Question: Problem 1: Statement of Cash Flows - Indirect Method The comparative balance sheet of Charles Inc. for December 31, 2014 and 2013 is shows

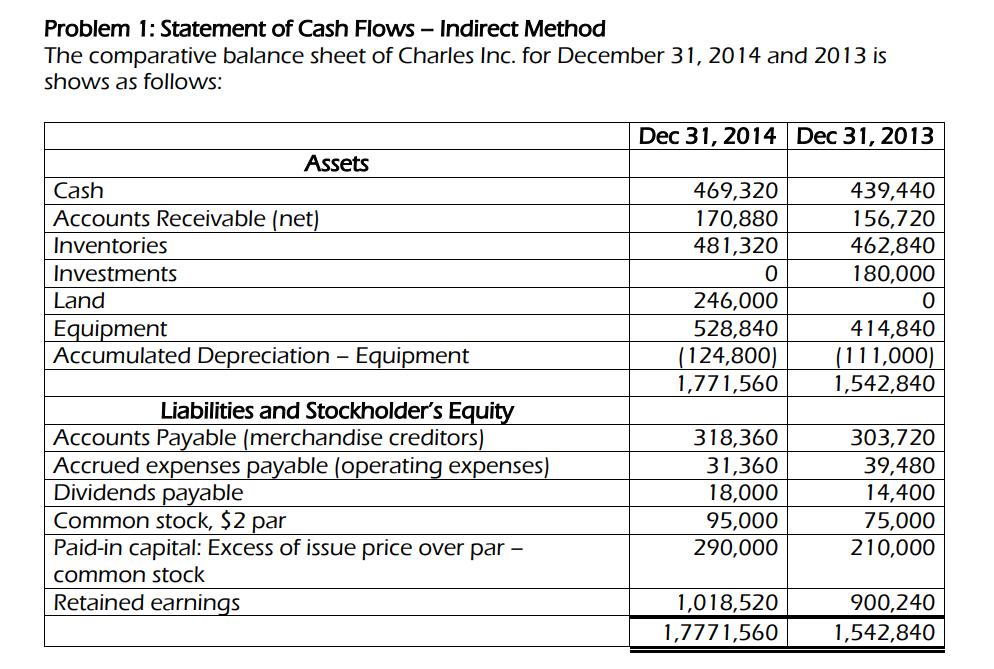

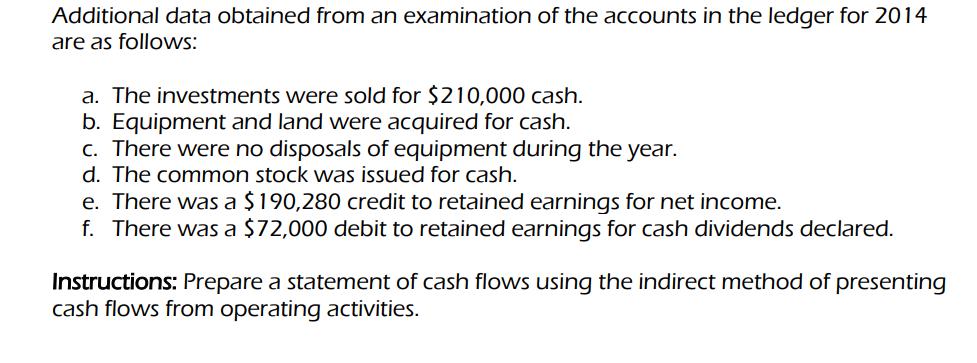

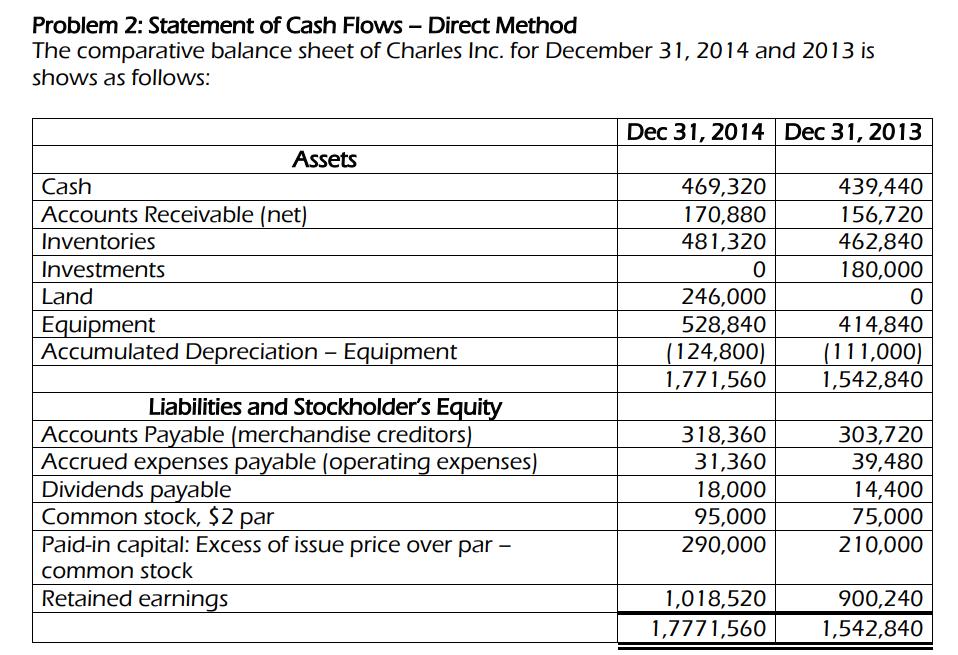

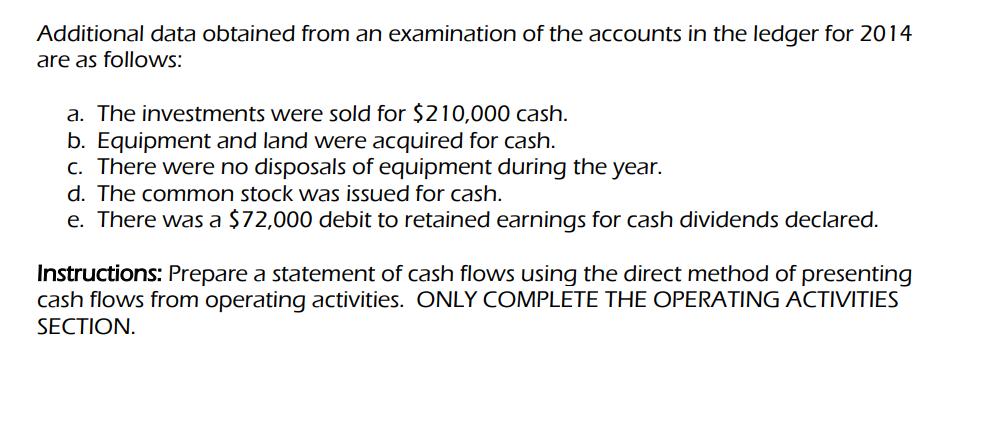

Problem 1: Statement of Cash Flows - Indirect Method The comparative balance sheet of Charles Inc. for December 31, 2014 and 2013 is shows as follows: Dec 31, 2014 Dec 31, 2013 Assets Cash 469,320 439,440 Accounts Receivable (net) 170,880 156,720 Inventories 481,320 462,840 Investments 0 180,000 Land 246,000 0 Equipment 528,840 414,840 Accumulated Depreciation - Equipment (124,800) (111,000) 1,771,560 1,542,840 Liabilities and Stockholder's Equity Accounts Payable (merchandise creditors) 318,360 303,720 31,360 39,480 Accrued expenses payable (operating expenses) Dividends payable 18,000 14,400 Common stock, $2 par 95,000 75,000 290,000 210,000 Paid-in capital: Excess of issue price over par - common stock Retained earnings 1,018,520 900,240 1,7771,560 1,542,840 Additional data obtained from an examination of the accounts in the ledger for 2014 are as follows: a. The investments were sold for $210,000 cash. b. Equipment and land were acquired for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. There was a $190,280 credit to retained earnings for net income. f. There was a $72,000 debit to retained earnings for cash dividends declared. Instructions: Prepare a statement of cash flows using the indirect method of presenting cash flows from operating activities. Problem 2: Statement of Cash Flows - Direct Method The comparative balance sheet of Charles Inc. for December 31, 2014 and 2013 is shows as follows: Dec 31, 2014 Dec 31, 2013 Assets Cash 469,320 439,440 Accounts Receivable (net) 170,880 156,720 Inventories 481,320 462,840 Investments 0 180,000 Land 246,000 0 Equipment 528,840 414,840 Accumulated Depreciation - Equipment (124,800) (111,000) 1,771,560 1,542,840 Liabilities and Stockholder's Equity 318,360 303,720 Accounts Payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable 31,360 39,480 18,000 14,400 Common stock, $2 par 95,000 75,000 290,000 210,000 Paid-in capital: Excess of issue price over par - common stock Retained earnings 1,018,520 900,240 1,7771,560 1,542,840 The income statement for the year ended December 31, 2014 is as follows: Sales $5,261,701 Cost of Merchandise Sold 3,237,970 Gross Profit 2,023,731 Operating Expenses $13,800 1,722,798 1736,598 Operating Income 287,133 Other Income: 30,000 317,133 Income before income tax Income tax expense 126,853 Net Income 190,280 Depreciation Expense Other Operating Expenses Total Operating Expenses Gain on Sale of Investments Additional data obtained from an examination of the accounts in the ledger for 2014 are as follows: a. The investments were sold for $210,000 cash. b. Equipment and land were acquired for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. There was a $72,000 debit to retained earnings for cash dividends declared. Instructions: Prepare a statement of cash flows using the direct method of presenting cash flows from operating activities. ONLY COMPLETE THE OPERATING ACTIVITIES SECTION.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Charles Inc Statement of Cash Flows For the Year Ended Dec 31 2014 Particulars Amount Calculation C... View full answer

Get step-by-step solutions from verified subject matter experts