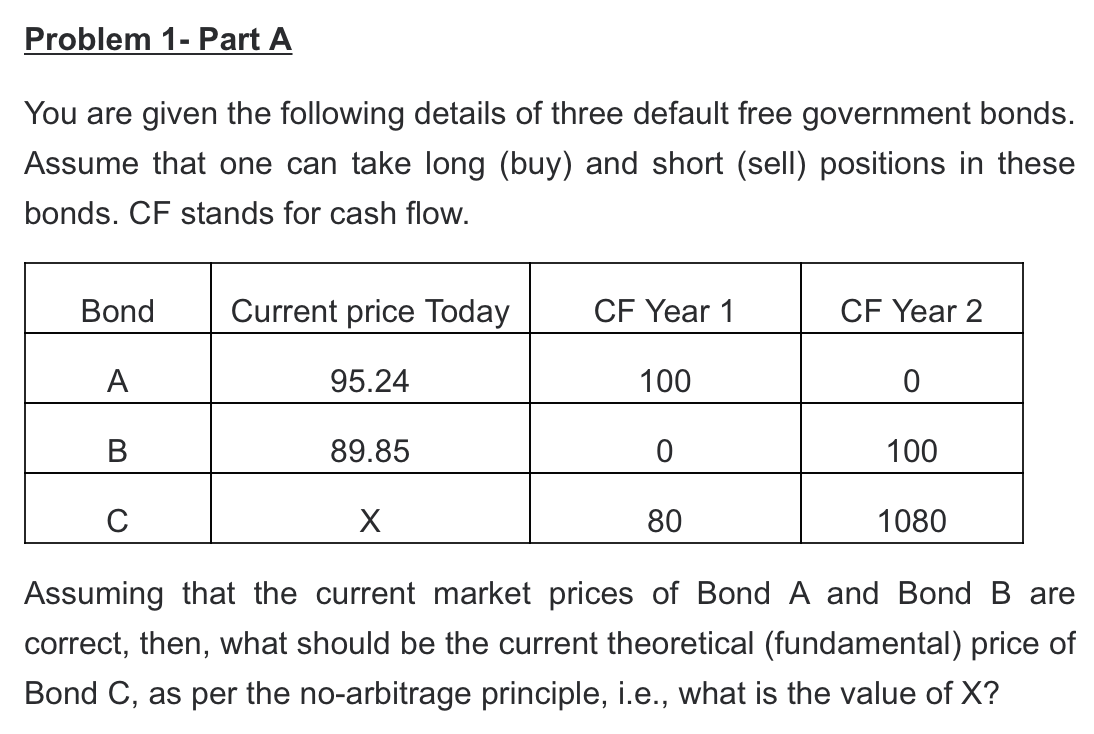

Question: Problem 1 - Part A You are given the following details of three default free government bonds. Assume that one can take long (buy) and

Problem 1 - Part A You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Bond Current price Today CF Year 1 CF Year 2 A 95.24 100 0 B 89.85 0 100 X 80 1080 Assuming that the current market prices of Bond A and Bond B are correct, then, what should be the current theoretical (fundamental) price of Bond C, as per the no-arbitrage principle, i.e., what is the value of X? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts