Question: Problem 1: Problem 2: Problem 3: Problem 4: Problem 5: Analyze El Pollo Loco Holdings, Inc. El Pollo Loco Holdings, Inc. (LOCO), Spanish for The

Problem 1:

Problem 2:

Problem 3:

Problem 4:

Problem 5:

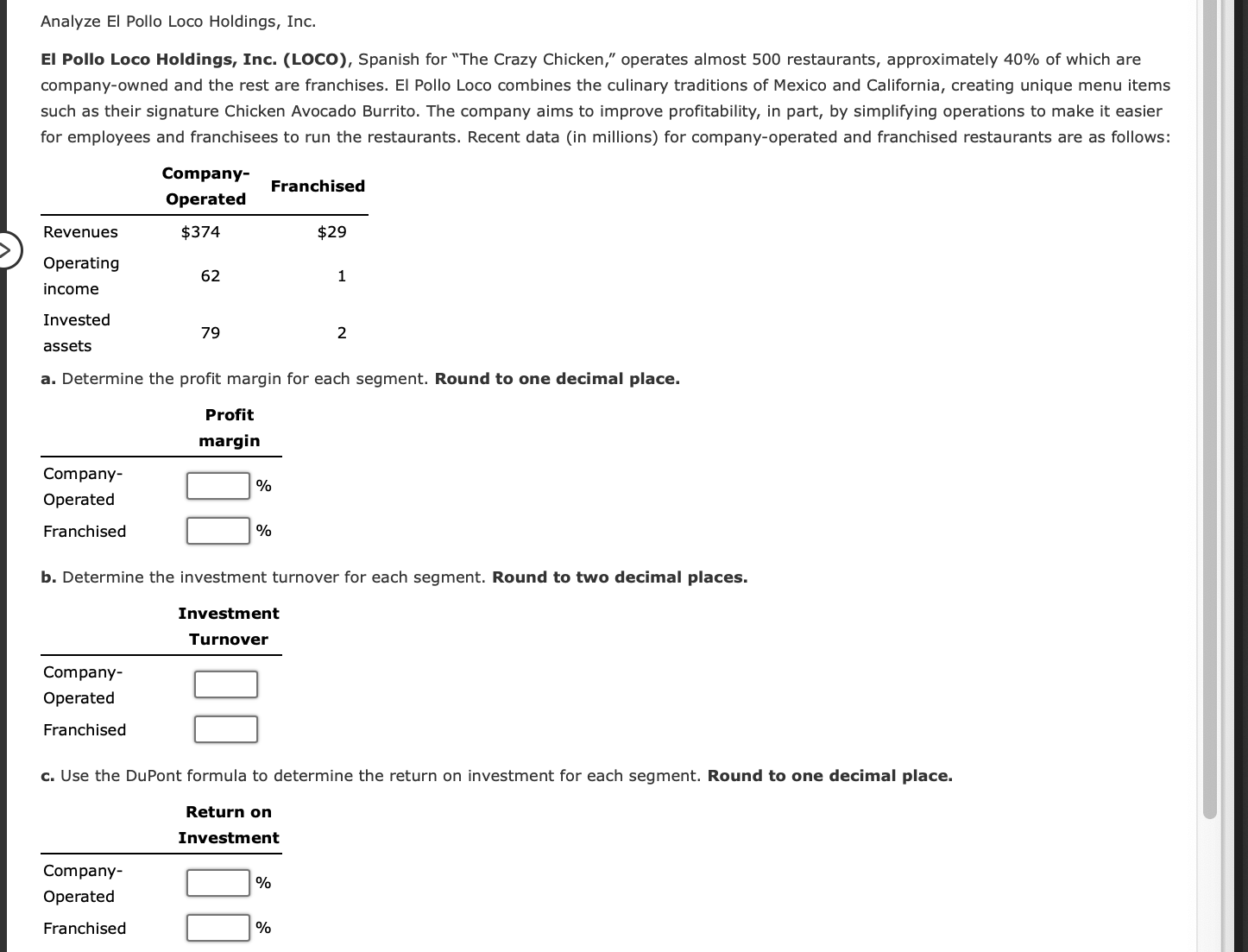

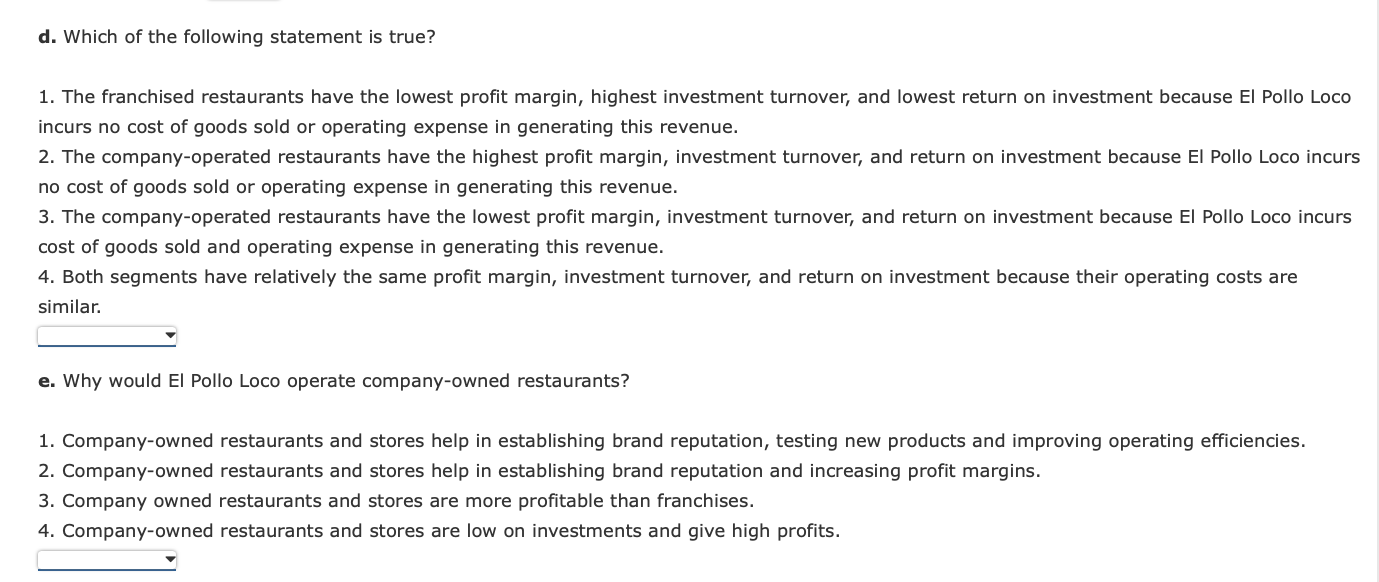

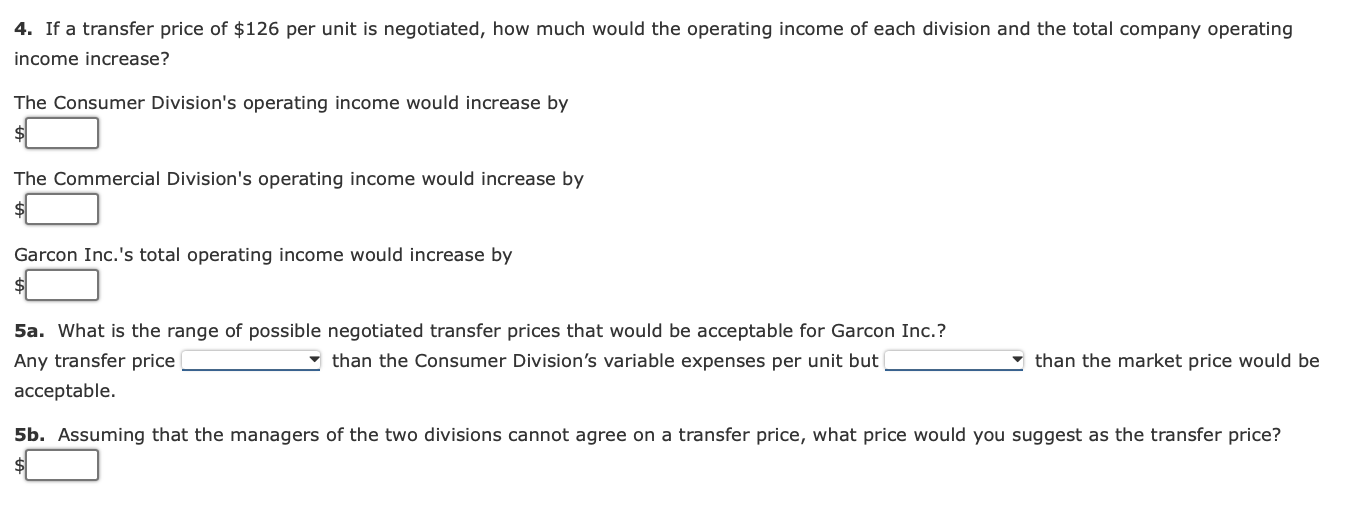

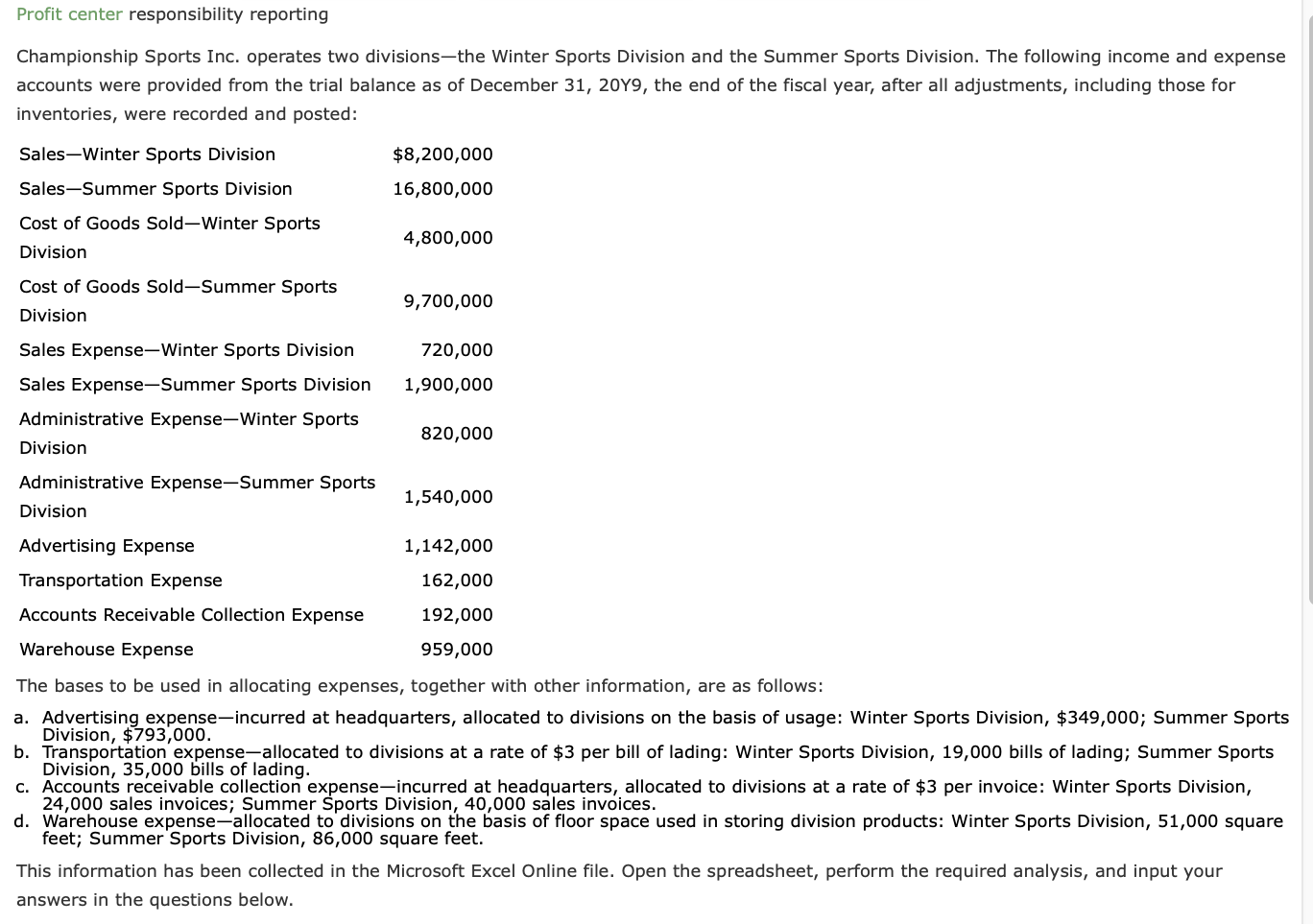

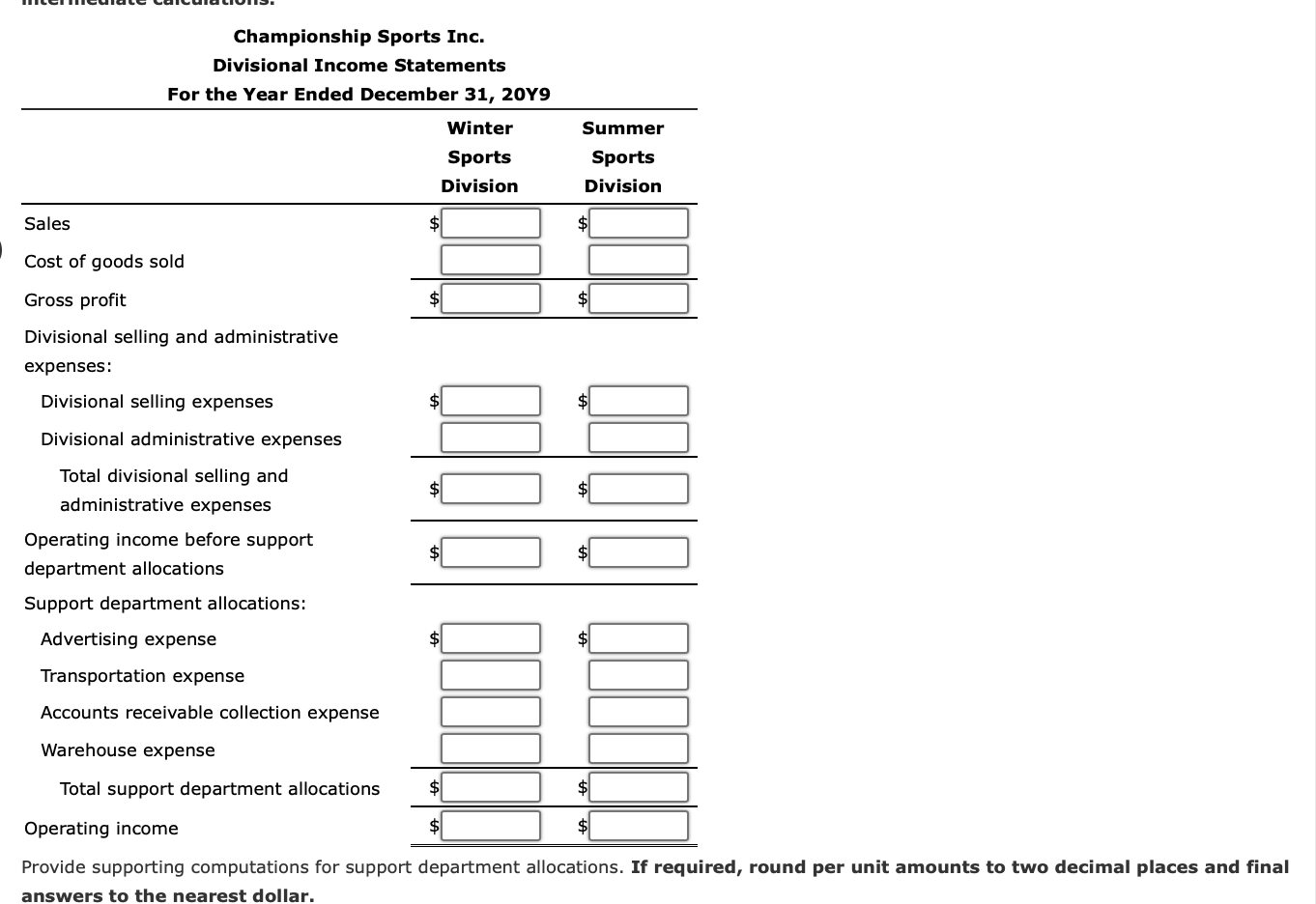

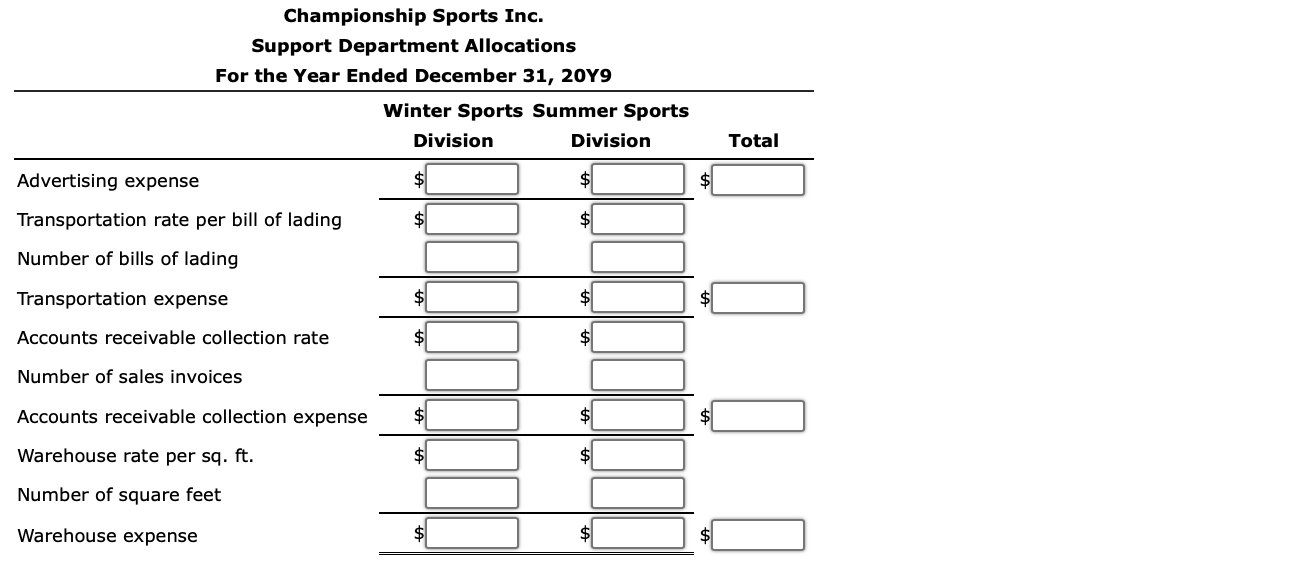

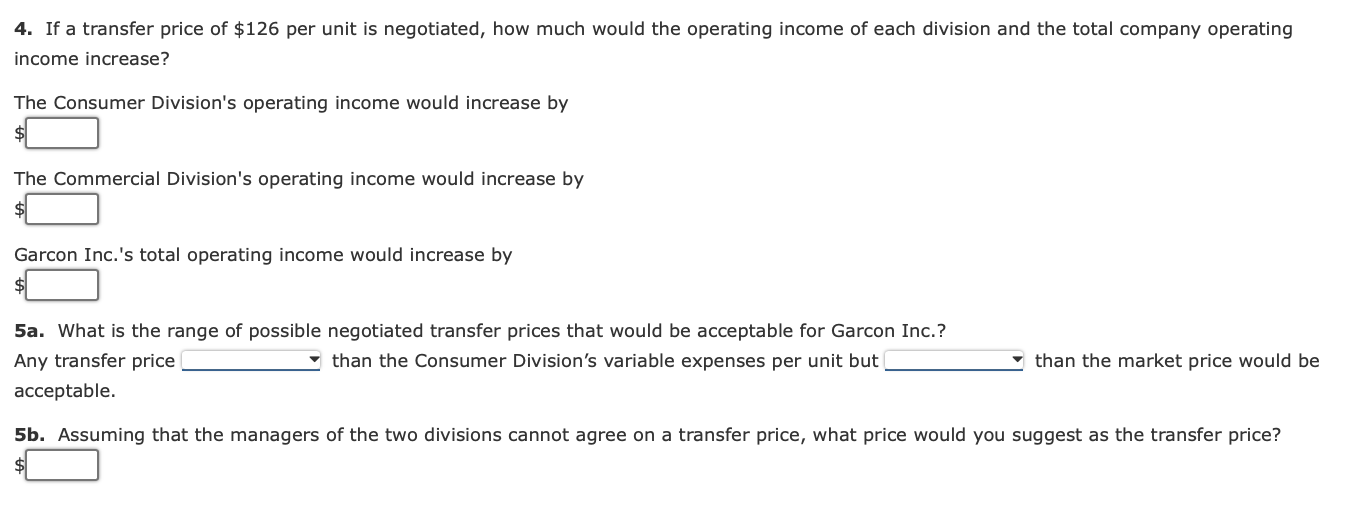

Analyze El Pollo Loco Holdings, Inc. El Pollo Loco Holdings, Inc. (LOCO), Spanish for "The Crazy Chicken," operates almost 500 restaurants, approximately 40% of which are company-owned and the rest are franchises. El Pollo Loco combines the culinary traditions of Mexico and California, creating unique menu items such as their signature Chicken Avocado Burrito. The company aims to improve profitability, in part, by simplifying operations to make it easier for employees and franchisees to run the restaurants. Recent data (in millions) for company-operated and franchised restaurants are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. d. Which of the following statement is true? 1. The franchised restaurants have the lowest profit margin, highest investment turnover, and lowest return on investment because El Pollo Loco incurs no cost of goods sold or operating expense in generating this revenue. 2. The company-operated restaurants have the highest profit margin, investment turnover, and return on investment because El Pollo Loco incurs no cost of goods sold or operating expense in generating this revenue. 3. The company-operated restaurants have the lowest profit margin, investment turnover, and return on investment because El Pollo Loco incurs cost of goods sold and operating expense in generating this revenue. 4. Both segments have relatively the same profit margin, investment turnover, and return on investment because their operating costs are similar. e. Why would El Pollo Loco operate company-owned restaurants? 1. Company-owned restaurants and stores help in establishing brand reputation, testing new products and improving operating efficiencies. 2. Company-owned restaurants and stores help in establishing brand reputation and increasing profit margins. 3. Company owned restaurants and stores are more profitable than franchises. 4. Company-owned restaurants and stores are low on investments and give high profits. 4. If a transfer price of $126 per unit is negotiated, how much would the operating income of each division and the total company operating income increase? The Consumer Division's operating income would increase by $ The Commercial Division's operating income would increase by $ Garcon Inc.'s total operating income would increase by $ 5a. What is the range of possible negotiated transfer prices that would be acceptable for Garcon Inc.? Any transfer price than the Consumer Division's variable expenses per unit but than the market price would be acceptable. 5b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price? $ Support Department Allocations And Cost Drivers Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August. One of the profit centers for Varney Corporation is the Communication Systems (COMM) division. Assume the following information for COMM: - COMM has 2,300 employees, of whom 20% are office employees. - All of the office employees have been issued a smartphone, and 96% of them have a computer on the network. - Of the employees with a computer, One hundred\% of them also have an email account. - The average number of help desk calls for August was 0.7 calls per individual with a computer. - There are 360 additional printers, servers, and peripherals on the network beyond the personal computers. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Compute the service allocation rate for each of CCS's services for August. Profit center responsibility reporting Championship Sports Inc. operates two divisions-the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31,20Y9, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: The bases to be used in allocating expenses, together with other information, are as follows: a. Advertising expense-incurred at headquarters, allocated to divisions on the basis of usage: Winter Sports Division, $349,000; Summer Sports Division, $793,000. b. Transportation expense-allocated to divisions at a rate of $3 per bill of lading: Winter Sports Division, 19,000 bills of lading; Summer Sports Division, 35,000 bills of lading. c. Accounts receivable collection expense-incurred at headquarters, allocated to divisions at a rate of $3 per invoice: Winter Sports Division, 24,000 sales invoices; Summer Sports Division, 40,000 sales invoices. d. Warehouse expense-allocated to divisions on the basis of floor space used in storing division products: Winter Sports Division, 51,000 square feet; Summer Sports Division, 86,000 square feet. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Championship Sports Inc. Divisional Income Statements For the Year Ended December 31, 20 Y9 \begin{tabular}{|c|c|c|} \hline & \begin{tabular}{c} Winter \\ Sports \\ Division \end{tabular} & \begin{tabular}{c} Summer \\ Sports \\ Division \end{tabular} \\ \hline \multicolumn{3}{|l|}{ Sales } \\ \hline \multicolumn{3}{|l|}{ Cost of goods sold } \\ \hline Gross profit & $ & $ \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Divisional selling and administrative \\ expenses: \end{tabular}} \\ \hline \multicolumn{3}{|l|}{ Divisional selling expenses } \\ \hline \multicolumn{3}{|l|}{ Divisional administrative expenses } \\ \hline \multicolumn{2}{|l|}{ Total divisional selling and } & $ \\ \hline \multicolumn{2}{|l|}{ Operating income before support } & $ \\ \hline \multicolumn{3}{|l|}{ Support department allocations: } \\ \hline \multicolumn{3}{|l|}{ Advertising expense } \\ \hline \multicolumn{3}{|l|}{ Transportation expense } \\ \hline \multicolumn{3}{|l|}{ Accounts receivable collection expense } \\ \hline \multicolumn{3}{|l|}{ Warehouse expense } \\ \hline Total support department allocations & $ & $ \\ \hline Operating income & $ & $ \\ \hline \end{tabular} Provide supporting computations for support department allocations. If required, round per unit amounts to two decimal places and final answers to the nearest dollar. Championship Sports Inc. Support Department Allocations For the Year Ended December 31, 20 Y9 \begin{tabular}{|c|c|c|c|} \hline & \multicolumn{3}{|c|}{ Winter Sports Summer Sports } \\ \hline & Division & Division & Total \\ \hline Advertising expense & $ & $ & $ \\ \hline Transportation rate per bill of lading & $ & $ & \\ \hline Number of bills of lading & & & \\ \hline Transportation expense & $ & $ & $ \\ \hline Accounts receivable collection rate & $ & $ & \\ \hline Number of sales invoices & & & \\ \hline Accounts receivable collection expense & $ & $ & $ \\ \hline Warehouse rate per sq. ft. & $ & $ & \\ \hline Number of square feet & & & \\ \hline Warehouse expense & $ & $ & $ \\ \hline \end{tabular} 4. If a transfer price of $126 per unit is negotiated, how much would the operating income of each division and the total company operating income increase? The Consumer Division's operating income would increase by $ The Commercial Division's operating income would increase by $ Garcon Inc.'s total operating income would increase by $ 5a. What is the range of possible negotiated transfer prices that would be acceptable for Garcon Inc.? Any transfer price than the Consumer Division's variable expenses per unit but than the market price would be acceptable. 5b. Assuming that the managers of the two divisions cannot agree on a transfer price, what price would you suggest as the transfer price? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts