Question: problem 1 problem 2 The following information relates to a company's accounts receivable: gross accounts receivable balance at the beginning of the year, $450,000; allowance

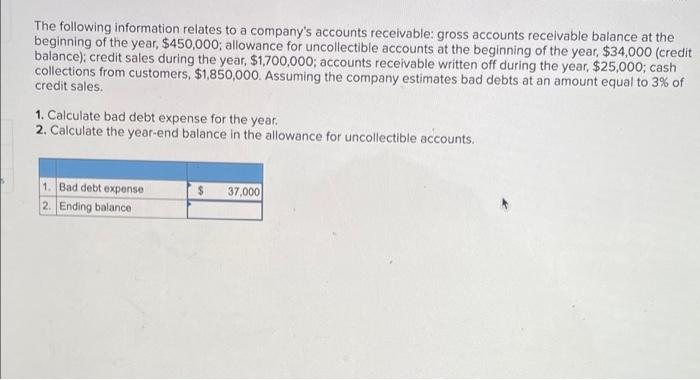

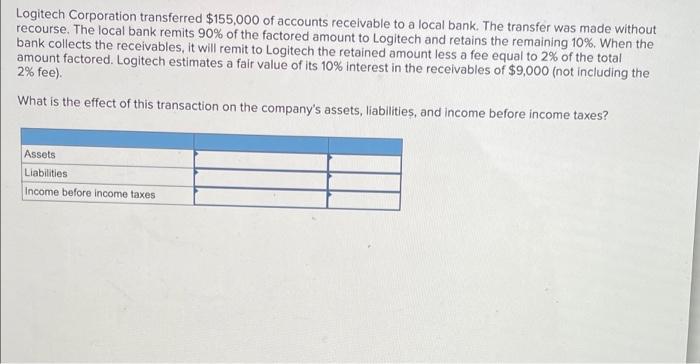

The following information relates to a company's accounts receivable: gross accounts receivable balance at the beginning of the year, $450,000; allowance for uncollectible accounts at the beginning of the year, $34,000 (credit balance); credit sales during the year, $1,700,000; accounts receivable written off during the year, $25,000; cash collections from customers, $1,850,000. Assuming the company estimates bad debts at an amount equal to 3% of credit sales. 1. Calculate bad debt expense for the year. 2. Calculate the year-end balance in the allowance for uncollectible accounts. $ 37,000 1. Bad debt expense 2. Ending balance Logitech Corporation transferred $155,000 of accounts receivable to a local bank. The transfer was made without recourse. The local bank remits 90% of the factored amount to Logitech and retains the remaining 10%. When the bank collects the receivables, it will remit to Logitech the retained amount less a fee equal to 2% of the total amount factored. Logitech estimates a fair value of its 10% interest in the receivables of $9,000 (not including the 2% fee). What is the effect of this transaction on the company's assets, liabilities, and income before income taxes? Assets Liabilities Income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts