Question: Problem 1: Prepare the Statement of Cash Flows for Computer Services Company on the Second Year of Operation - 1997 based on the given information.

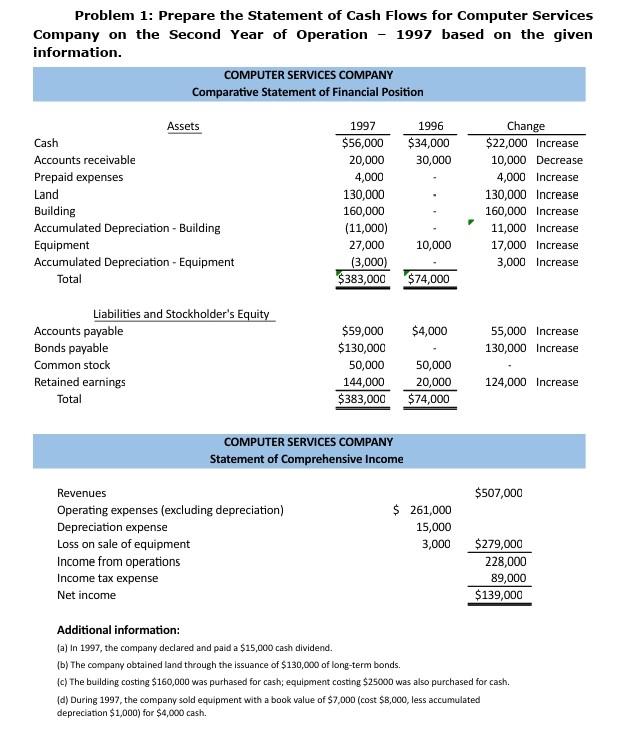

Problem 1: Prepare the Statement of Cash Flows for Computer Services Company on the Second Year of Operation - 1997 based on the given information. COMPUTER SERVICES COMPANY Comparative Statement of Financial Position Assets Cash Accounts receivable Prepaid expenses Land Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment 1997 1996 $56,000 $34,000 20,000 30,000 4,000 130,000 160,000 (11,000) 27,000 10,000 (3,000) $383,000 $74,000 Change $22,000 Increase 10,000 Decrease 4,000 Increase 130,000 Increase 160,000 Increase 11,000 Increase 17,000 Increase 3,000 Increase Total Liabilities and Stockholder's Equity Accounts payable Bonds payable Common stock Retained earnings Total 55,000 Increase 130,000 Increase $59,000 $4,000 $130,000 50,000 50,000 144,000 20,000 $383,000 $74,000 124,000 Increase COMPUTER SERVICES COMPANY Statement of Comprehensive Income $507,000 Revenues Operating expenses (excluding depreciation) Depreciation expense Loss on sale of equipment Income from operations Income tax expense Net income $ 261,000 15,000 3,000 $279,000 228,000 89,000 $139,000 Additional information: (a) In 1997, the company declared and paid a $15,000 cash dividend. (b) The company obtained land through the issuance of $130,000 of long-term bonds. (c) The building costing $160,000 was purhased for cash; equipment casting $25000 was also purchased for cash. (d) During 1997, the company sold equipment with a book value of $7,000 (cost $8,000, less accumulated depreciation $1,000) for $4,000 cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts