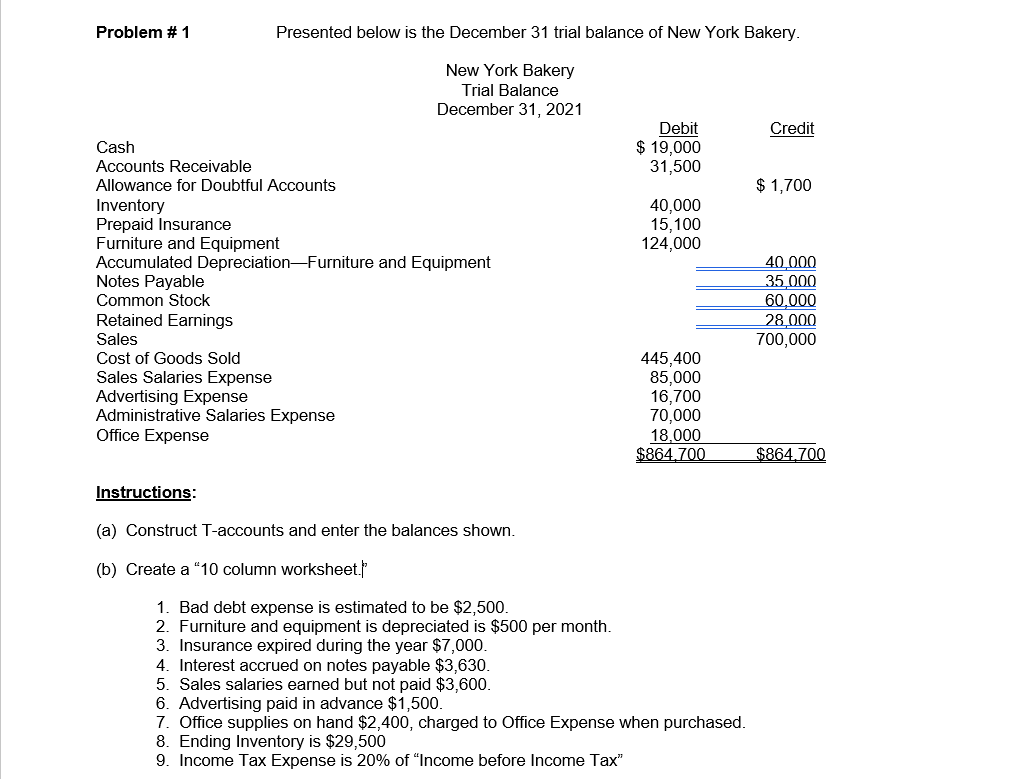

Question: Problem # 1 Presented below is the December 31 trial balance of New York Bakery. New York Bakery Trial Balance December 31, 2021 Credit Debit

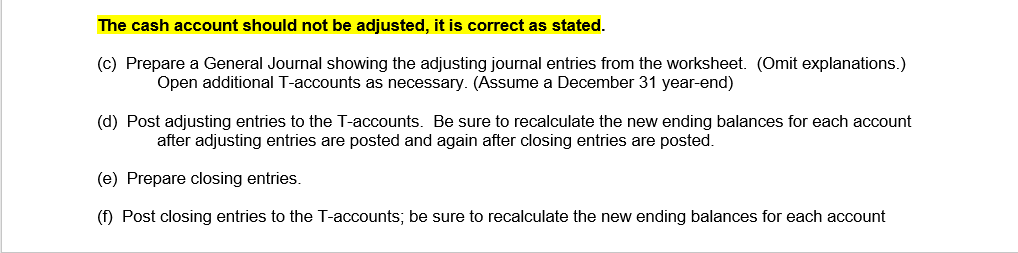

Problem # 1 Presented below is the December 31 trial balance of New York Bakery. New York Bakery Trial Balance December 31, 2021 Credit Debit $ 19.000 31,500 $ 1,700 40,000 15,100 124,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Furniture and Equipment Accumulated Depreciation Furniture and Equipment Notes Payable Common Stock Retained Earnings Sales Cost of Goods Sold Sales Salaries Expense Advertising Expense Administrative Salaries Expense Office Expense 40.000 35.000 60.000 28.000 700,000 445,400 85,000 16,700 70,000 18.000 $864,700 $864.700 Instructions: (a) Construct T-accounts and enter the balances shown. (b) Create a "10 column worksheet." 1. Bad debt expense is estimated to be $2,500. 2. Furniture and equipment is depreciated is $500 per month. 3. Insurance expired during the year $7,000. 4. Interest accrued on notes payable $3,630. 5. Sales salaries earned but not paid $3,600. 6. Advertising paid in advance $1,500. 7. Office supplies on hand $2,400, charged to Office Expense when purchased. 8. Ending Inventory is $29,500 9. Income Tax Expense is 20% of "Income before Income Tax" The cash account should not be adjusted, it is correct as stated. (c) Prepare a General Journal showing the adjusting journal entries from the worksheet. (Omit explanations.) Open additional T-accounts as necessary. (Assume a December 31 year-end) (d) Post adjusting entries to the T-accounts. Be sure to recalculate the new ending balances for each account after adjusting entries are posted and again after closing entries are posted. (e) Prepare closing entries. (1) Post closing entries to the T-accounts, be sure to recalculate the new ending balances for each account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts