Question: Problem 1 Sugar Land Company is considering adding a new line to its product mix and the capital budgeting analysis is being conducted by a

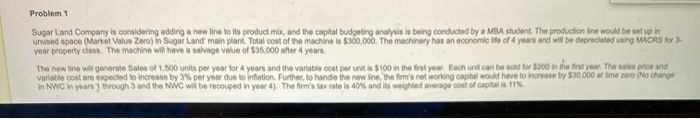

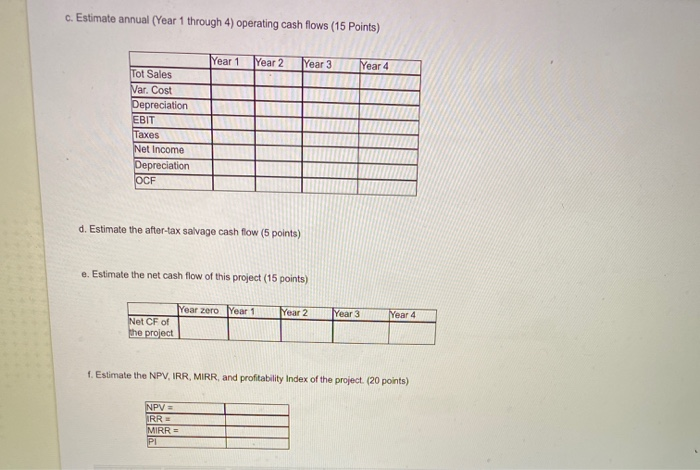

Problem 1 Sugar Land Company is considering adding a new line to its product mix and the capital budgeting analysis is being conducted by a MBA student. The production line would be set up in urused space (Market Value Zero) in Sugar and main plant. Total cost of the machine is $300,000. The machinery has an economic if of 4 years and will be deprecated using MACRS for 3 year property dess. The machine will have a salvage value of $35.000 after 4 year The wine will generale Sales of 1.500 units per year for 4 years and the variable cost per unit is $100 in the first year Each unit can be sold for $200 in the first year. The sale price and Variable cost respected to increase by 3% per year due to intation. Further, to handle the new line them's not working capital would have to increase by $30.000 of meer (No change in NWC in years through and the NWC will be recouped in year 4). The firm's tax rate is 40% and its weighted average cost of capital is 11% c. Estimate annual (Year 1 through 4) operating cash flows (15 Points) Year 1 Year 2 Year 3 Year 4 Tot Sales Nar. Cost Depreciation EBIT Taxes Net Income Depreciation OCF d. Estimate the after-tax salvage cash flow (5 points) e. Estimate the net cash flow of this project (15 points) Year 1 Year 2 Year 3 Year 4 Year zoro Net CF of the project 1. Estimate the NPV, IRR, MIRR, and profitability Index of the project. (20 points) NPV = IRRE MIRR = PI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts