Question: Problem 1 The decision rule for net present value is to: Problem 2 What is the NPV of a project that costs $15,000 and returns

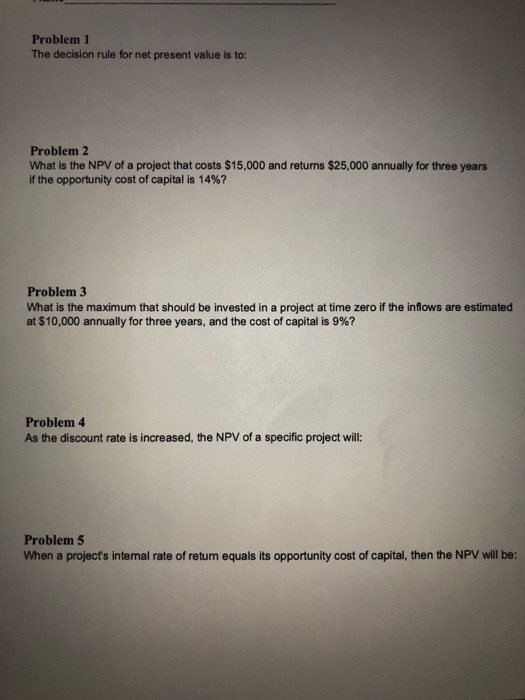

Problem 1 The decision rule for net present value is to: Problem 2 What is the NPV of a project that costs $15,000 and returns $25,000 annually for three years if the opportunity cost of capital is 14%? Problem3 What is the maximum that should be invested in a project at time zero if the inflows are estimated at $10,000 annually for three years, and the cost of capital is 9%? Problem 4 As the discount rate is increased, the NPV of a specific project will: Problem 5 When a project's internal rate of return equals its opportunity cost of capital, then the NPV will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts