Question: Problem 1 Suppose you want to buy a house for $620,000 and you have $80,000 in savings you can use as a down payment. The

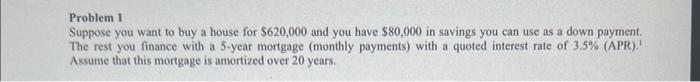

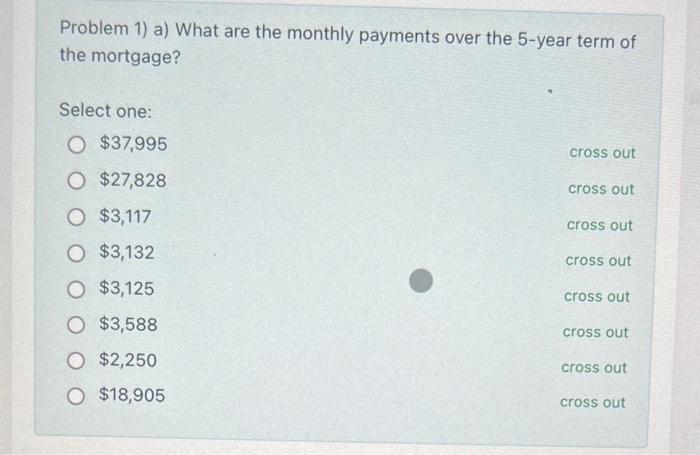

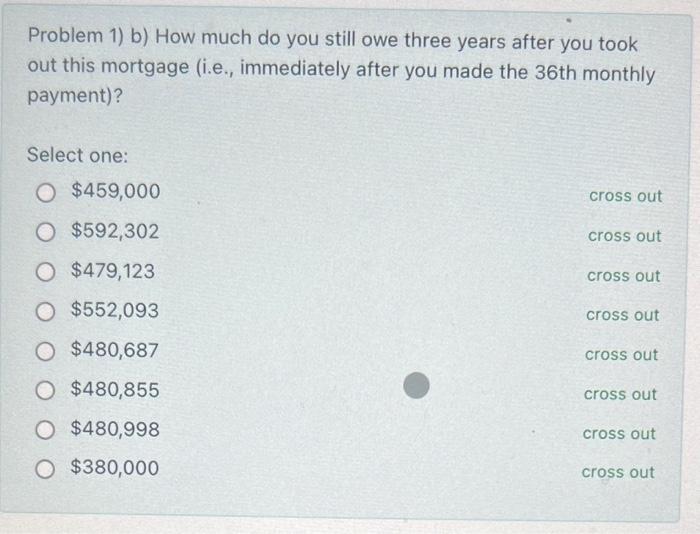

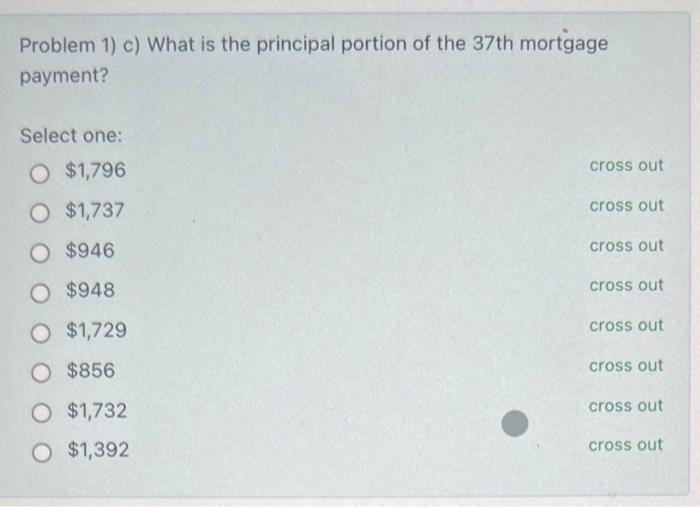

Problem 1 Suppose you want to buy a house for $620,000 and you have $80,000 in savings you can use as a down payment. The rest you finance with a 5 -year mortgage (monthly payments) with a quoted interest rate of 3.5% (APR). Assume that this mortgage is amortized over 20 years. Problem 1) a) What are the monthly payments over the 5 -year term of the mortgage? Select one: $37,995$27,828$3,117$3,132$3,125$3,588$2,250$18,905crossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossout Problem 1) b) How much do you still owe three years after you took out this mortgage (i.e., immediately after you made the 36 th monthly payment)? Select one: $459,000$592,302$479,123$552,093$480,687$480,855$480,998$380,000crossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossout Problem 1) c) What is the principal portion of the 37 th mortgage payment? Select one: $1,796$1,737$946$948$1,729$856$1,732$1,392crossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossoutcrossout

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts