Question: Problem #1 Problem #2 Problem #3 Problem #4 What will be the firm's after-tax cost of debt on the bond? The firm's after-tax cost of

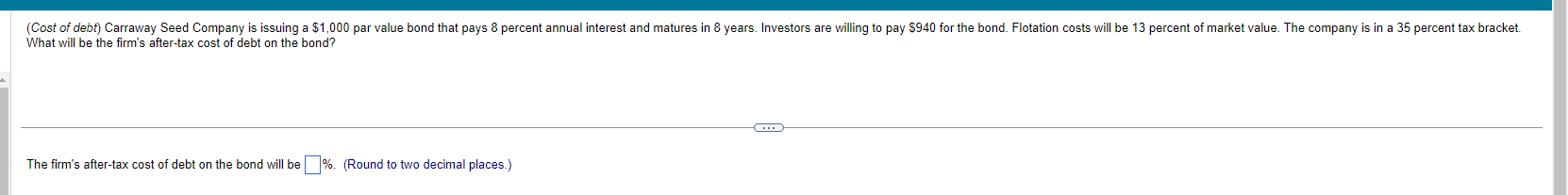

Problem #1

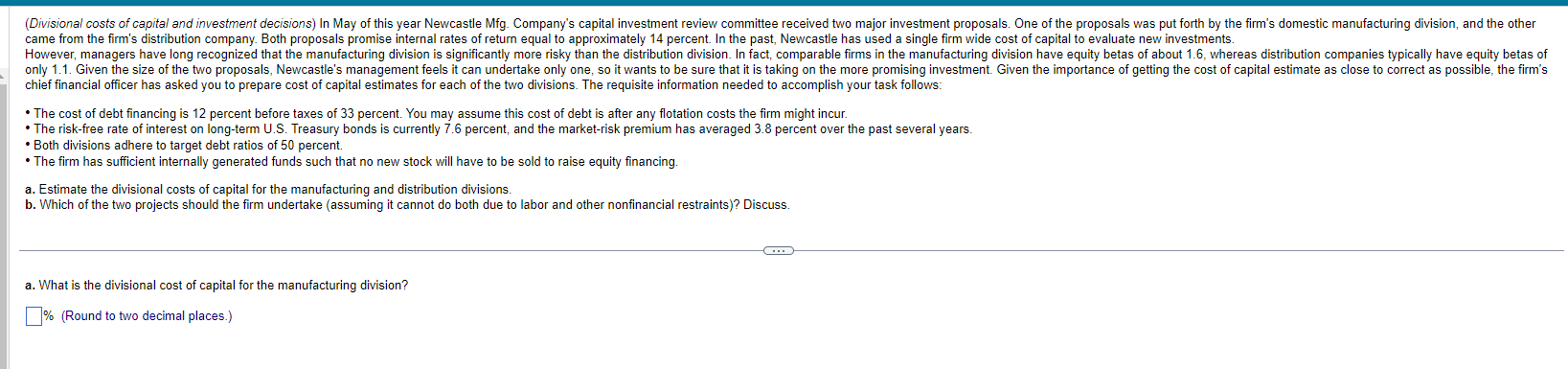

Problem #2

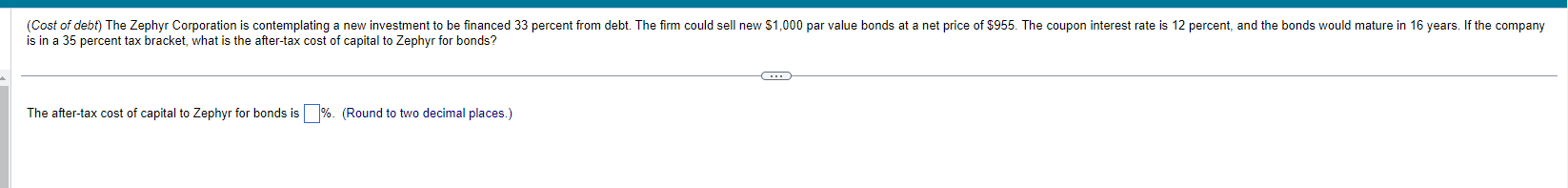

Problem #3

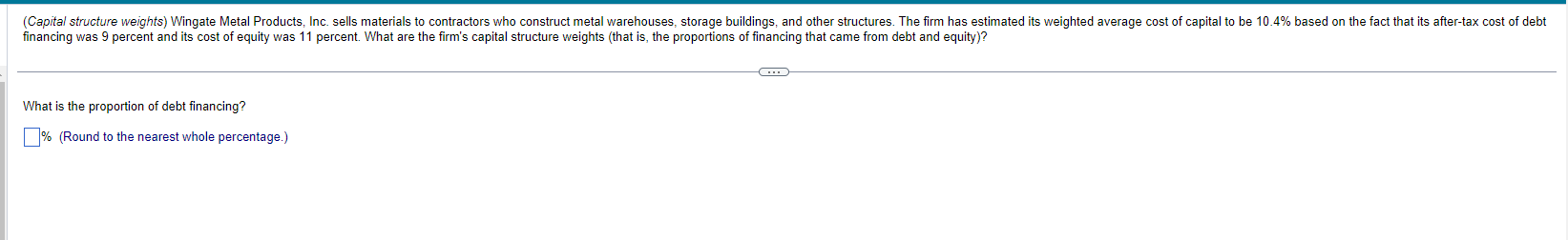

Problem #4

Problem #4

What will be the firm's after-tax cost of debt on the bond? The firm's after-tax cost of debt on the bond will be ;. (Round to two decimal places.) chief financial officer has asked you to prepare cost of capital estimates for each of the two divisions. The requisite information needed to accomplish your task follows: - The cost of debt financing is 12 percent before taxes of 33 percent. You may assume this cost of debt is after any flotation costs the firm might incur. - The risk-free rate of interest on long-term U.S. Treasury bonds is currently 7.6 percent, and the market-risk premium has averaged 3.8 percent over the past several years. - Both divisions adhere to target debt ratios of 50 percent. - The firm has sufficient internally generated funds such that no new stock will have to be sold to raise equity financing. a. Estimate the divisional costs of capital for the manufacturing and distribution divisions. b. Which of the two projects should the firm undertake (assuming it cannot do both due to labor and other nonfinancial restraints)? Discuss. a. What is the divisional cost of capital for the manufacturing division? : (Round to two decimal places.) is in a 35 percent tax bracket, what is the after-tax cost of capital to Zephyr for bonds? The after-tax cost of capital to Zephyr for bonds is %. (Round to two decimal places.) financing was 9 percent and its cost of equity was 11 percent. What are the firm's capital structure weights (that is, the proportions of financing that came from debt and equity)? What is the proportion of debt financing? ; (Round to the nearest whole percentage.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts