Question: Problem 1 Revenue management involves managing the short-term demand for a fixed perishable inventory in order to maximize the revenue potential for an organization. The

Problem 1 Revenue management involves managing the short-term demand for a fixed perishable inventory in order to maximize the revenue potential for an organization. The methodology, originally developed for American Airlines, was first used to determine how many airline flight seats to sell at an early reservation discount fare and how many airline flight seats to sell at a full fare. By making the optimal decision for the number of discount-fare seats and the number of full-fare seats on each flight, the airline is able to increase its average number of passengers per flight and maximize the total revenue generated by the combined sale of discount- fare and full-fare seats. Today, all major airlines use some form of revenue management.

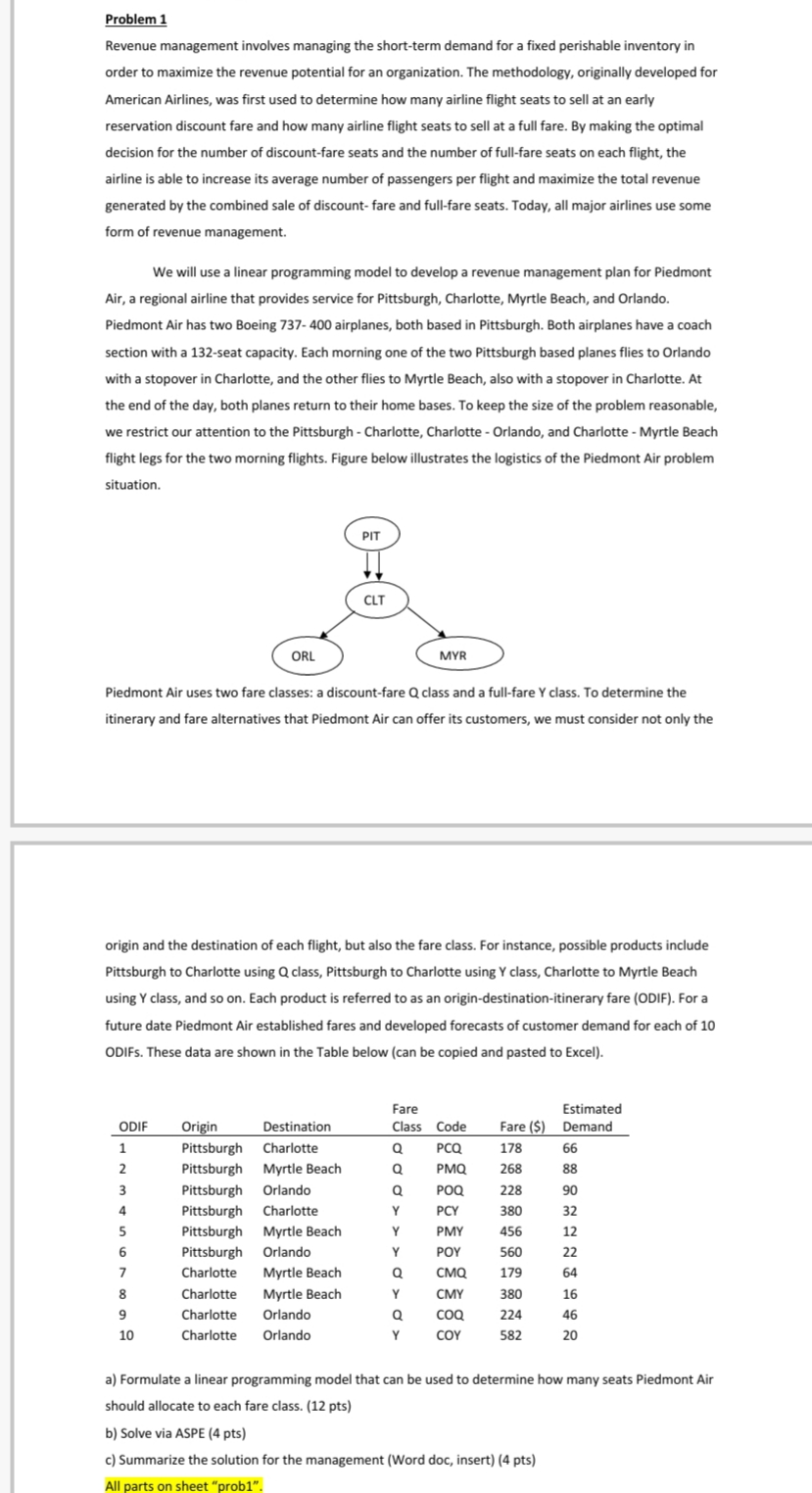

We will use a linear programming model to develop a revenue management plan for Piedmont Air, a regional airline that provides service for Pittsburgh, Charlotte, Myrtle Beach, and Orlando. Piedmont Air has two Boeing 737- 400 airplanes, both based in Pittsburgh. Both airplanes have a coach section with a 132-seat capacity. Each morning one of the two Pittsburgh based planes flies to Orlando with a stopover in Charlotte, and the other flies to Myrtle Beach, also with a stopover in Charlotte. At the end of the day, both planes return to their home bases. To keep the size of the problem reasonable, we restrict our attention to the Pittsburgh - Charlotte, Charlotte - Orlando, and Charlotte - Myrtle Beach flight legs for the two morning flights. Figure below illustrates the logistics of the Piedmont Air problem situation.

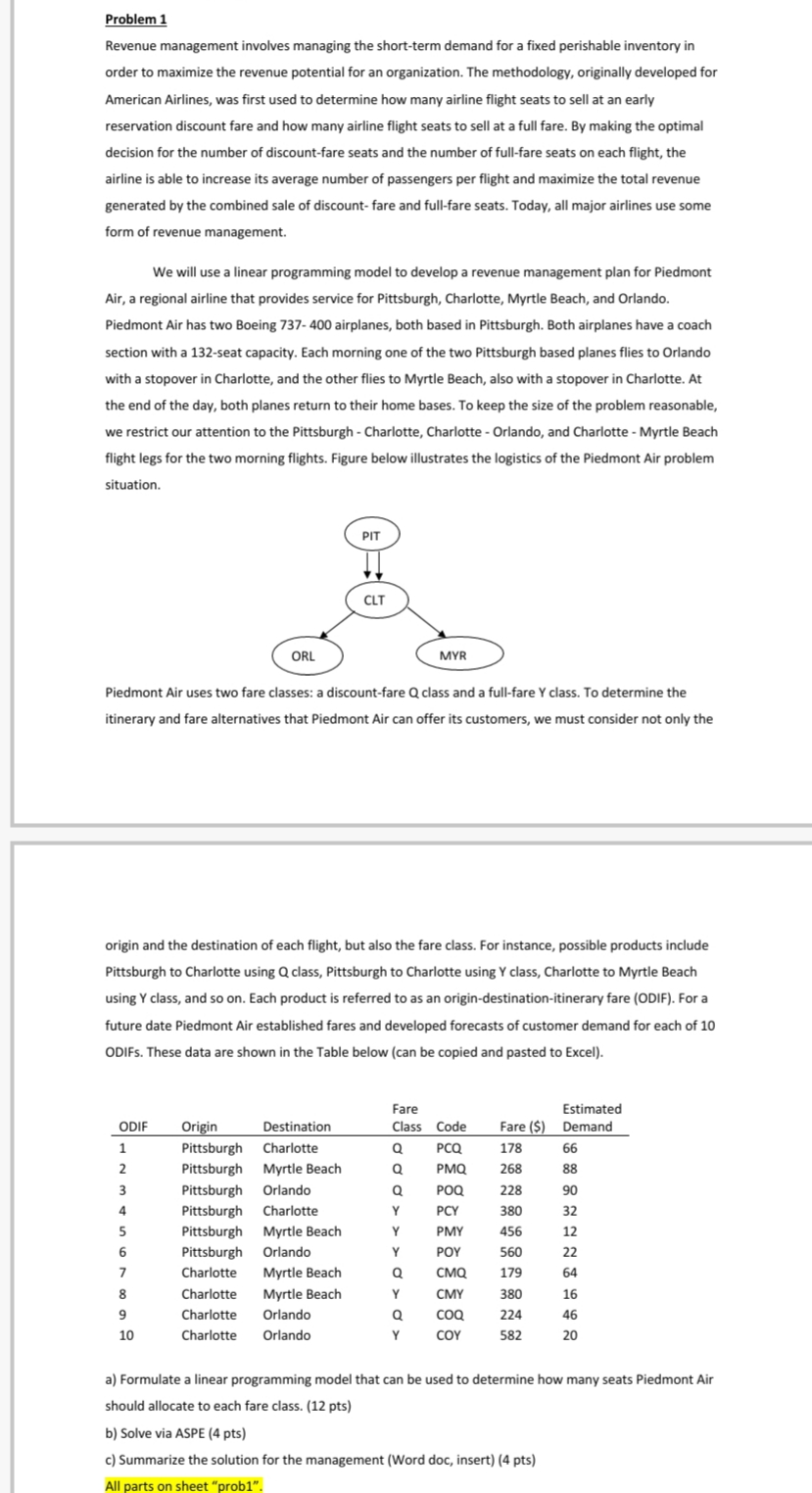

Piedmont Air uses two fare classes: a discount-fare Q class and a full-fare Y class. To determine the itinerary and fare alternatives that Piedmont Air can offer its customers, we must consider not only the origin and the destination of each flight, but also the fare class. For instance, possible products include Pittsburgh to Charlotte using Q class, Pittsburgh to Charlotte using Y class, Charlotte to Myrtle Beach using Y class, and so on. Each product is referred to as an origin-destination-itinerary fare (ODIF). For a future date Piedmont Air established fares and developed forecasts of customer demand for each of 10 ODIFs. These data are shown in the Table below (can be copied and pasted to Excel).

| ODIF | Origin | Destination | Fare Class | Code | Fare ($) | Estimated Demand |

| 1 | Pittsburgh | Charlotte | Q | PCQ | 178 | 66 |

| 2 | Pittsburgh | Myrtle Beach | Q | PMQ | 268 | 88 |

| 3 | Pittsburgh | Orlando | Q | POQ | 228 | 90 |

| 4 | Pittsburgh | Charlotte | Y | PCY | 380 | 32 |

| 5 | Pittsburgh | Myrtle Beach | Y | PMY | 456 | 12 |

| 6 | Pittsburgh | Orlando | Y | POY | 560 | 22 |

| 7 | Charlotte | Myrtle Beach | Q | CMQ | 179 | 64 |

| 8 | Charlotte | Myrtle Beach | Y | CMY | 380 | 16 |

| 9 | Charlotte | Orlando | Q | COQ | 224 | 46 |

| 10 | Charlotte | Orlando | Y | COY | 582 | 20 |

a) Formulate a linear programming model that can be used to determine how many seats Piedmont Air should allocate to each fare class. (12 pts) b) Solve via ASPE (4 pts) c) Summarize the solution for the management (Word doc, insert) (4 pts) All parts on sheet prob1.

Problem 1 Revenue management involves managing the short-term demand for a fixed perishable inventory in order to maximize the revenue potential for an organization. The methodology, originally developed for American Airlines, was first used to determine how many airline flight seats to sell at an early reservation discount fare and how many airline flight seats to sell at a full fare. By making the optimal decision for the number of discount-fare seats and the number of full-fare seats on each flight, the airline is able to increase its average number of passengers per flight and maximize the total revenue generated by the combined sale of discount-fare and full-fare seats. Today, all major airlines use some form of revenue management. We will use a linear programming model to develop a revenue management plan for Piedmont Air, a regional airline that provides service for Pittsburgh, Charlotte, Myrtle Beach, and Orlando. Piedmont Air has two Boeing 737-400 airplanes, both based in Pittsburgh. Both airplanes have a coach section with a 132-seat capacity. Each morning one of the two Pittsburgh based planes flies to Orlando with a stopover in Charlotte, and the other flies to Myrtle Beach, also with a stopover in Charlotte. At the end of the day, both planes return to their home bases. To keep the size of the problem reasonable, we restrict our attention to the Pittsburgh - Charlotte, Charlotte - Orlando, and Charlotte - Myrtle Beach flight legs for the two morning flights. Figure below illustrates the logistics of the Piedmont Air problem situation. ORL MYR Piedmont Air uses two fare classes: a discount-fare Q class and a full-fare Y class. To determine the itinerary and fare alternatives that Piedmont Air can offer its customers, we must consider not only the origin and the destination of each flight, but also the fare class. For instance, possible products include Pittsburgh to Charlotte using Q class, Pittsburgh to Charlotte using Y class, Charlotte to Myrtle Beach using Y class, and so on. Each product is referred to as an origin-destination-itinerary fare (ODIF). For a future date Piedmont Air established fares and developed forecasts of customer demand for each of 10 ODIFs. These data are shown in the Table below (can be copied and pasted to Excel). ODIF Fare Class Code PCQ Estimated Demand Fare() 178 268 228 380 B00UwNlO Origin Pittsburgh Pittsburgh Pittsburgh Pittsburgh Pittsburgh Pittsburgh Charlotte Charlotte Charlotte Charlotte Destination Charlotte Myrtle Beach Orlando Charlotte Myrtle Beach Orlando Myrtle Beach Myrtle Beach Orlando Orlando 456 560 POQ Y PCY PMY Y POY QCMQ CMY a coQ Y COY 179 380 224 582 46 20 a) Formulate a linear programming model that can be used to determine how many seats Piedmont Air should allocate to each fare class. (12 pts) b) Solve via ASPE (4 pts) c) Summarize the solution for the management (Word doc, insert) (4 pts) All parts on sheet "prob1". Problem 1 Revenue management involves managing the short-term demand for a fixed perishable inventory in order to maximize the revenue potential for an organization. The methodology, originally developed for American Airlines, was first used to determine how many airline flight seats to sell at an early reservation discount fare and how many airline flight seats to sell at a full fare. By making the optimal decision for the number of discount-fare seats and the number of full-fare seats on each flight, the airline is able to increase its average number of passengers per flight and maximize the total revenue generated by the combined sale of discount-fare and full-fare seats. Today, all major airlines use some form of revenue management. We will use a linear programming model to develop a revenue management plan for Piedmont Air, a regional airline that provides service for Pittsburgh, Charlotte, Myrtle Beach, and Orlando. Piedmont Air has two Boeing 737-400 airplanes, both based in Pittsburgh. Both airplanes have a coach section with a 132-seat capacity. Each morning one of the two Pittsburgh based planes flies to Orlando with a stopover in Charlotte, and the other flies to Myrtle Beach, also with a stopover in Charlotte. At the end of the day, both planes return to their home bases. To keep the size of the problem reasonable, we restrict our attention to the Pittsburgh - Charlotte, Charlotte - Orlando, and Charlotte - Myrtle Beach flight legs for the two morning flights. Figure below illustrates the logistics of the Piedmont Air problem situation. ORL MYR Piedmont Air uses two fare classes: a discount-fare Q class and a full-fare Y class. To determine the itinerary and fare alternatives that Piedmont Air can offer its customers, we must consider not only the origin and the destination of each flight, but also the fare class. For instance, possible products include Pittsburgh to Charlotte using Q class, Pittsburgh to Charlotte using Y class, Charlotte to Myrtle Beach using Y class, and so on. Each product is referred to as an origin-destination-itinerary fare (ODIF). For a future date Piedmont Air established fares and developed forecasts of customer demand for each of 10 ODIFs. These data are shown in the Table below (can be copied and pasted to Excel). ODIF Fare Class Code PCQ Estimated Demand Fare() 178 268 228 380 B00UwNlO Origin Pittsburgh Pittsburgh Pittsburgh Pittsburgh Pittsburgh Pittsburgh Charlotte Charlotte Charlotte Charlotte Destination Charlotte Myrtle Beach Orlando Charlotte Myrtle Beach Orlando Myrtle Beach Myrtle Beach Orlando Orlando 456 560 POQ Y PCY PMY Y POY QCMQ CMY a coQ Y COY 179 380 224 582 46 20 a) Formulate a linear programming model that can be used to determine how many seats Piedmont Air should allocate to each fare class. (12 pts) b) Solve via ASPE (4 pts) c) Summarize the solution for the management (Word doc, insert) (4 pts) All parts on sheet "prob1