Question: Problem # 1 On July 31, after all transactions have been recorded, the balance in the company's Cash account has a balance of $15,244 b.

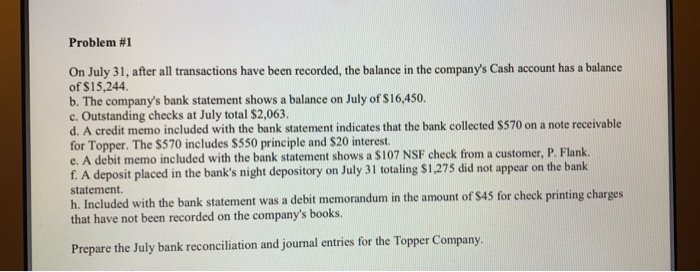

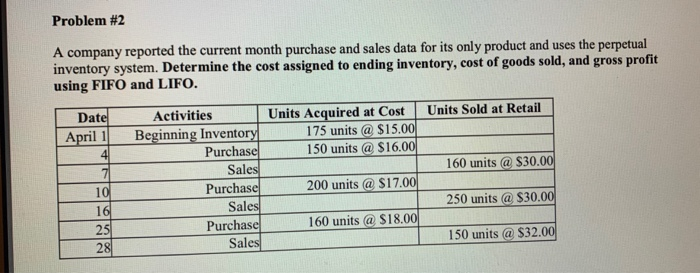

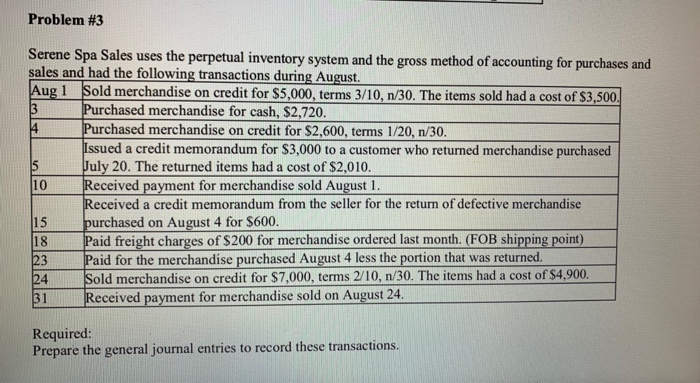

Problem # 1 On July 31, after all transactions have been recorded, the balance in the company's Cash account has a balance of $15,244 b. The company's bank statement shows a balance on July of $16,450. c. Outstanding checks at July total $2,063. d. A credit memo included with the bank statement indicates that the bank collected $570 on a note receivable for Topper. The $570 includes $550 principle and $20 interest. e. A debit memo included with the bank statement shows a $107 NSF check from a customer, P. Flank f. A deposit placed in the bank's night depository on July 31 totaling $1,275 did not appear on the bank C statement. h. Included with the bank statement was a debit memorandum in the amount of $45 for check printing charges that have not been recorded on the company's books. Prepare the July bank reconciliation and journal entries for the Topper Company Problem # 2 A company reported the current month purchase and sales data for its only product and uses the perpetual inventory system. Determine the cost assigned to ending inventory, cost of goods sold, and gross profit using FIFO and LIFO. Date April 1 Units Acquired at Cost 175 units @ $15.00 150 units @ $16.00 Activities Units Sold at Retail Beginning Inventory Purchase Sales Purchase Sales Purchase Sales 4 160 units @ $30.00 7 200 units @ $17.00 10 16 250 units @ S30.00 160 units @ $18.00 25 150 units (@ $32.00 28 Problem #3 Serene Spa Sales uses the perpetual inventory system and the gross method of accounting for purchases and sales and had the following transactions during August. Aug 1 Sold merchandise on credit for $5,000, terms 3/10, n/30. The items sold had a cost of $3,500. Purchased merchandise for cash, $2,720. Purchased merchandise on credit for $2,600, terms 1/20, n/30. Issued a credit memorandum for $3,000 to a customer who returned merchandise purchased July 20. The returned items had a cost of $2,010. Received payment for merchandise sold August 1. Received a credit memorandum from the seller for the return of defective merchandise purchased on August 4 for $600. Paid freight charges of $200 for merchandise ordered last month. (FOB shipping point) Paid for the merchandise purchased August 4 less the portion that was returned. Sold merchandise on credit for $7,000, terms 2/10, n/30. The items had a cost of $4,900 Received payment for merchandise sold on August 24 3 4 10 15 18 23 24 31 Required: Prepare the general journal entries to record these transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts