Question: Problem 1 Question: How much cash must be contributed by each of the partners after they contributed their properties? ffCelestine and Jewel are partners who

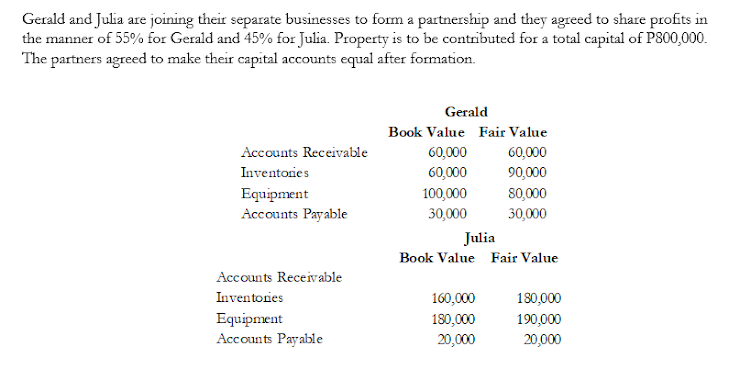

Problem 1

Question: How much cash must be contributed by each of the partners after they contributed their properties?

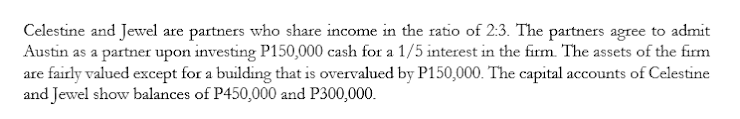

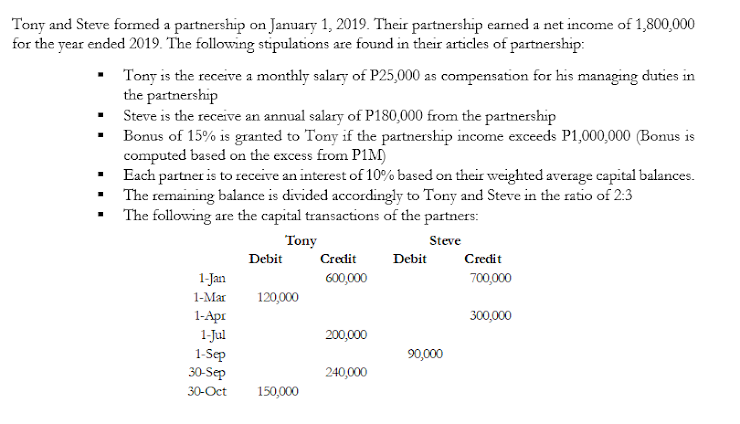

\f\fCelestine and Jewel are partners who share income in the ratio of 2:3. The partners agree to admit Austin as a partner upon investing P150,000 cash for a 1/5 interest in the firm. The assets of the firm are fairly valued except for a building that is overvalued by P150,000. The capital accounts of Celestine and Jewel show balances of P450,000 and P300,000.Tony and Steve formed a partnership on January 1, 2019. Their partnership earned a net income of 1,800,000 for the year ended 2019. The following stipulations are found in their articles of partnership: Tony is the receive a monthly salary of P25,000 as compensation for his managing duties in the partnership Steve is the receive an annual salary of P180,000 from the partnership Bonus of 15% is granted to Tony if the partnership income exceeds P1,000,000 (Bonus is computed based on the excess from PIM) Each partner is to receive an interest of 10% based on their weighted average capital balances. The remaining balance is divided accordingly to Tony and Steve in the ratio of 2:3 The following are the capital transactions of the partners: Tony Steve Debit Credit Debit Credit 1-Jan 600,000 700.000 1-Mar 120,000 1-Apr 300,000 1-Jul 200,000 1-Sep 90,000 30-Sep 240,000 30-Oct 150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts