Question: Problem #1 - Recording and Reporting Stockholders' Equity Transactions Pool Corporation, Inc., is the world's largest wholesale distributor of swimming pool supplies and equipment. It

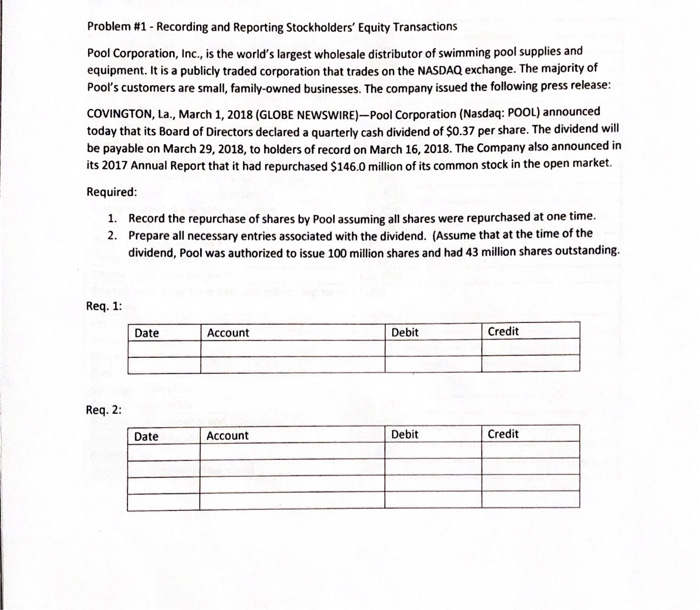

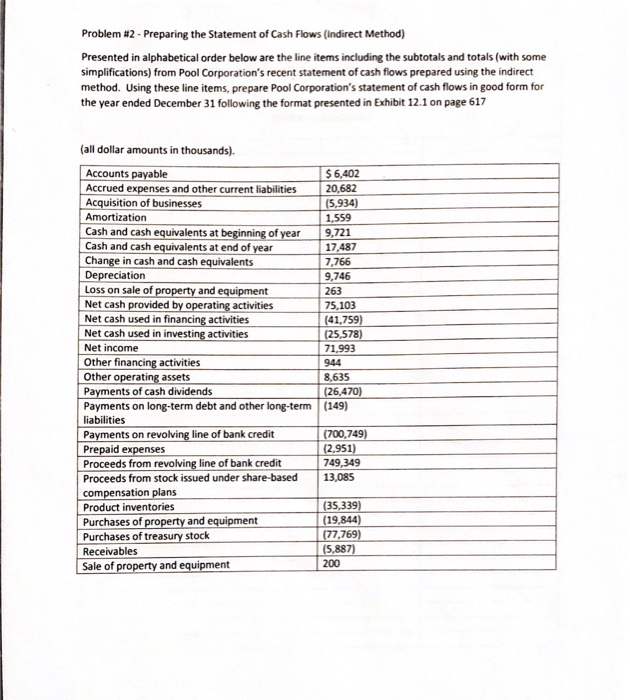

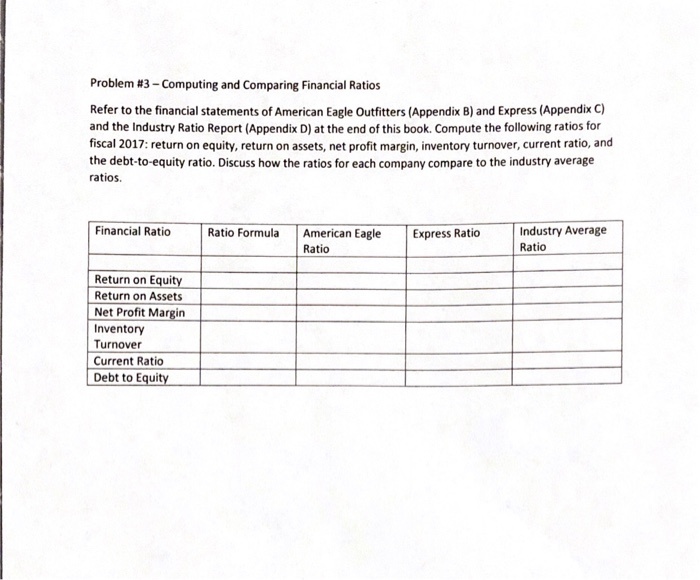

Problem #1 - Recording and Reporting Stockholders' Equity Transactions Pool Corporation, Inc., is the world's largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool's customers are small, family-owned businesses. The company issued the following press release: COVINGTON, La., March 1, 2018 (GLOBE NEWSWIRE)-Pool Corporation (Nasdaq: POOL) announced today that its Board of Directors declared a quarterly cash dividend of $0.37 per share. The dividend will be payable on March 29, 2018, to holders of record on March 16, 2018. The Company also announced in its 2017 Annual Report that it had repurchased $146.0 million of its common stock in the open market. Required: 1. Record the repurchase of shares by Pool assuming all shares were repurchased at one time. 2. Prepare all necessary entries associated with the dividend. (Assume that at the time of the dividend, Pool was authorized to issue 100 million shares and had 43 million shares outstanding. Req. 1: Date Account Debit Credit Req. 2: Date Account Debit Credit Problem #2 - Preparing the Statement of Cash Flows (Indirect Method) Presented in alphabetical order below are the line items including the subtotals and totals (with some simplifications) from Pool Corporation's recent statement of cash flows prepared using the indirect method. Using these line items, prepare Pool Corporation's statement of cash flows in good form for the year ended December 31 following the format presented in Exhibit 12.1 on page 617 $6,402 20,682 15.934) 1,559 9,721 (all dollar amounts in thousands). Accounts payable Accrued expenses and other current liabilities Acquisition of businesses Amortization Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Change in cash and cash equivalents Depreciation Loss on sale of property and equipment Net cash provided by operating activities Net cash used in financing activities Net cash used in investing activities Net income Other financing activities Other operating assets Payments of cash dividends Payments on long-term debt and other long-term liabilities Payments on revolving line of bank credit Prepaid expenses Proceeds from revolving line of bank credit Proceeds from stock issued under share-based compensation plans Product inventories Purchases of property and equipment Purchases of treasury stock Receivables Sale of property and equipment 7,766 9.746 263 75,103 (41,759) (25,578) 71,993 944 (26,470) (149) (700,749) 12,951) 749,349 13,085 (35,339) (19,844) 177,769) (5.887) 200 Pool Corporation Statement of Cash Flow Year Ended December 31. (dollars in thousands) Problem #3 - Computing and comparing Financial Ratios Refer to the financial statements of American Eagle Outfitters (Appendix B) and Express (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Compute the following ratios for fiscal 2017: return on equity, return on assets. net profit margin, inventory turnover, current ratio, and the debt-to-equity ratio. Discuss how the ratios for each company compare to the industry average ratios. Financial Ratio Ratio Formula American Eagle Ratio Express Ratio Industry Average Ratio Return on Equity Return on Assets Net Profit Margin Inventory Turnover Current Ratio Debt to Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts