Question: Problem 1) Problem 2) Emergency please! In November 2017, Treasury 4 3/4s of 2043 offered a semiannually compounded yield to maturity of 2.72%. Recognizing that

Problem 1)

Problem 2)

Problem 2)

Emergency please!

Emergency please!

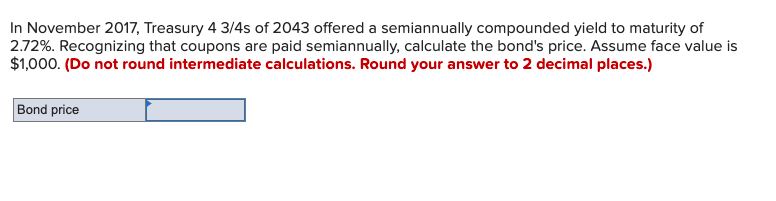

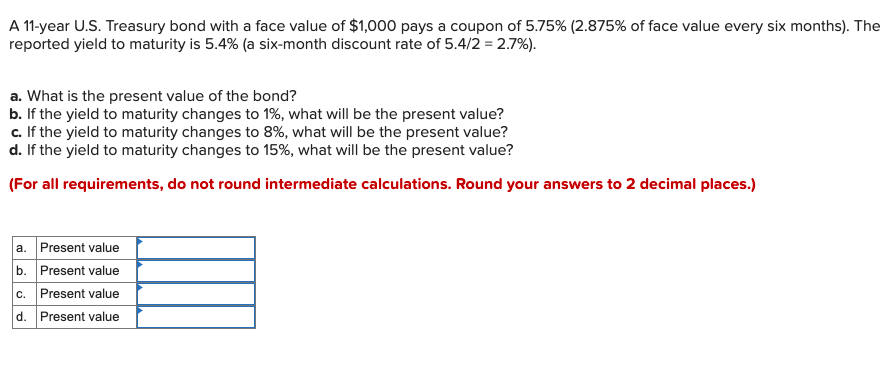

In November 2017, Treasury 4 3/4s of 2043 offered a semiannually compounded yield to maturity of 2.72%. Recognizing that coupons are paid semiannually, calculate the bond's price. Assume face value is $1,000. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Bond price A 11-year U.S. Treasury bond with a face value of $1,000 pays a coupon of 5.75% (2.875% of face value every six months). The reported yield to maturity is 5.4% (a six-month discount rate of 5.4/2 2.7%) a. What is the present value of the bond? b. If the yield to maturity changes to 1%, what will be the present value? c. If the yield to maturity changes to 8%, what will be the present value? d. If the yield to maturity changes to 15%, what will be the present value? |(For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) Present value a. b. Present value Present value C. d. Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts