Question: Problem 1: Presented below are three independent situations . Answer the question at the end of each situation 1. During 2019, Maverick ASA became involved

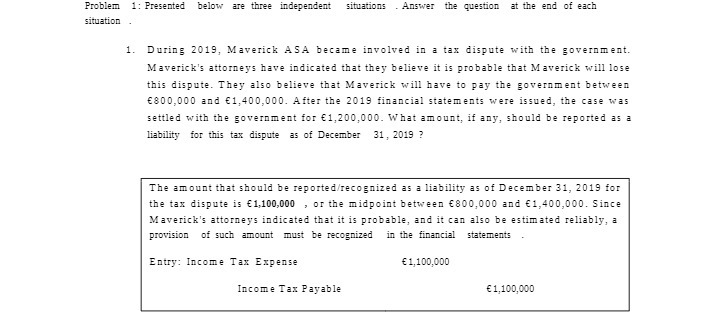

Problem 1: Presented below are three independent situations . Answer the question at the end of each situation 1. During 2019, Maverick ASA became involved in a tax dispute with the government. Maverick's attorneys have indicated that they believe it is probable that Maverick will lose this dispute. They also believe that Maverick will have to pay the government between 6800,000 and 61,400,000. After the 2019 financial statements were issued, the case was settled with the government for (1, 200,000. What amount, if any, should be reported as a liability for this tax dispute as of December 31, 2019 ? The amount that should be reported/recognized as a liability as of December 31, 2019 for the tax dispute is (1,100,000 , or the midpoint between 6800,000 and 61, 400,000. Since Maverick's attorneys indicated that it is probable, and it can also be estimated reliably, a provision of such amount must be recognized in the financial statements Entry: Income Tax Expense E 1,100,000 Income Tax Payable E1,100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts