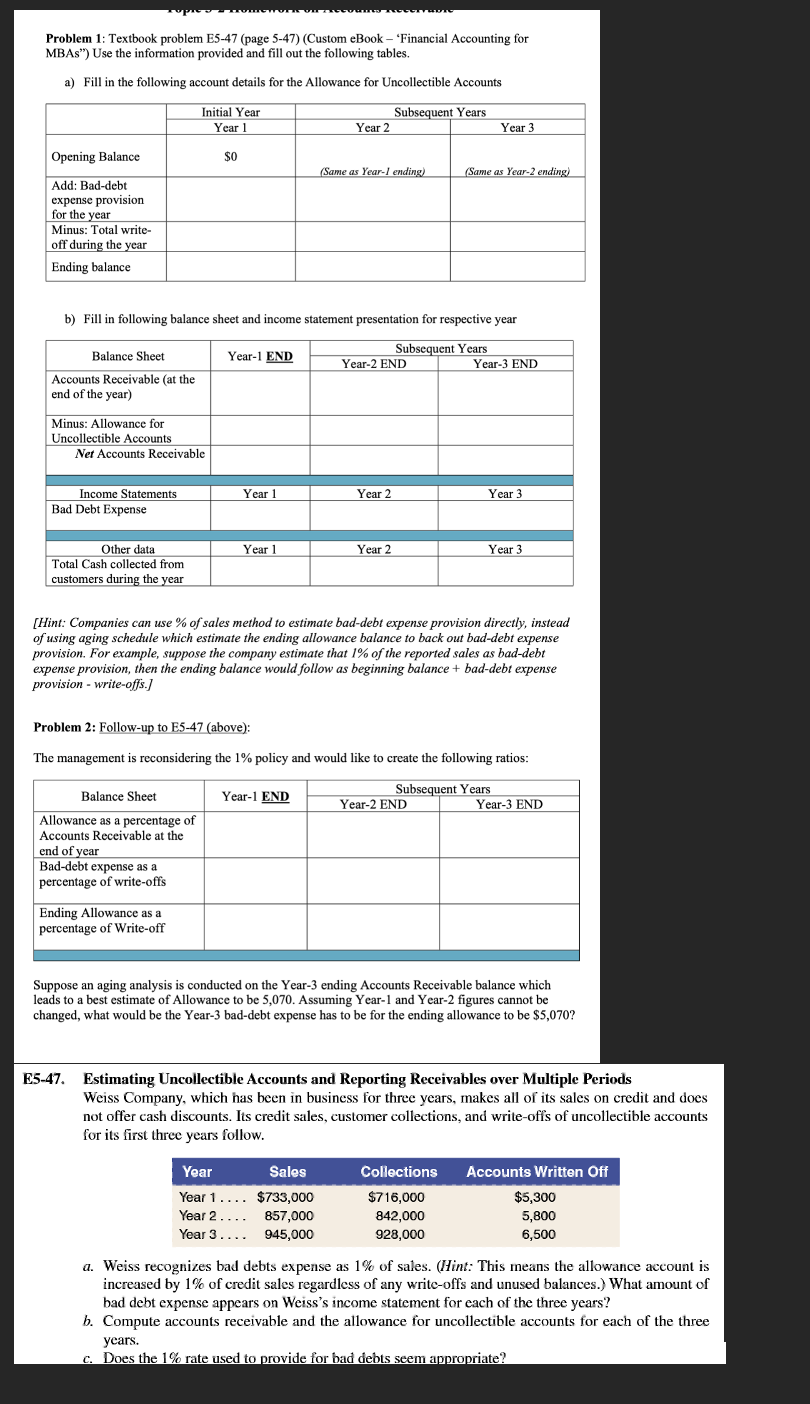

Question: Problem 1 : Textbook problem E 5 - 4 7 ( page 5 - 4 7 ) ( Custom eBook - 'Financial Accounting for MBAs

Problem : Textbook problem Epage Custom eBook 'Financial Accounting for

MBAs" Use the information provided and fill out the following tables.

a Fill in the following account details for the Allowance for Uncollectible Accounts

b Fill in following balance sheet and income statement presentation for respective year

Hint: Companies can use of sales method to estimate baddebt expense provision directly, instead

of using aging schedule which estimate the ending allowance balance to back out baddebt expense

provision. For example, suppose the company estimate that of the reported sales as baddebt

expense provision, then the ending balance would follow as beginning balance baddebt expense

provision writeoffs.

Problem : Followup to Eabove:

The management is reconsidering the policy and would like to create the following ratios:

Suppose an aging analysis is conducted on the Year ending Accounts Receivable balance which

leads to a best estimate of Allowance to be Assuming Year and Year figures cannot be

changed, what would be the Year baddebt expense has to be for the ending allowance to be $

Please see attachment for E

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock