Question: Problem 1 (Required, 20 marks) An investor has entered into the short position of a 9-month forward contract on 1000 units of foreign currency (denoted

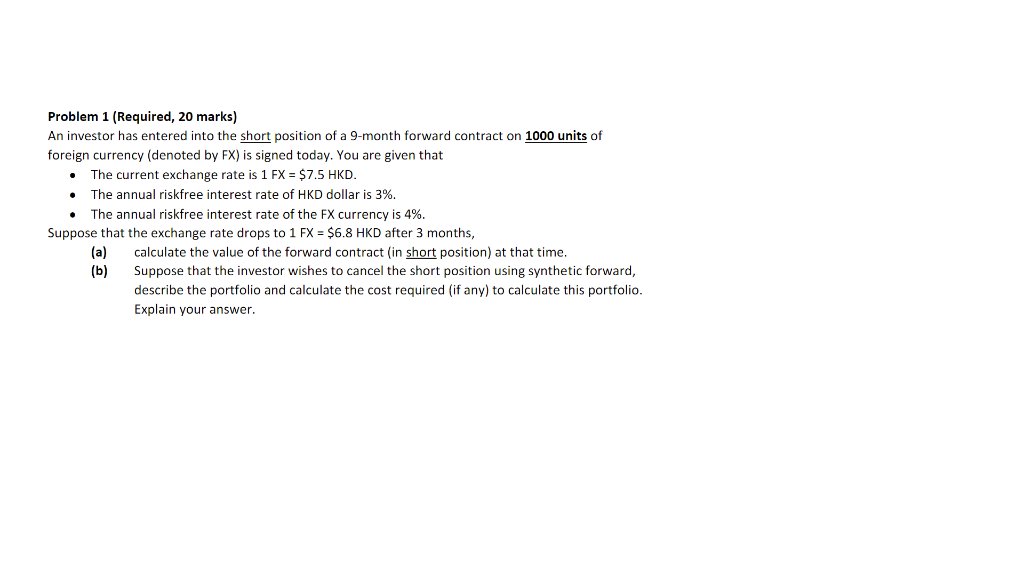

Problem 1 (Required, 20 marks) An investor has entered into the short position of a 9-month forward contract on 1000 units of foreign currency (denoted by FX) is signed today. You are given that The current exchange rate is 1 FX = $7.5 HKD. The annual riskfree interest rate of HKD dollar is 3%. The annual riskfree interest rate of the FX currency is 4%. Suppose that the exchange rate drops to 1 FX = $6.8 HKD after 3 months, (a) calculate the value of the forward contract (in short position) at that time. (b) Suppose that the investor wishes to cancel the short position using synthetic forward, describe the portfolio and calculate the cost required (if any) to calculate this portfolio. Explain your answer.

Problem 1 (Required, 20 marks) An investor has entered into the short position of a 9-month forward contract on 1000 units of foreign currency (denoted by FX) is signed today. You are given that The current exchange rate is 1 FX = $7.5 HKD. The annual riskfree interest rate of HKD dollar is 3%. The annual riskfree interest rate of the FX currency is 4%. Suppose that the exchange rate drops to 1 FX = $6.8 HKD after 3 months, (a) calculate the value of the forward contract (in short position) at that time. (b) Suppose that the investor wishes to cancel the short position using synthetic forward, describe the portfolio and calculate the cost required (if any) to calculate this portfolio. Explain your answer.

Problem 1 (Required, 20 marks) An investor has entered into the short position of a 9-month forward contract on 1000 units of foreign currency (denoted by FX) is signed today. You are given that The current exchange rate is 1 FX = $7.5 HKD. The annual riskfree interest rate of HKD dollar is 3%. The annual riskfree interest rate of the FX currency is 4%. Suppose that the exchange rate drops to 1 FX = $6.8 HKD after 3 months, (a) calculate the value of the forward contract (in short position) at that time. (b) Suppose that the investor wishes to cancel the short position using synthetic forward, describe the portfolio and calculate the cost required (if any) to calculate this portfolio. Explain your answer. Problem 1 (Required, 20 marks) An investor has entered into the short position of a 9-month forward contract on 1000 units of foreign currency (denoted by FX) is signed today. You are given that The current exchange rate is 1 FX = $7.5 HKD. The annual riskfree interest rate of HKD dollar is 3%. The annual riskfree interest rate of the FX currency is 4%. Suppose that the exchange rate drops to 1 FX = $6.8 HKD after 3 months, (a) calculate the value of the forward contract (in short position) at that time. (b) Suppose that the investor wishes to cancel the short position using synthetic forward, describe the portfolio and calculate the cost required (if any) to calculate this portfolio. Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts