Question: PROBLEM 1 PROBLEM 2 Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but

PROBLEM 1

PROBLEM 2

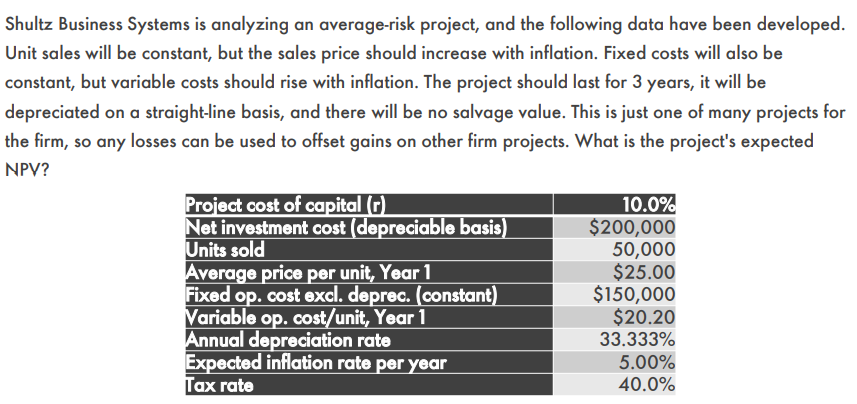

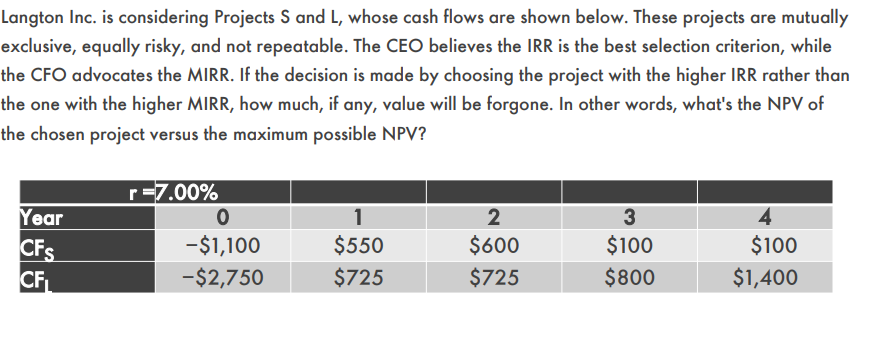

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV? Project cost of capital (0) 10.0% Net investment cost (depreciable basis) $200,000 Units sold 50,000 Average price per unit, Year 1 $25.00 Fixed op. cost excl. deprec. (constant) $150,000 Variable op. cost/unit, Year 1 $20.20 Annual depreciation rate 33.333% Expected inflation rate per year 5.00% Tax rate 40.0% Langton Inc. is considering Projects S and I, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Year CFS CF r=7.00% 0 -$1,100 -$2,750 $550 $725 2 $600 $725 3 $100 $800 4 $100 $1,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts