Question: Problem 1 Recreate the bond amortization schedule found on page 96 of the notes. The bond is a $100 par, 5-year bond with semiannual coupons

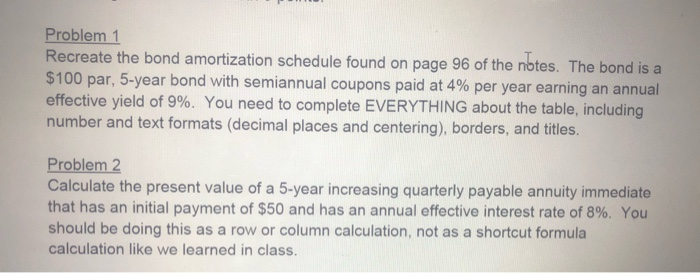

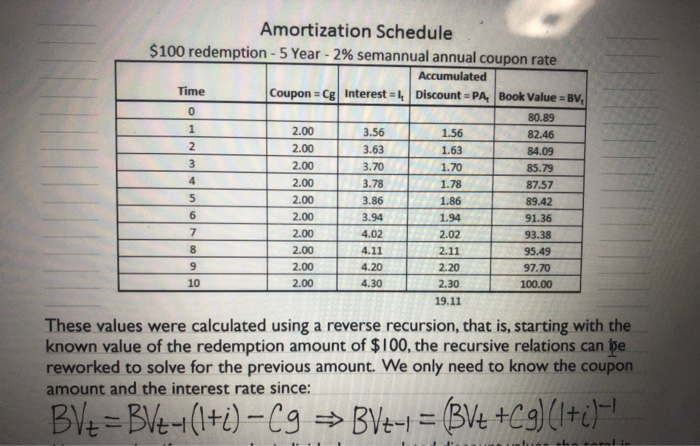

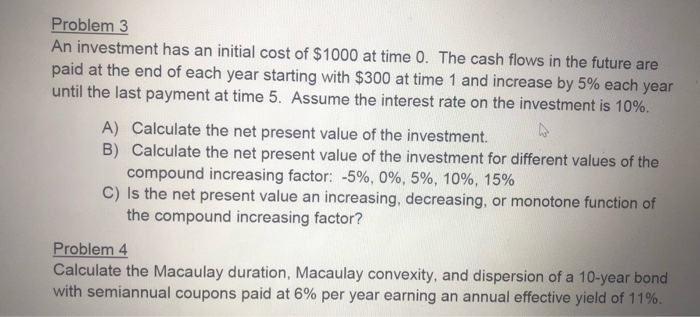

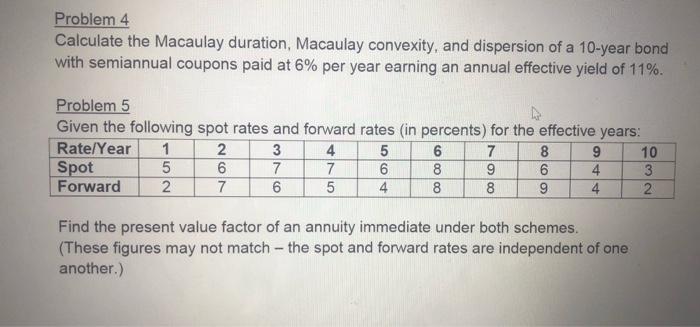

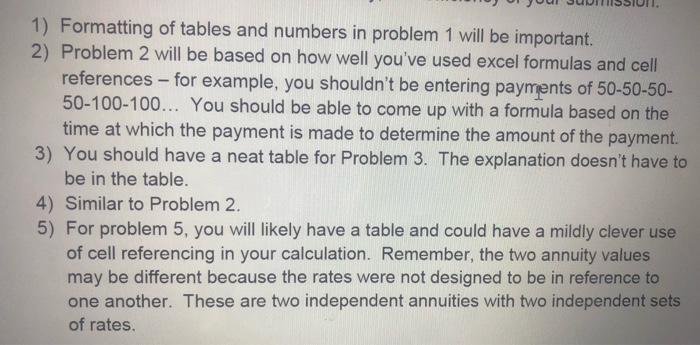

Problem 1 Recreate the bond amortization schedule found on page 96 of the notes. The bond is a $100 par, 5-year bond with semiannual coupons paid at 4% per year earning an annual effective yield of 9%. You need to complete EVERYTHING about the table, including number and text formats (decimal places and centering), borders, and titles. Problem 2 Calculate the present value of a 5-year increasing quarterly payable annuity immediate that has an initial payment of $50 and has an annual effective interest rate of 8%. You should be doing this as a row or column calculation, not as a shortcut formula calculation like we learned in class. 2.00 363 2.00 3.20 3.78 1.78 3.86 1.86 Amortization Schedule $100 redemption - 5 Year - 2% semannual annual coupon rate Accumulated Time Coupon Cg Interest Discount =PA, Book Value = BV, 0 80.89 2.00 3.56 1.56 82.46 84.09 85.79 87.57 5 2.00 89.42 1.94 2.00 2.02 2.00 2.11 2.00 2.20 2.00 2.30 100.00 19.11 These values were calculated using a reverse recursion, that is, starting with the known value of the redemption amount of $100, the recursive relations can be reworked to solve for the previous amount. We only need to know the coupon amount and the interest rate since: 2.00 3.94 91.36 4.02 93.38 4. 20 97.70 BV2 = BV+-+(1+i) -C9 BV7-1 = (BV+ +Cg)(1+i)-|| Problem 3 An investment has an initial cost of $1000 at time 0. The cash flows in the future are paid at the end of each year starting with $300 at time 1 and increase by 5% each year until the last payment at time 5. Assume the interest rate on the investment is 10%. A) Calculate the net present value of the investment. B) Calculate the net present value of the investment for different values of the compound increasing factor: -5%, 0%, 5%, 10%, 15% C) Is the net present value an increasing, decreasing, or monotone function of the compound increasing factor? Problem 4 Calculate the Macaulay duration, Macaulay convexity, and dispersion of a 10-year bond with semiannual coupons paid at 6% per year earning an annual effective yield of 11%. Problem 4 Calculate the Macaulay duration, Macaulay convexity, and dispersion of a 10-year bond with semiannual coupons paid at 6% per year earning an annual effective yield of 11%. Problem 5 Given the following spot rates and forward rates (in percents) for the effective years: Rate/Year 34 56 Spot 167 76 896 4 43 Forward 6 / 5 48 94 19 10 2 Find the present value factor of an annuity immediate under both schemes. (These figures may not match - the spot and forward rates are independent of one another.) 1) Formatting of tables and numbers in problem 1 will be important. 2) Problem 2 will be based on how well you've used excel formulas and cell references - for example, you shouldn't be entering payments of 50-50-50- 50-100-100... You should be able to come up with a formula based on the time at which the payment is made to determine the amount of the payment. 3) You should have a neat table for Problem 3. The explanation doesn't have to be in the table. 4) Similar to Problem 2. 5) For problem 5, you will likely have a table and could have a mildly clever use of cell referencing in your calculation. Remember, the two annuity values may be different because the rates were not designed to be in reference to one another. These are two independent annuities with two independent sets of rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts