Question: Problem 1: Peace Dividend (PD) Inc. currently has a perpetual debt valued at $165 million. The cost of debt for this loan is 6.7%. The

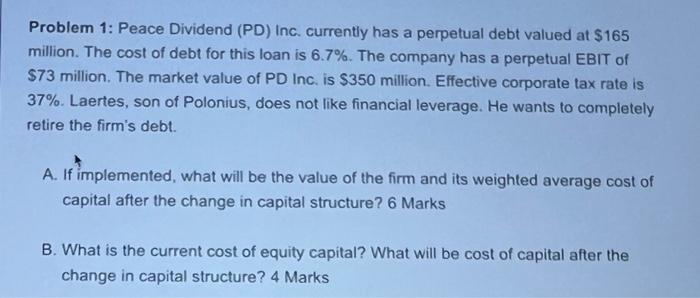

Problem 1: Peace Dividend (PD) Inc. currently has a perpetual debt valued at $165 million. The cost of debt for this loan is 6.7%. The company has a perpetual EBIT of $73 million. The market value of PD Inc. is $350 million. Effective corporate tax rate is 37%. Laertes, son of Polonius, does not like financial leverage. He wants to completely retire the firm's debt. A. If implemented, what will be the value of the firm and its weighted average cost of capital after the change in capital structure? 6 Marks B. What is the current cost of equity capital? What will be cost of capital after the change in capital structure? 4 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts