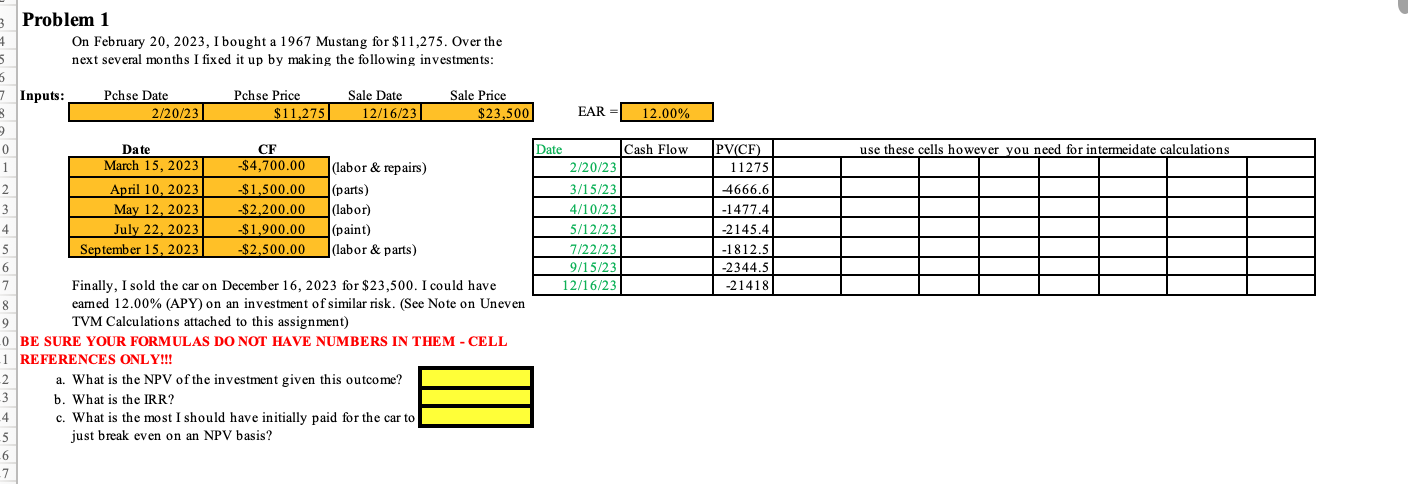

On February I bought a Mustang for $ Over the

next several months I fixed it up by making the following investments:

Inputs:

Pchse Date

Pchse Price

Sale Date

Sale Price

EAR

Finally, I sold the car on December for $ I could have

earned APY on an investment of similar risk. See Note on Uneven

TVM Calculations attached to this assignment

BE SURE YOUR FORMULAS DO NOT HAVE NUMBERS IN THEM CELL

REFERENCES ONLY!!!

a What is the NPV of the investment given this outcome?

b What is the IRR?

c What is the most I should have initially paid for the car to

just break even on an NPV basis?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock